(TN&MT) - Saigon - Hanoi Bank (SHB, HoSE: SHB) has just announced its consolidated financial report for the third quarter of 2024 with accumulated pre-tax profit reaching VND 9,048 billion, achieving 80% of the yearly plan.

In addition to developing business activities, the Bank actively participates in social security activities, supports the poor, eliminates temporary housing according to the Government's policy, fulfills community responsibilities, and contributes to the socio-economic development of the country.

As of September 30, 2024, total assets were VND 688,387 billion, up 9.2% compared to the end of 2023. Outstanding credit balance reached VND 495,420 billion. SHB's business performance indicators remained in the top group in the industry with ROE reaching 22.8%.

Since the beginning of the year, SHB has implemented many credit programs with preferential interest rates for individual customers with a scale of 43,000 billion VND with interest rates from 5.79%/year and for corporate customers with a scale of 16,000 billion VND, interest rates from 4.8%/year.

In addition, the Bank proactively provides interest rate support credit packages for individual customers and businesses to recover production and stabilize after natural disasters. For example, SHB announced a VND2,000 billion loan package with an interest rate of only 4.5%/year for individual customers and businesses affected by Typhoon Yagi, along with an average 50% exemption/reduction of interest payable in the last 4 months of 2024.

Credit programs are designed to suit each field, profession, and customer group, thereby creating favorable conditions for businesses and individuals to access credit, stabilize their lives, and promote recovery and business development.

At the same time, SHB is determined to develop sustainably, safely and effectively, continuously improving its management capacity according to international standards and modern models. The CAR ratio is over 11.8%, higher than the regulations of the State Bank, contributing significantly to ensuring safety and maintaining sustainable stability for the banking industry. In addition, the Bank continues to strictly control credit quality, promote debt settlement and overdue debt collection, accompany customers to overcome difficulties and gradually recover.

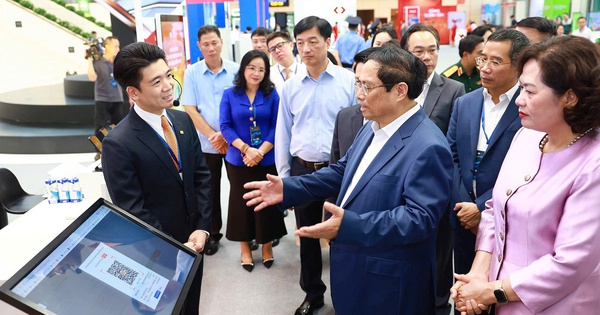

In its strong and comprehensive transformation strategy for 2024-2028, SHB continuously promotes innovation, applies technology, applies new initiatives internally and brings customers convenient and modern products, services and solutions. This is one of the factors that helps the CIR index to be optimized at 24.68% - the lowest in the industry thanks to promoting digitalization, applying technology to operational processes, to optimize operating costs.

By applying today's leading technologies such as artificial intelligence AI, big data, machine learning... SHB is digitizing internal processes to products and customer services. The proportion of transactions via digital channels and online platforms is continuously increasing in the top of the industry. To date, 90% of essential banking operations can be performed entirely on digital channels; at the same time, 92% of the number of transactions of corporate and individual customers are performed entirely through digital channels such as Mobile banking and Internet banking.

Accompanying social security work

Along with business activities, SHB always proactively accompanies local authorities and people to effectively carry out social security work.

Responding to the Prime Minister's call, SHB donated 100 billion VND to Soc Trang province at the Program to support the elimination of temporary and dilapidated houses for poor and near-poor households nationwide - "Warm home for my people".

In addition to financial policies suitable for customers, people and businesses affected by storm Yagi, SHB, in collaboration with T&T Group, SHS Securities Company and VinaWind Company, has spent VND23.5 billion to support people affected by storms and floods. The bank has also proactively implemented many practical activities to support localities in all essential aspects of life such as health, culture, education, etc. It is estimated that SHB has contributed VND150 billion to social security activities and interest rate reductions for customers, supporting people affected by storms and floods.

SHB also actively contributes to sponsoring the construction of schools and investing in infrastructure to create the best conditions for children in mountainous areas to study. In mid-October, SHB coordinated with the Vietnam Buddhist Sangha and the People's Committees of Tua Chua and Dien Bien Dong districts, Dien Bien province, to inaugurate two classrooms for ethnic minority boarding primary schools in the province, sponsored by SHB with a total value of 12.5 billion VND.

Originating from the Heart, SHB always wishes to accompany, create and spread good values to the Vietnamese people, joining the country in entering a new era.

In the period of 2024-2028, SHB is focusing resources to implement a strong and comprehensive Transformation Strategy based on 4 pillars: Reforming mechanisms, policies, regulations, and processes; People are the subject; Taking customers and markets as the center; Modernizing information technology and digital transformation and steadfastly following 6 core cultural values "Heart - Trust - Faith - Knowledge - Intelligence - Vision".

SHB sets a strategic goal of becoming the TOP 1 Bank in terms of efficiency; the most favorite Digital Bank; the best Retail Bank and at the same time the TOP Bank providing capital, financial products and services to strategic private and state corporate customers, with a supply chain, value chain, ecosystem, and green development.

Source: https://baotainguyenmoitruong.vn/shb-lai-truoc-thue-9-thang-dat-hon-9-048-ty-dong-382476.html

Comment (0)