Saigon - Hanoi Commercial Joint Stock Bank (SHB) has just announced its business results for the first quarter of 2025 with impressive growth marks, continuing to affirm its strong internal resilience with a properly planned and methodical development strategy.

As of March 31, 2025, SHB's total consolidated assets reached VND 790,742 billion, up 6% compared to the end of 2024, outstanding credit balance reached VND 575,777 billion, up 7%, focusing on investing in key production and business sectors and industries with growth potential associated with the sustainable development orientation of the economy, creating a foundation for stable and effective growth in the long term. Credit quality continues to be controlled within a safe threshold thanks to proactive, drastic and effective risk management and debt settlement solutions.

|

| Saigon - Hanoi Commercial Joint Stock Bank (SHB) has just announced its business results for the first quarter of 2025. Photo: SHB |

SHB has chosen a selective growth orientation, focusing on investing in strategic customer segments, taking advantage of competitive advantages in the ecosystem, supply chain, and customer value chain to create stable and differentiated growth. Developing business activities in depth along with optimizing resources, investing heavily in digitalization and modernization has helped the bank improve system-wide performance, creating real value. SHB's operating system has been transforming from quality compliance assessment to customer experience management, affirming compliance with international standards and SHB's strong commitment to a customer-centric strategy.

At the end of the first quarter of 2025, SHB's pre-tax profit reached nearly VND 4,400 billion, reaching 30% of the 2025 plan. This growth shows SHB's solid internal capacity, and a favorable foundation for breakthrough growth targets in 2025. For many years, SHB has been in the TOP 5 banks with the largest budget contributions.

The year 2025 is identified by the Bank as the strategic milestone to kick off the acceleration and comprehensive breakthrough phase in the 5-year strategy. SHB sets a target of pre-tax profit of VND 14,500 billion, a growth of 25%, total assets of VND 832,000 billion, charter capital of nearly VND 46,000 billion, along with a credit growth plan of 16% and strict control of the bad debt ratio below 2%; towards reaching VND 1 million billion in total assets by 2026, affirming its stature and position in the domestic and foreign financial markets, reaching international standards.

Maintain high dividend rate

Committed to bringing the best value to shareholders, SHB continues to maintain a stable and transparent dividend policy. The bank plans to pay a dividend of 18% in 2024, of which 5% is in cash and 13% is in shares, and expects a dividend of 18% for 2025, in line with the goal of increasing equity capital and increasing sustainable value for shareholders in the medium and long term. Recently, SHB has also completed the increase of charter capital to VND 40,658 billion, firmly in the Top 5 largest private joint stock commercial banks in Vietnam.

SHB identifies that digital transformation and scale growth must go hand in hand with improving the quality of operations. The bank will focus on perfecting its technology platform, modernizing its operational infrastructure, streamlining its apparatus and continuing to increase business efficiency, with the focus for 2025 being on key solutions such as: Applying a sales management system, retail and corporate credit management according to an integrated model; Developing smart digital channels with seamless customer experience and high security; Applying AI, big data and process automation (RPA) to improve analysis efficiency, risk control and service personalization. From 2026, SHB will enter an acceleration phase, aiming to comprehensively integrate the financial - digital - customer ecosystem.

SHB's development strategy is implemented synchronously according to 4 core pillars: Reforming mechanisms, policies, and processes - towards international standards; People are the center of transformation and innovation; Customers and markets are the compass for action; Digital transformation is the lever for growth.

| Based on the 6 core cultural values of “Heart – Trust – Faith – Knowledge – Intelligence – Vision”, SHB commits to continue comprehensive innovation, drastic action, effective and sustainable growth, affirming its role as a leading financial institution, accompanying businesses and people and making practical contributions to the development of the country’s economy. |

Source: https://congthuong.vn/shb-lai-gan-4400-ty-dong-quy-i-dat-30-ke-hoach-nam-du-kien-tong-ty-le-co-tuc-2024-2025-la-36-384101.html

![[Photo] Fireworks light up Hanoi sky to celebrate national reunification day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/5b4a75100b3e4b24903967615c3f3eac)

![[Photo] General Secretary To Lam's wife and Japanese Prime Minister's wife make traditional green rice cakes together](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/7bcfbf97dd374eb0b888e9e234698a3b)

![[Photo] Living witnesses of the country's liberation day present at the interactive exhibition of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/b3cf6665ebe74183860512925b0b5519)

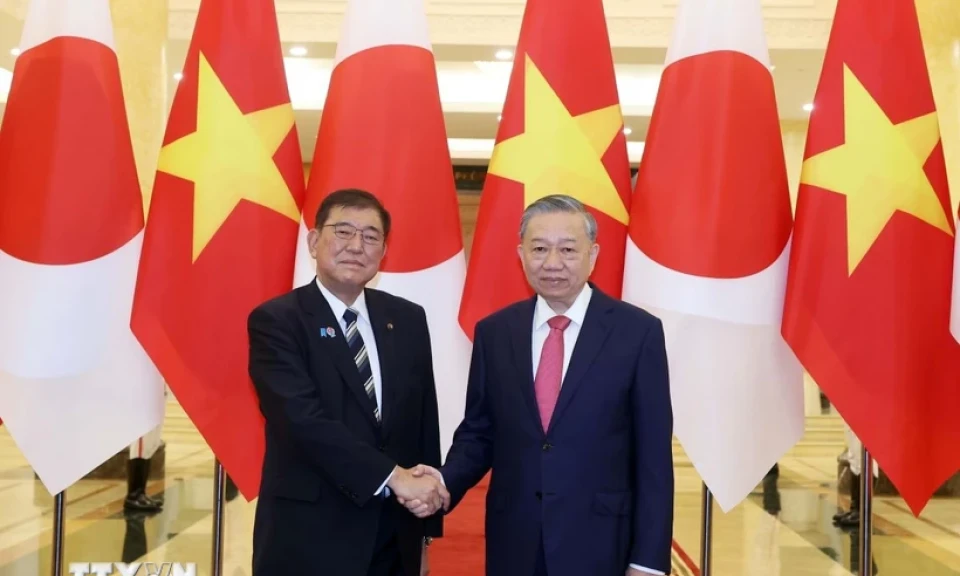

![[Photo] General Secretary To Lam receives Chairman of the Liberal Democratic Party, Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/63661d34e8234f578db06ab90b8b017e)

![[Photo] Japanese Prime Minister's wife visits Vietnamese Women's Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/8160b8d7c7ba40eeb086553d8d4a8152)

Comment (0)