Impressive business metrics

Saigon - Hanoi Bank (stock codeSHB ) announced its consolidated financial report for the second quarter of 2024, recording total assets as of June 30 at VND 659,767 billion, charter capital reaching VND 36,629 billion, holding the position of Top 5 largest private banks in Vietnam.

SHB's capital mobilization in the first market reached VND 500,177 billion. For many years, SHB has always been in the group with higher capital mobilization growth than the industry average, a trusted destination for people, businesses and customers to deposit savings, pay for and use financial services and solutions.

Outstanding credit balance reached VND 475,267 billion, ranking among the top banks in providing capital to the market. In the context of the economy 's improved capital demand, the entire SHB system has actively and effectively implemented the direction of the Prime Minister and the State Bank of Vietnam (SBV), proactively working directly with customers, together finding ways to remove obstacles in accessing capital, promptly providing capital sources for production and business, promoting economic growth.

In the first 6 months of 2024, SHB's pre-tax profit reached VND 6,860 billion, up 13% over the same period in 2023, completing 61% of the yearly plan. Return on equity (ROE) was 25.91%. SHB continues to be the bank with the lowest cost-to-income ratio (CIR) in the system at 22.25%, with contributions from digital transformation and automation of operational processes.

The bank continues to strengthen operational safety indicators, risk management according to Basel II and Basel III. SHB's capital adequacy ratio (CAR) is at 12.32%, higher than the regulations of the State Bank, the bad debt ratio is controlled below 3%. In the context of bad debt in the whole industry tending to increase in the first 6 months of the year, SHB is focusing on monitoring and handling bad debt. The bank has established teams from the head office to branches/transaction offices, directly clarifying and providing appropriate solutions to recover bad debt, supporting customers to remove/overcome difficulties.

Preparing to pay dividends in 2023, increasing charter capital to 40,658 billion VND

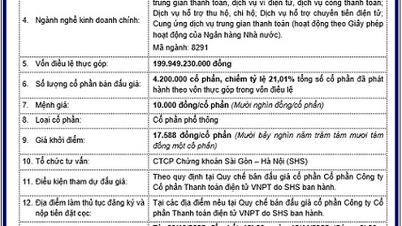

Recently, SHB closed the shareholder list on July 19 to pay 2023 cash dividends at a rate of 5%, with implementation date on August 6. The bank is also completing documents to submit to the management agency, carrying out procedures to issue 2023 dividends in shares at a rate of 11% in the third quarter of 2024, expected to increase charter capital to VND 40,658 billion.

SHB always ensures shareholders' rights, paying annual stock dividends at a rate of 9.9 - 18% in the past 5 years (2023 dividends are paid in cash and stocks). The bank continuously improves its capital base, capital adequacy ratios, and risk management always complies better than the regulations of the State Bank. SHB is steadfast in its orientation of sustainable, safe and effective development, continuously improving its governance capacity according to international standards and modern models.

2024 is the pivotal year of SHB's 2024 - 2028 transformation strategy. The Bank is focusing its resources on implementing a strong and comprehensive Transformation Strategy based on 4 pillars: Reforming mechanisms, policies, regulations, and processes; People are the subject; Taking customers and markets as the center; Modernizing information technology and digital transformation and steadfastly following 6 core cultural values "Heart - Trust - Faith - Knowledge - Intelligence - Vision".

SHB sets a strategic goal of becoming the top 1 bank in terms of efficiency; the most favorite digital bank; the best retail bank, and at the same time the top bank providing capital, financial products and services to strategic private and state corporate customers, with a supply chain, value chain, ecosystem, and green development.

Thuy Nga

Source: https://vietnamnet.vn/shb-lai-6-860-ty-dong-trong-6-thang-dat-61-ke-hoach-nam-2307348.html

![[Photo] Chairman of the Hungarian Parliament visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760941009023_ndo_br_hungary-jpg.webp)

![[Photo] Solemn opening of the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760937111622_ndo_br_1-202-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with Hungarian National Assembly Chairman Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760952711347_ndo_br_bnd-1603-jpg.webp)

Comment (0)