Billionaire Pham Nhat Vuong's Vinhomes has just decided to reorganize its subsidiaries, signaling a move in a new strategic field, after a historic deal to buy back 370 million VHM shares.

Vinhomes Joint Stock Company (HoSE: VHM), of which billionaire Pham Nhat Vuong is a member and Vingroup (VIC) is the controlling shareholder, has just announced information about separating the company in the industrial park sector into 3 new subsidiaries, with a total capital of 18,500 billion VND. Accordingly, Vinhomes Joint Stock Company decided to establish two new subsidiaries on the basis of separating Vinhomes Industrial Park Investment Joint Stock Company. Specifically, Vinhomes Industrial Park Investment Joint Stock Company will have a charter capital of 340 billion VND, with Vinhomes holding 51% of the capital. Before the separation, Vinhomes Industrial Park Investment Joint Stock Company had a charter capital of 18,500 billion VND. The two newly established companies are Vinhomes Hai Phong Industrial Park Joint Stock Company with a charter capital of 15,160 billion VND and Vinhomes Vung Ang Industrial Park Joint Stock Company with a charter capital of 3,000 billion VND. Vinhomes will hold 51% of the capital of these two companies. By the end of the second quarter, Vinhomes had a total of 45 subsidiaries.

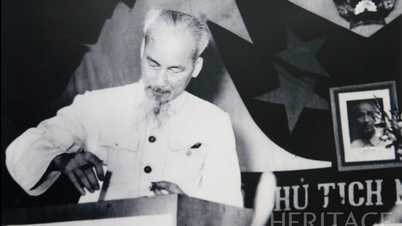

Billionaire Pham Nhat Vuong. Photo: HH

In July, Vinhomes was approved to invest in an industrial park in Ha Tinh with a scale of nearly 965 hectares. KC Vinhomes Investment Joint Stock Company is the project investor, with a total investment of nearly VND13,280 billion. Billionaire Pham Nhat Vuong has made strides in the industrial real estate sector since 2020 when Vietnam had the potential to attract foreign investment. Industrial real estate and housing in the capital Hanoi and Ho Chi Minh City are assessed to benefit once again when the Covid pandemic disrupted the supply chain and trade tensions escalated between China and other economic powers. Many large corporations have a long-term trend of shifting production to Vietnam such as Samsung, Intel, Nike and Adidas. Vietnam enjoys the advantage of cheap labor costs, has many free trade agreements FTA... Vinhomes recently recorded a re-increase in capitalization after a very large share buyback. In the first 9 months, Vinhomes recorded total consolidated net revenue of VND69,910 billion. The company's consolidated profit after tax reached VND20,600 billion.Vietnamnet.vn

Source: https://vietnamnet.vn/sau-thuong-vu-lich-su-vinhomes-cua-ty-phu-pham-nhat-vuong-co-buoc-di-lon-moi-2338965.html

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)