Over the years, the top position in terms of charter capital among securities companies has constantly changed. Most recently, VNDIRECT Securities Company (code VND) completed the issuance of over 304 million new shares through two methods. The company offered nearly 244 million shares to existing shareholders at a ratio of 5:1 and distributed stock dividends to shareholders at a rate of 5%. The remaining more than 9.5 million shares that were not sold were further distributed to other investors at an issue price of VND 10,000 per share.

Following the issuance, VNDIRECT's shareholding increased to 1.52 billion units, corresponding to a charter capital of nearly 15,223 billion VND. This allowed VNDIRECT to reclaim its position as the securities company with the largest charter capital in the market from SSI (15,111 billion VND).

At the 2024 Annual General Meeting of Shareholders held at the end of June, VNDIRECT continued to approve two capital increase plans: a private placement and an ESOP issuance. If completed, the company will raise its charter capital to over VND 18,300 billion.

In contrast to VNDIRECT's continuous capital increase (nearly sevenfold increase in six years), SSI's approach has been more gradual (more than fourfold increase in nine years). At the end of December 2023, SSI shareholders approved two capital increase plans: issuing over 302.2 million bonus shares at a ratio of 100:20 and offering over 151 million shares to existing shareholders at VND 15,000 per share at a ratio of 100:10. In total, SSI will issue over 453.3 million new shares. After this issuance, SSI's charter capital is expected to increase from over VND 15,111 billion to nearly VND 19,645 billion. If the plan is successful, SSI will once again consolidate its position as the number one securities company in terms of capital.

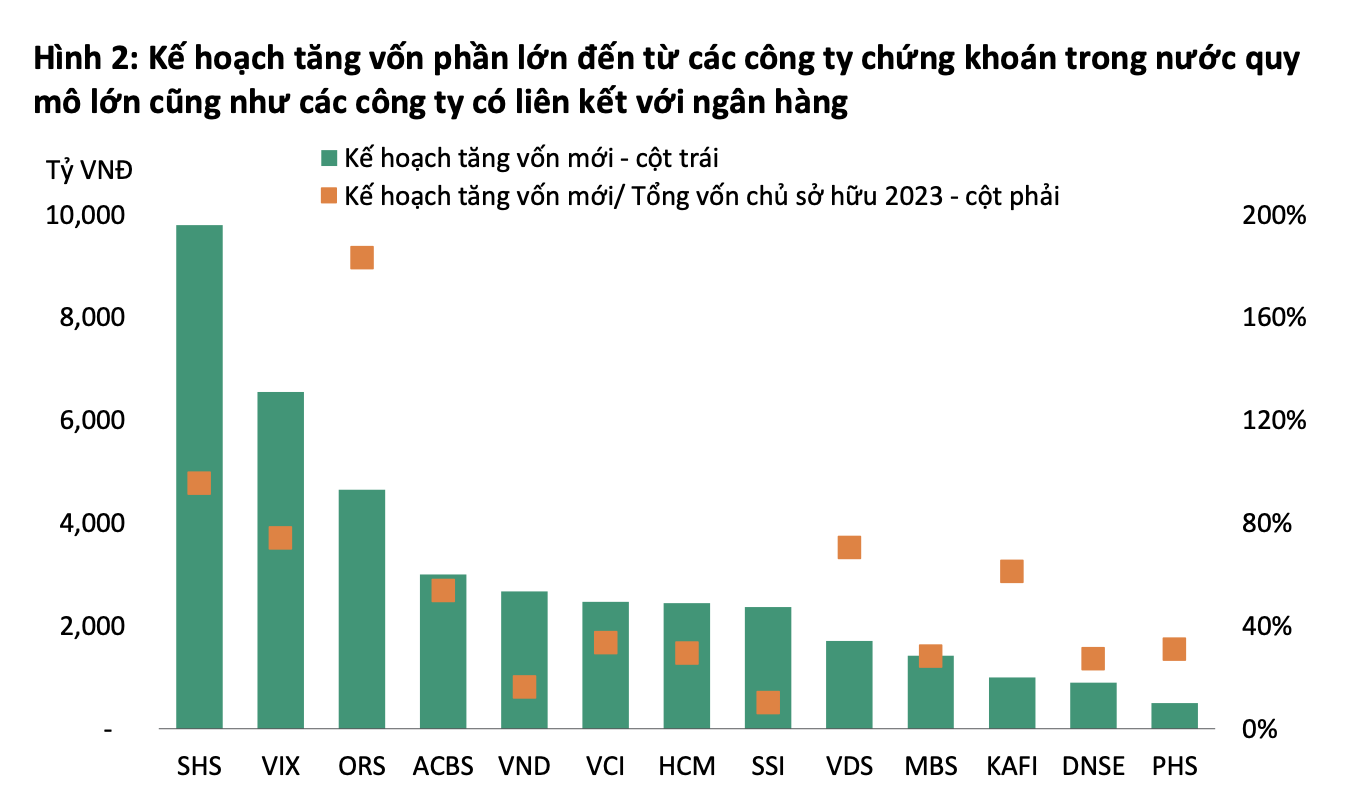

The race to increase capital is not only intense at the top, but also among other companies. For example, VIX Securities Company (code VIX) recently received a certificate from the State Securities Commission to register for a public offering of shares on July 15, 2024. If all four plans are successfully implemented, VIX will increase its charter capital from VND 6,694 billion to nearly VND 14,600 billion. Similarly, Saigon - Hanoi Securities Company (code SHS) plans to increase its charter capital by a maximum of VND 8,994 billion, bringing it to VND 17,126 billion.

Conversely, the capital raising process of foreign securities companies has slowed down over the past two years, coinciding with a gradual lag in business growth compared to domestic companies.

According to VIS Ratings' assessment, with the additional capital, companies can boost their core business activities of investment and margin lending in 2024. Higher profit growth from these activities will help companies strengthen their risk buffers.

Low interest rates and improved investor sentiment in the stock and corporate bond markets will encourage investor trading activity. At the same time, regulatory plans to upgrade trading infrastructure and eliminate pre-trading margin requirements for foreign investors will help attract new investors over time.

Source: https://laodong.vn/kinh-doanh/sao-doi-ngoi-trong-top-cong-ty-chung-khoan-co-von-lon-nhat-1367819.ldo

![[Image] Vietnam's colorful journey of innovation](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F14%2F1765703036409_image-1.jpeg&w=3840&q=75)

![[Image] Vietnam's colorful journey of innovation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/14/1765703036409_image-1.jpeg)

Comment (0)