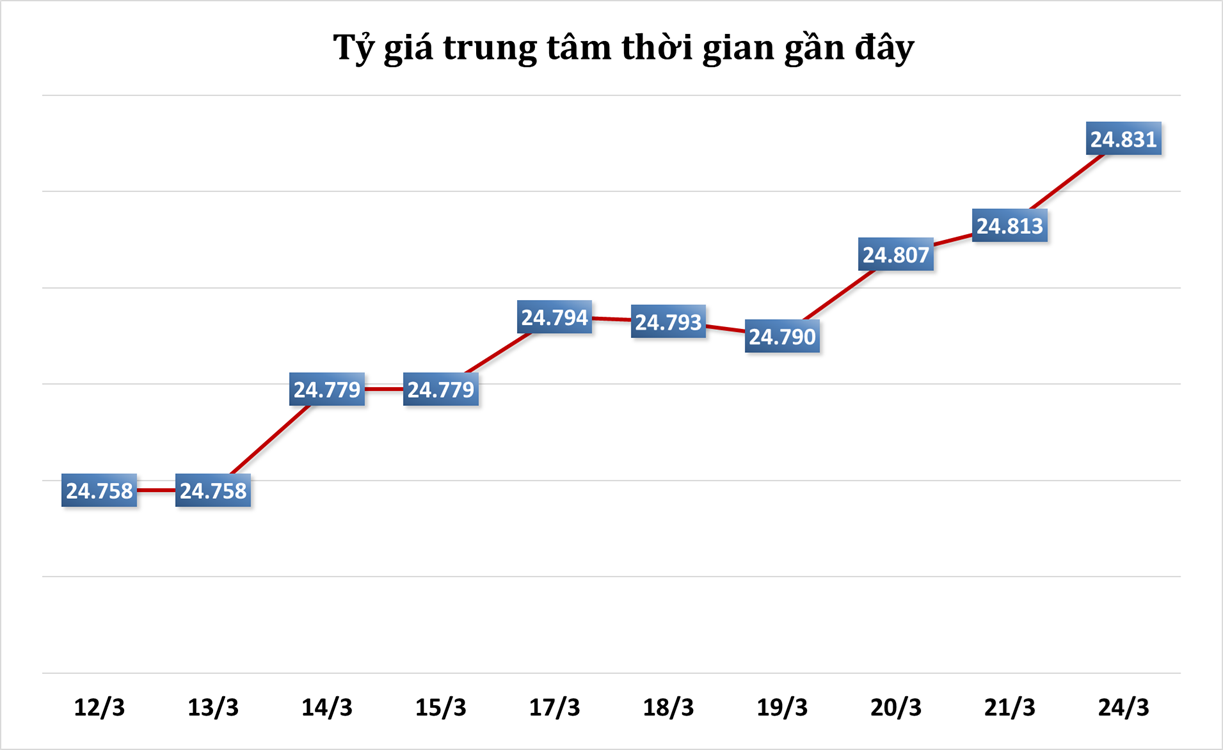

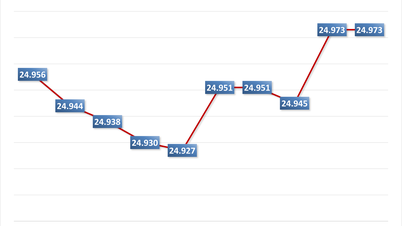

The State Bank this morning listed the central exchange rate at 24,831 VND, up 18 VND compared to the previous session.

This morning, the State Bank of Vietnam listed the USD buying price at 23,640 VND/USD, up 17 VND; while the USD selling price was listed at 26,022 VND/USD, up 19 VND compared to the previous session.

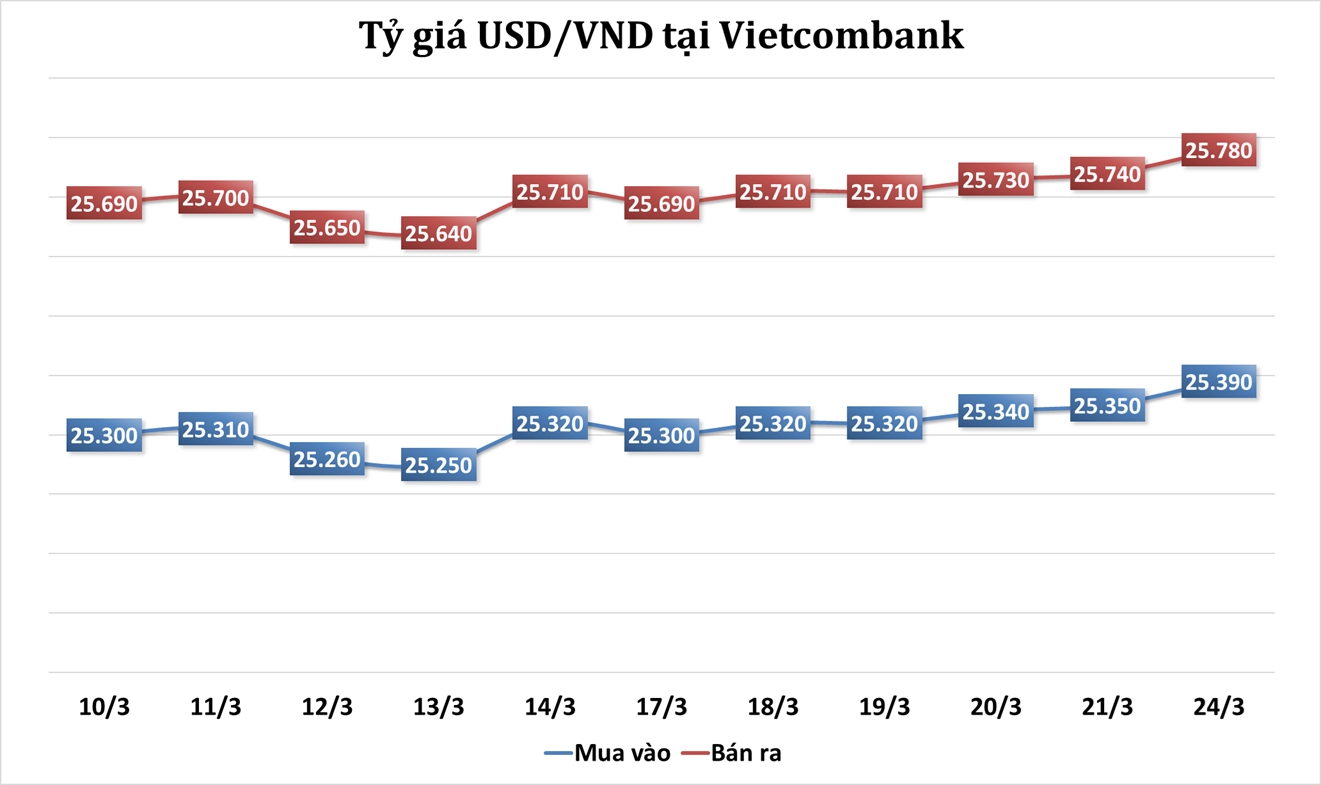

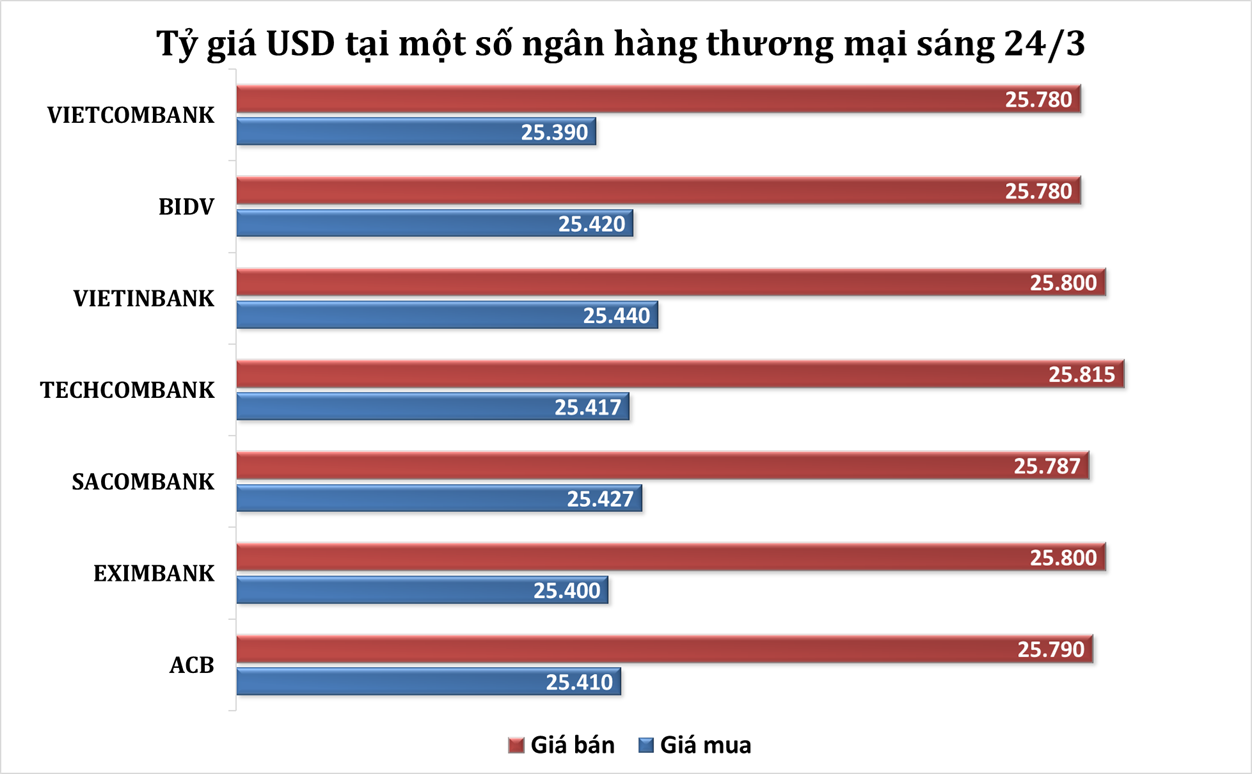

Meanwhile, USD buying and selling prices at all commercial banks were adjusted up with a common amplitude of 40-60 VND compared to the previous session.

Specifically, as of 9:00 a.m. this morning, the lowest USD buying price is at 25,390 VND/USD (40 VND higher), the highest buying price is at 25,440 VND/USD (58 VND higher). On the selling side, the lowest USD selling price is at 25,780 VND/USD (50 VND higher), the highest selling price is at 25,815 VND/USD (60 VND higher).

The US dollar index (DXY), which measures the greenback's performance against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), is currently listed at 104.138, down 0.032 points from the opening.

The US dollar edged lower, falling below a three-week high against a basket of major currencies, as cautious investors awaited clarity on the next round of tariffs by US President Donald Trump.

Last week, the US dollar index rose 0.4%, marking its first weekly gain in a month, although it has remained under pressure this year due to concerns that Trump's aggressive tariff policies could trigger an economic recession.

The US is expected to implement reciprocal tariffs with many countries from April 2, increasing instability.

“We have lowered our USD forecasts, but still expect the currency to be stronger than it is now. The market has quickly repriced the growth outlook, which is well above our 2025 forecast. Despite the slowdown in US growth due to the sharp increase in tariffs, we still think the USD will benefit,” analysts at Goldman Sachs said.

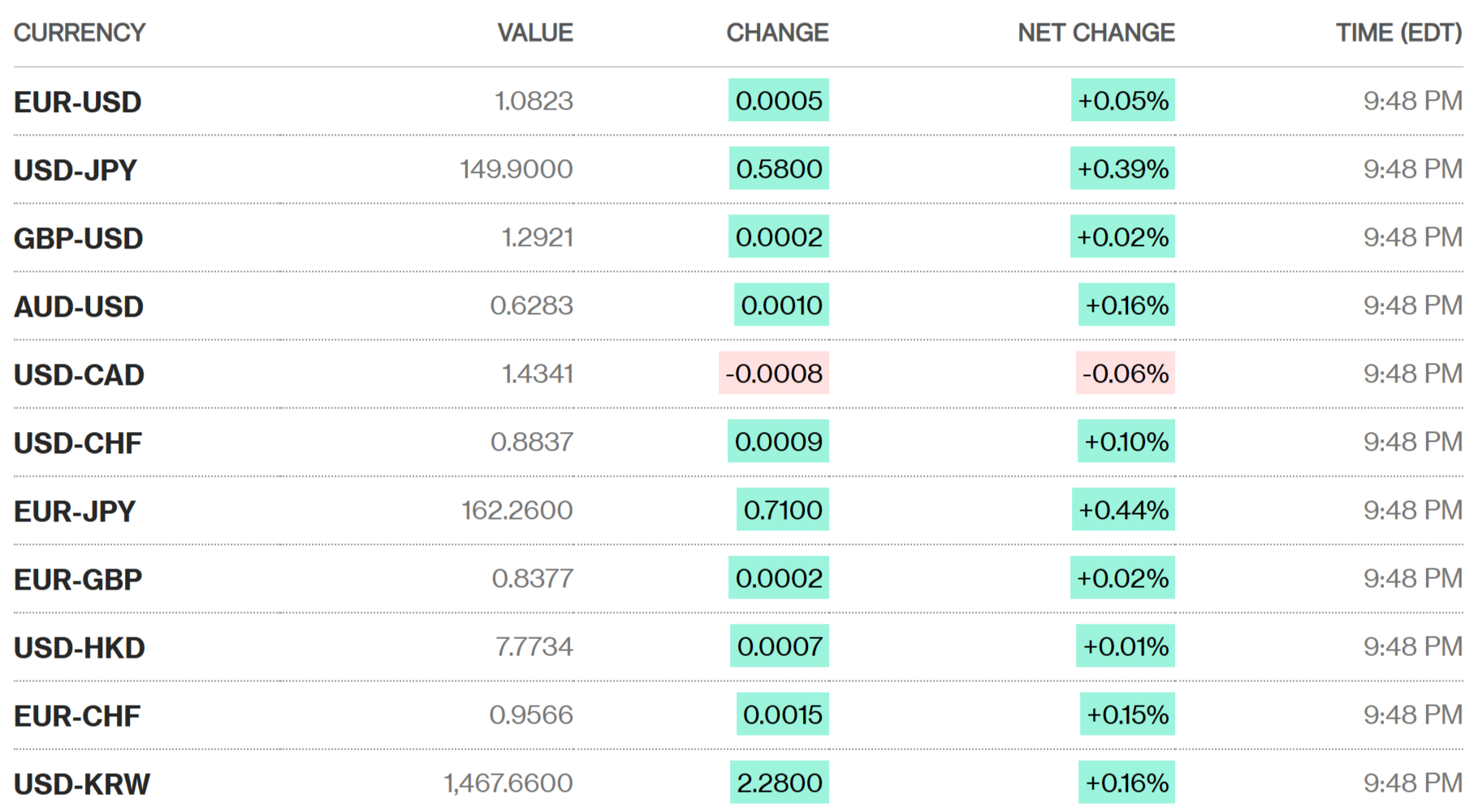

The yield on the 10-year US Treasury note rose 2.5 basis points to 4.2770%, supporting the dollar, which rose 0.39% against the yen to 149.90 yen per UAUD, reflecting the trend of tracking yields.

The euro rose 0.05% to $1.0823, off a near three-week low of $1.0795 hit on Friday. Last week, the common currency hit a peak of $1.0955 - its highest since early October - on optimism about a large German spending package.

Germany's upper house of parliament on Friday approved a "debt brake" reform, paving the way for a 500 billion euro ($544 billion) fund to support the military and infrastructure.

However, Carol Kong from Commonwealth Bank of Australia warned: “The euro could lose recent gains once the bill is approved, as significant spending increases will take time. The market’s bigger concern is the news of Donald Trump’s new tariffs next week.”

The pound rose 0.02% to $1.2921.

The Australian dollar rose 0.16% to $0.6283.

The New Zealand dollar fell 0.03% to $0.5729.

The Turkish lira traded at 38.0050 lira per dollar. Last week, the lira hit a record low of 42 lira per dollar after the Turkish central bank raised its overnight lending rate to 46% and suspended repo auctions in a bid to tighten policy.

Comment (0)