|

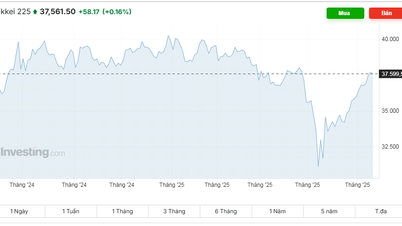

The US dollar eased slightly from the start of the session after rising sharply after US President Donald Trump backed away from his threat to fire Federal Reserve Chairman Jerome Powell, temporarily easing concerns about the politicization of monetary policy that had rattled markets in previous days.

Donald Trump’s repeated criticism of the Fed for not cutting interest rates – especially after the Easter holiday – has raised concerns about the Fed’s independence. However, in an interview with reporters in the Oval Office on Tuesday evening, Trump insisted: “I have no intention of firing Jerome Powell. I just want him to be a little more aggressive about cutting interest rates.”

In response to this “step back” move, the USD jumped sharply. Specifically, the USD increased by 0.15% against the Yen to 141.78 Yen per USD and increased by 0.33% against the Swiss Franc to 0.8216 Franc per USD.

The greenback earlier hit multi-year lows against the euro and Swiss franc, while the yen hit a seven-month peak as investors dumped U.S. assets on trade tensions and negative signals from the White House.

Also supporting market sentiment were conciliatory remarks from Donald Trump and US Treasury Secretary Scott Bessent on US-China trade relations. Both said progress was being made in negotiations and stressed that a deal could result in “substantial reductions” in tariffs, a move that is expected to be positive for the US economy.

“Clearly the sudden change in Trump’s stance is a relief to the market,” said Matt Simpson, senior analyst at City Index. “It reinforces the belief that Powell will not be replaced by a more dovish figure.”

However, the expert noted that international trade is still the "bigger story" at the moment, because how the US government handles the tariff issue will have a direct impact on the interest rate path in the coming time.

Meanwhile, Mr. Bessent reassured investors that the goal of the US President Donald Trump administration is not to "decouple" the world's two largest economies, although he admitted the current situation is "unsustainable".

Mr. Donald Trump also expressed optimism that a deal with China would reduce tariffs, although he affirmed that tariffs “will not go to zero.”

“The fact that Trump has toned down his tone with Powell has helped to ease market concerns about the risk of a major policy mistake,” said Chris Weston, research director at Pepperstone, adding: “The market is increasingly reliant on President Trump making a surprise decision and then reversing his stance as if it was never a big deal.”

Elsewhere, sterling fell 0.17% to $1.3309.

The Australian dollar rose 0.44% to $0.6395.

The New Zealand dollar rose 0.08% to $0.5972.

Source: https://thoibaonganhang.vn/sang-234-ty-gia-trung-tam-tang-tro-lai-163207.html

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)