Vietnam's hot-rolled coil (HRC) steel industry is facing a series of serious challenges, not only from fierce competition from cheap imported steel but also the risk of being investigated by the European Commission (EC) for anti-dumping measures. This is a "double whammy", with difficulties piling up for the domestic steel industry.

Risk of EU anti-dumping investigation

On July 30, 2024, the Department of Trade Remedies (Ministry of Industry and Trade) announced that the European Commission (EC) has received a valid dossier requesting an anti-dumping investigation into hot-rolled flat steel made of iron, non-alloy steel or other alloy steel imported into the European Union originating from Vietnam.

The Trade Defense Department said that if the EC initiates an investigation, the parties involved will receive documents including a request, a decision to initiate the investigation, and a questionnaire. The EC requested detailed information about steel exporters before August 5, 2024. Before the above announcement, the Trade Defense Department recommended that enterprises exporting products subject to the investigation monitor the case and have appropriate response plans.

Previously, on July 29, the Ministry of Industry and Trade decided to initiate an anti-dumping investigation into HRC steel from China and India, after reviewing the request from domestic HRC steel manufacturers Hoa Phat and Formosa Ha Tinh and the opinions of related enterprises. This move was assessed by industry experts as necessary and timely to protect domestic production in accordance with legal regulations.

|

| Vietnam's HRC hot-rolled steel production is struggling with double storms |

Pressure from cheap imports

According to the Vietnam Steel Association, the domestic demand for hot-rolled steel is estimated at 12-13 million tons per year. This is the upstream material for the production of galvanized, cold-galvanized, color-coated steel products, steel pipes, and other steel products used in many applications in the construction, mechanical, and other industries. However, investing in the production of this type of steel is not easy. Currently, Vietnam has two enterprises, Hoa Phat and Formosa, producing HCR steel with a total investment of up to billions of USD.

According to statistics from the Vietnam Steel Association, hot-rolled coil steel output in the second quarter of 2024 decreased by 10% compared to the first quarter of 2024 due to difficulties in consumption in both domestic and export markets.

The amount of imported low-priced hot-rolled coil steel flooding the Vietnamese market in the first half of 2024 increased sharply (6 million tons, 1.5 times higher than the same period in 2023 and exceeding the growth rate of the entire market), causing great pressure on Hoa Phat's hot-rolled coil steel consumption in the domestic market. Along with that, although the price of HRC steel products in the Vietnamese market increased in February 2024, it has continuously decreased from March to the end of the second quarter of 2024.

The massive influx of cheap HRC steel into Vietnam, at times reaching nearly 200% of domestic production, has made it impossible for domestic manufacturers to exploit their full capacity. In 2023, Vietnam's hot-rolled steel output reached only 6.7 million tons, equivalent to 79% of design capacity, a sharp decrease compared to 86% in 2021. Domestic sales market share dropped dramatically from 42% in 2021 to 30% in 2023.

Faced with the sudden increase in steel imports into Vietnam, Mr. Nghiem Xuan Da, Chairman of the Vietnam Steel Association, has proposed that the Ministry of Industry and Trade promptly conduct an investigation to clarify whether there is dumping, the dumping margin and the extent of damage to domestic production. He also emphasized the importance of determining the extent of impact on the market in order to take timely measures to protect the domestic manufacturing industry.

Regarding this incident, Deputy Prime Minister Le Minh Khai assigned the Ministry of Industry and Trade to preside over and coordinate with the Ministry of Finance and relevant agencies to review and grasp the situation of increased hot-rolled steel imports in recent times. The Ministry of Industry and Trade needs to take appropriate measures within its authority and legal regulations to protect the interests of the domestic manufacturing industry, comply with international practices and create a fair competitive environment.

Countries in the region such as Thailand and Indonesia have applied safeguard measures against Chinese hot-rolled steel. Thailand and Indonesia's production only meets 43% and 65% of consumption demand, respectively, and since 2019, these two countries have imposed anti-dumping duties in addition to the most-favored-nation (MFN) import duties they are maintaining.

Meanwhile, Vietnam's current HRC production capacity has met 70% of consumption demand (8.5/12 million tons) and there is currently no MFN import tax and no other tariff barriers to protect domestic production. This has made Vietnam a low-lying area for imports.

Source: https://congthuong.vn/san-xuat-thep-can-nong-hrc-viet-nam-lao-dao-truoc-song-gio-kep-335973.html

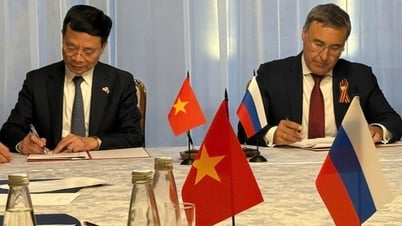

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

Comment (0)