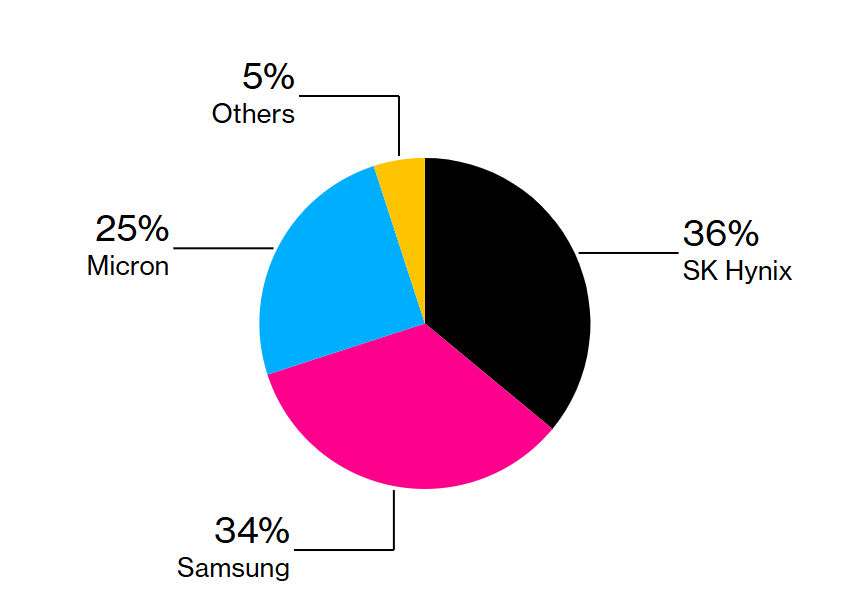

SK Hynix, the world's second-largest memory chipmaker, has surpassed Samsung Electronics to become the global DRAM market leader in the first quarter of 2025. According to newly released data from Counterpoint Research , SK Hynix holds a 36% market share, while Samsung has dropped to 34%.

|

Statistics show that SK Hynix is leading in Q1/2025. Source: Counterpoint |

This is the first time in the more than 30-year history of competition between the two Korean companies that Samsung has been dethroned in the DRAM arena - a key component in computers, servers and artificial intelligence systems.

“This is another wake-up call for Samsung,” said MS Hwang, research director at Counterpoint Research. SK Hynix has been riding the AI wave by dominating the high-bandwidth memory (HBM) chip segment, which has high added value and superior margins compared to traditional DRAM.

HBM is a special DRAM chip with many layers stacked on top of each other to optimize data transmission speed, widely used in Nvidia's high-end graphics cards and high-performance AI systems. With the explosion of artificial intelligence, the demand for HBM has increased sharply, opening up a golden opportunity for SK Hynix.

|

SK Hynix's HBM3E memory chip. Source: Bloomberg |

SK Hynix is expected to report a 38% rise in first-quarter revenue and a 129% jump in operating profit from a year earlier, according to analysts surveyed by Bloomberg . The Icheon, South Korea-based company now has a 70% share of the global HBM market, a dominant figure in a fiercely competitive environment.

TrendForce forecasts that in 2025, SK Hynix is likely to maintain more than 50% of the HBM market share in terms of gigabit output, while Samsung’s market share will fall to less than 30%. Micron Technology, another competitor, is expected to increase its market share to nearly 20%.

In addition, according to Bloomberg Intelligence analysis, although the first quarter often records seasonal factors affecting revenue, SK Hynix was still able to achieve an impressive operating profit margin of 36-38%. "HBM chip prices remain high, playing a key role in helping SK Hynix maintain its profit momentum," said Mr. Masahiro Wakasugi - an expert at Bloomberg Intelligence.

At the same time, rival Micron also recorded a single-digit average price increase for its mainstream DRAM line in the three months ended February 27, showing that the memory market is gradually recovering but the differentiation between product lines is very clear.

While the DRAM market is recovering thanks to AI, analysts warn of potential challenges. According to Morgan Stanley, the risks of US tariffs, export restrictions to China, and the risk of a global recession are hanging over the semiconductor industry.

“The real impact of tariffs is like an iceberg — the most dangerous part is still to come,” Morgan Stanley said. Still, the firm sees Samsung as an attractive investment option due to its strong defenses, low valuation and aggressive share buyback strategy.

Samsung reported a preliminary operating profit of 6.6 trillion won (about 4.6 billion USD ) on revenue of 79 trillion won in the first quarter of 2025. The company is expected to release a detailed financial report on April 30, clarifying the business results of each segment, of which the semiconductor business situation is especially awaited by investors.

As AI continues to reshape the global technology landscape, the race between SK Hynix, Samsung and Micron in the memory chip sector will become increasingly fierce, not only in terms of output but also in terms of technology and the ability to respond to flexible market needs.

Source: https://znews.vn/samsung-bi-vuot-qua-post1548297.html

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)