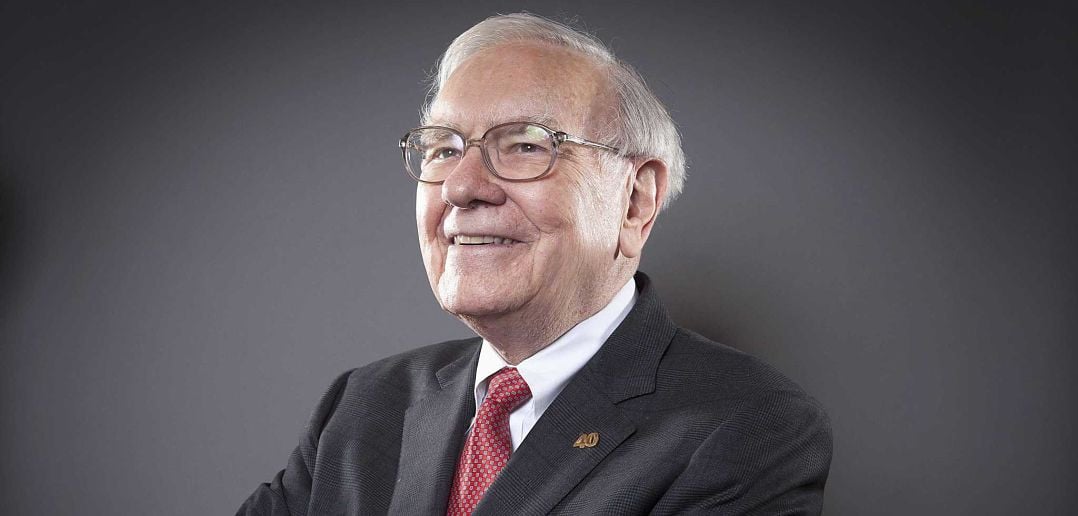

How legendary billionaire Warren Buffett prepared before ending his 60-year reign at Berkshire Hathaway.

Warren Buffett spent 60 years transforming Berkshire Hathaway from a failing textile mill into a $1 trillion company, worth more than Tesla, Walmart or JPMorgan.

The legendary investor took control of Berkshire in 1965 and went on to acquire a string of businesses, including Geico and See's Candies, while amassing billion-dollar stakes in public companies like Apple and Coca-Cola.

At 94, the business magnate knows the Buffett era is coming to an end. He's already preparing for his departure.

Buffett has warned shareholders that his time at the helm is running out. He has talked about Greg Abel and is preparing his planned successor.

He also sought to protect his legacy and ensure that this huge fortune was not squandered after he was gone.

“Succession planning is the most important thing in corporate governance for a company led by an iconic CEO,” said Lawrence Cunningham, director of the University of Delaware’s Weinberg Center for Corporate Governance and author of several books about Buffett and Berkshire.

Buffett's conglomerate is preparing the way not only for Greg to succeed Warren as CEO, but also for shareholders to no longer have a controlling shareholder in their company.

Transfer of power

"At age 94, it won't be long before Greg Abel replaces me as CEO and writes the annual letters," Buffett shared in a recent letter to Berkshire shareholders, making it clear that he will soon hand over the reins.

The billionaire has repeatedly assured shareholders that Abel is a worthy successor. In the new letter, he wrote that in rare moments when opportunity arose, Abel showed his ability to act on those moments, just like his late partner Charlie Munger.

Buffett joked at last year's annual meeting that shareholders "won't have to wait too long" for a change in management.

David Kass, a finance professor at the University of Maryland who has closely followed Buffett's company for four decades, predicts the 90-year-old will likely announce his decision as soon as Berkshire's annual meeting in May.

Make way

Billionaire Buffett appears to be clearing the decks before the next captain takes over.

Berkshire's $334 billion cash pile reflects a desire to empower Greg and allow him to perform more of a CEO's primary function, which is capital allocation, Kass said.

Buffett and his investment managers have sold some small, long-held investments, including General Motors and Procter & Gamble, in recent years, netting $158 billion in stock sales in just the past two years, boosting Berkshire’s cash pile to a record.

This gives the new CEO plenty of cash to invest in stocks or big deals that Buffett hasn't been able to make in years.

Heritage protection

Buffett revealed last year that when he dies, about 14% of his Berkshire stake (worth more than $150 billion) will be placed in a trust. His three children are trustees and they will have to vote unanimously on how to spend the money.

The plan is to avoid taxes and set aside for legitimate purposes. It also aims to prevent other investors from trying to buy Buffett's shares after his death and calls for his conglomerate to be dissolved.

"I look at Berkshire Hathaway like a painter looks at a painting," Buffett said in 2016, emphasizing that the company will last for generations.

All of which shows his dedication to ensuring Berkshire thrives long after he is gone.

(According to Business Insider)

Source: https://vietnamnet.vn/nha-tien-tri-xu-omaha-lam-gi-khi-sap-roi-de-che-ty-usd-2378207.html

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)