Also thanks to the loan from the People's Credit Fund, Mr. Le Van Thuong, in Chau Tu village, Binh Nguyen commune (Binh Son) has had a good life. Mr. Thuong shared that at the end of 2024, he borrowed 250 million VND, with an interest rate of 0.79%/month from the Binh Nguyen People's Credit Fund to invest in business. Thanks to effective business, he has so far paid off both principal and interest to the credit fund.

|

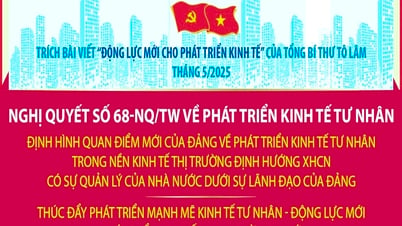

| Thanks to loans from Duc Hiep People's Credit Fund (Mo Duc), many households in the area have invested in farming and doing business effectively. PHOTO: TRUONG AN |

Recently, credit institutions and people's credit funds have actively implemented the direction of the Governor of the State Bank of Vietnam on continuing to implement solutions to reduce lending interest rates, support people and businesses to borrow capital to invest in production and business development.

Director of Duc Hiep People's Credit Fund Ly Ngoc Binh said that since the beginning of the first quarter of 2025, the fund has adjusted to reduce lending interest rates. If previously short-term lending capital had an interest rate of 0.8%/month, it has now been reduced to 0.78%/month. Medium-term capital from 0.85%/month, has now been reduced to 0.82%/month. To help people access the policy of lowering lending interest rates, the fund has taken advantage of popularizing it at local meetings to disseminate it to the people. Thanks to that, by April 15, the fund had a total outstanding loan balance of more than 70 billion VND, with 500 customers borrowing capital to invest in afforestation, livestock farming, purchasing agricultural tools, supplies, fertilizers, etc. The fund currently has more than 90 billion VND in mobilized capital.

Director of Binh Nguyen People's Credit Fund Vo Van Khanh has also implemented the policy of reducing lending interest rates since the beginning of 2025. Mr. Khanh said that the fund is complying with the regulations of the State Bank, currently reducing 0.2%/year compared to before. Specifically, the current lending interest rate is only 0.65%/month. In addition to lowering lending interest rates, the fund has a convenient location, creating conditions for customers to complete loan procedures, with flexible loan terms from 12-24 months. The fund also loosens the principal repayment period. If customers have money at any time, they can pay the principal at that time, but the fund does not charge prepayment fees and does not require the purchase of loan insurance. With many preferential policies, by March 31, 2025, the fund had a total outstanding debt of more than 42 billion VND, with 700 borrowers. Thanks to that, by the end of the first quarter of 2025, the fund had a credit growth of 10.5% compared to the beginning of 2025.

Director of the Thu Xa People's Credit Fund, Nghia Hoa Commune (Tu Nghia) Dang Quang Cang also directed the fund to reduce lending interest rates and increase charter capital to increase the limit for customers to borrow. In addition, the mobilization interest rate is increased to have abundant capital to meet the needs of customers. Currently, the fund's mobilized capital is nearly 40 billion VND, which can meet the loan demand of up to 350 - 400 million VND/customer.

TRUONG AN

Source: https://baoquangngai.vn/kinh-te/202504/quy-tin-dung-nhan-dan-ho-tro-nguoi-dan-doanh-nghiep-vay-von-80e05fc/

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)