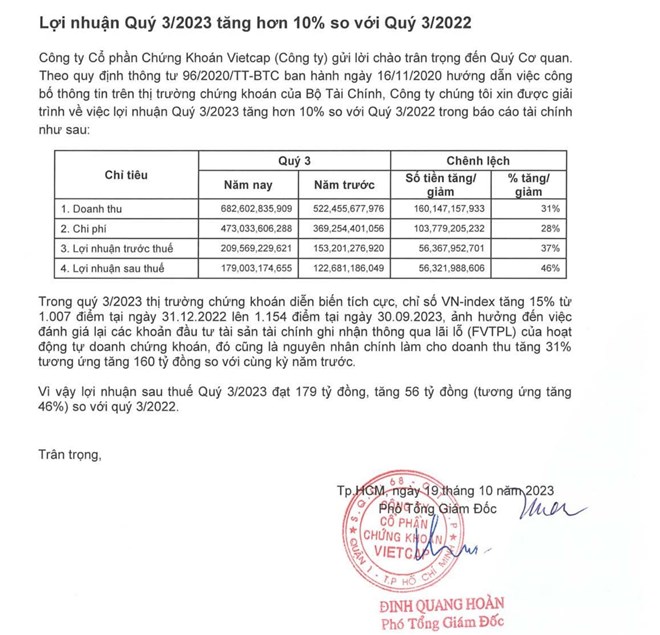

Vietcap Securities Joint Stock Company (HOSE: VCI) has just announced its financial report for the third quarter of 2023, recording operating revenue of VND 667 billion, an increase of 28% over the same period. Profit after tax reached VND 179 billion, an increase of 46%.

Explaining the fluctuations in business performance during the period, Mr. Dinh Quang Hoan - Deputy General Director of Vietcap - informed that in the third quarter of 2023, the stock market performed positively, the VN-Index increased by 15% from 1,007 points on December 31, 2022, to 1,154 points on September 30, 2023, affecting the revaluation of main asset investments recorded through profit and loss (FVTPL) of securities trading activities.

Therefore, after-tax profit in the third quarter of 2023 reached VND 179 billion, an increase of VND 56 billion (equivalent to an increase of 46%) compared to the third quarter of 2022.

However, in the first 9 months of this year, the company's business results declined compared to the same period last year. Specifically, operating revenue reached VND1,667 billion, down 29%, pre-tax profit reached VND421 billion, down 59%.

Thus, after 9 months, Vietcap Securities achieved 51% of the revenue plan (VND 3,256 billion) and 42% of the pre-tax profit plan (VND 1,000 billion).

As of September 30, Viepcap Securities' total assets reached VND16,917 billion, an increase of 19% compared to the beginning of the year.

Of which, cash and cash equivalents were about VND 1,775 billion, down nearly VND 1,650 billion after 9 months. However, Viepcap's asset size still "bloated" thanks to the "sudden" growth of financial assets recorded through profit and loss (FVTPL) and financial assets available for sale (AFS).

Accordingly, as of the end of September 2023, the market value of the FVTPL portfolio at Vietcap Securities reached VND 1,123 billion, an increase of about VND 458 billion compared to the beginning of the year. According to the explanation, the company is holding a number of stocks such as HPG, CTG, VNM... and VND 586 billion worth of bonds in FVTPL. The value of the FVTPL portfolio is not too volatile compared to the purchase price.

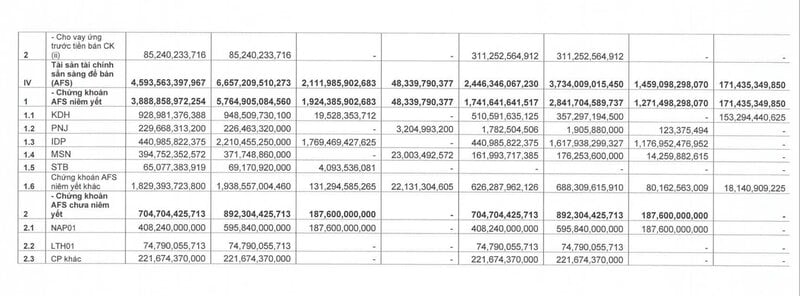

The majority of the proprietary portfolio is still in the AFS portfolio with VND 6,657 billion (market price), up 78% compared to the beginning of the year.

The largest investments are in stocks IDP, KDH, PNJ, MSN... The AFS portfolio is making a profit of more than VND2,000 billion, mainly thanks to the strategic investment in IDP (profit of VND1,769 billion), along with KDH, STB. On the contrary, this securities company is recording losses on investments in PNJ and MSN.

In addition, the securities company has 634 billion VND in held-to-maturity (HTM) investments, down 28% compared to the beginning of the year. The value of margin loans and pre-sales at the end of September reached 5,782 billion VND, an increase of about 500 billion VND after 9 months.

On the other side of the balance sheet, Vietcap Securities' liabilities are 9,625 billion VND, up 24% compared to the beginning of the year. The majority is short-term debt with 8,722 billion VND. In addition, the outstanding bond debt at this securities company is 120 billion VND.

Source

![[Photo] 60th Anniversary of the Founding of the Vietnam Association of Photographic Artists](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764935864512_a1-bnd-0841-9740-jpg.webp&w=3840&q=75)

![[Photo] National Assembly Chairman Tran Thanh Man attends the VinFuture 2025 Award Ceremony](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F05%2F1764951162416_2628509768338816493-6995-jpg.webp&w=3840&q=75)

Comment (0)