|

| Regulations on social insurance payment period to receive pension in 2023. (Source: TVPL) |

Social insurance regimes

According to the provisions of the Law on Social Insurance 2014, social insurance can be understood as a guarantee to replace or partially compensate employees' income when they have reduced or lost income due to illness, maternity, work accidents, occupational diseases, retirement age or death, based on contributions to the social insurance fund.

Social insurance includes two basic types: compulsory social insurance and voluntary social insurance. Each type has its own corresponding regimes, specifically as follows:

(1) Compulsory social insurance is a type of social insurance organized by the State in which employees and employers must participate. Compulsory social insurance includes the following regimes:

- Sick;

- Maternity;

- Work accidents, occupational diseases;

- Retirement;

- Death.

(2) Voluntary social insurance is a type of social insurance organized by the State in which participants can choose the contribution level and payment method suitable to their income, and the State has a policy to support social insurance contributions so that participants can enjoy retirement and death benefits. Voluntary social insurance includes the following regimes:

- Retirement;

- Death.

In particular, the retirement regime is an extremely important regime to help social insurance participants have an income (also known as pension) to ensure basic living needs after reaching the legal working age.

Regulations on social insurance payment period to receive pension

Based on the provisions of Articles 54, 55, 73 of the Law on Social Insurance 2014 (amended by Clause 1, Article 219 of the Labor Code 2019), it can be seen that in order to receive a pension, social insurance participants (including compulsory social insurance and voluntary social insurance) must meet two conditions on retirement age and time participating in social insurance.

In which, for the conditions on social insurance participation time, the requirements are:

- For compulsory social insurance participants: Must have at least 20 years of social insurance contributions, except for female workers who are full-time or part-time workers in communes, wards, and towns, who must have at least 15 years of social insurance contributions.

- For voluntary social insurance participants: Must have 20 years or more of social insurance contributions.

How to calculate the latest pension level

The pension level is calculated based on the pension rate according to the employee's social insurance contribution salary, the formula is as follows:

Monthly pension = Monthly pension rate x Average monthly salary for social insurance contribution

In there:

(1) Monthly pension rate

- Pension rate for male workers: If you have participated in social insurance for 20 years, you will receive 45%, then for each additional year, add 2%, up to a maximum of 75%.

In case the employee has a social insurance payment period higher than the number of years corresponding to the pension rate of 75%, in addition to the pension, the employee will receive a one-time allowance.

- Pension rate for female workers: 45% after 15 years of social insurance payment, then 2% is added for each additional year, up to 75%.

In case the employee has a social insurance payment period higher than the number of years corresponding to the pension rate of 75%, in addition to the pension, the employee will receive a one-time allowance.

Source

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

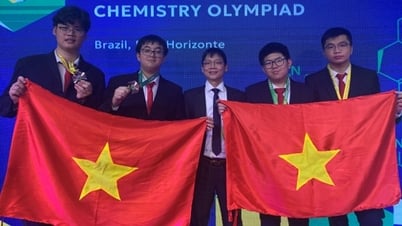

![[Video] Four Vietnamese students won medals at the Mendeleev International Chemistry Olympiad](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/13/d0578baffa61400f8913f3916a728cc7)

Comment (0)