On the morning of November 29, with 93.52% of delegates in agreement, the National Assembly voted to pass the Resolution on applying additional corporate income tax according to regulations against global tax base erosion (global minimum tax).

According to this resolution, Vietnam will apply a global minimum tax from January 1, 2024. The tax rate will be 15% for multinational enterprises with a total consolidated revenue of 750 million euros (about 800 million USD) or more in 2 of the 4 most recent years. Taxable investors will be required to pay the global minimum tax in Vietnam.

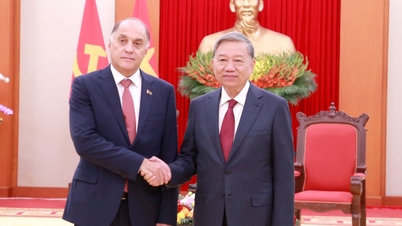

Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh reports on the explanation and acceptance of the National Assembly Standing Committee on the draft resolution.

However, the imposition of a global minimum tax will directly affect the interests of foreign-invested enterprises during the tax exemption period, with an actual tax rate lower than 15%.

In the report explaining and accepting before the National Assembly voted to approve the resolution, the National Assembly Standing Committee said that there is a possibility that businesses that have to pay global minimum tax in Vietnam will file a lawsuit if they want to pay this tax to their home country.

Therefore, in addition to issuing resolutions, the Government needs to proactively prepare, have appropriate solutions and handling plans if disputes and complaints arise to ensure the investment environment.

When the global minimum tax is applied, Vietnam's tax exemption and reduction incentives for foreign enterprises will no longer be effective, which may affect the investment environment. In previous discussions, some National Assembly deputies suggested that the Government assess the overall investment environment when implementing the global minimum tax, in order to have appropriate investment incentive solutions, as well as clarify the tax incentive regime for new investors entering Vietnam.

Others want to clarify that in case enterprises invest in Vietnam after the resolution takes effect, tax investment incentives will be applied according to the provisions of the Corporate Income Tax Law or the global minimum tax resolution.

Reporting on behalf of the National Assembly Standing Committee, the Chairman of the National Assembly Finance and Budget Committee said that the tax regime for new investors will continue to be resolved by the Government when amending the Corporate Income Tax Law. However, new investment support policies are needed to replace ineffective tax incentives so that investors can feel secure about the investment environment in Vietnam and attract large, strategic investors, while supporting domestic enterprises.

There will be an investment support fund from global minimum tax revenue.

Faced with many concerns about ensuring the investment environment when there are no suitable incentive solutions when implementing the global minimum tax, the National Assembly Standing Committee said that on November 15, the Government reported on the development of the draft Resolution on applying additional corporate income tax and the draft Resolution on piloting support policies in the high-tech sector, including the proposal to establish a fund to implement investment support measures.

National Assembly passes resolution to apply global minimum tax from January 1, 2024

However, the National Assembly will not issue a separate resolution on investment support policy, but will include it in the general resolution of the session. Accordingly, the National Assembly agrees in principle, assigning the Government in 2024 to draft a decree on the establishment, management and use of investment support funds from global minimum tax revenue and other legal sources to stabilize the investment environment, encourage and attract strategic investors, multinational corporations and support domestic enterprises in a number of areas that need investment incentives.

According to the resolution, taxable payments below the minimum level effective from January 1, 2025 will be included in the amended Corporate Income Tax Law. The National Assembly assigned the Government to promptly prepare a draft of the amended Corporate Income Tax Law, adding it to the 2024 law and ordinance making program so that it can be applied from fiscal year 2025. This is to ensure the right to tax taxable payments below the minimum level of Vietnam according to the global minimum tax regulations.

The global minimum tax is an agreement reached by G7 countries in June 2021 to combat multinational corporations shifting profits to low-tax countries to avoid taxes, effective from January 1, 2024. The tax rate will be 15% for multinational enterprises with a total consolidated revenue of 750 million euros (about 800 million USD) or more in 2 of the 4 most consecutive years. The UK, Japan, South Korea, and the EU will impose the tax in 2024.

According to a review by the General Department of Taxation and the Ministry of Finance , there are about 122 foreign corporations investing in Vietnam that are affected by the global minimum tax. If the countries with parent companies all apply the tax from 2024, these countries will collect an additional tax difference of about more than VND 14,600 billion next year.

Source link

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

Comment (0)