Many families have an income of over 30 million VND/month, but at the end of the month they are still "empty-pocketed". Meanwhile, many households with an income of only about 15-25 million have a decent amount of savings. According to personal finance expert Dr. Dinh Thi Thanh Van, the difference lies in spending habits and cash flow management , not in income.

"A person who knows how to manage money is someone who knows how to prioritize - what is essential, what can be postponed, what is an investment for the future. This is the root to avoid falling into the spiral of reckless spending," Ms. Van commented.

A spending management principle recommended by many experts is to fully record income and expenditure. This can be done through notebooks, Excel spreadsheets, or phone applications such as MoneyLover, MISA Income and Expenditure Book, etc.

Why do we need to keep a record? Helps visualize the real financial picture. Detect unnecessary expenses. Create a basis for monthly or quarterly financial planning. Especially if the family has many people contributing income - recording is even more important to ensure transparency, consistency and effective savings. |

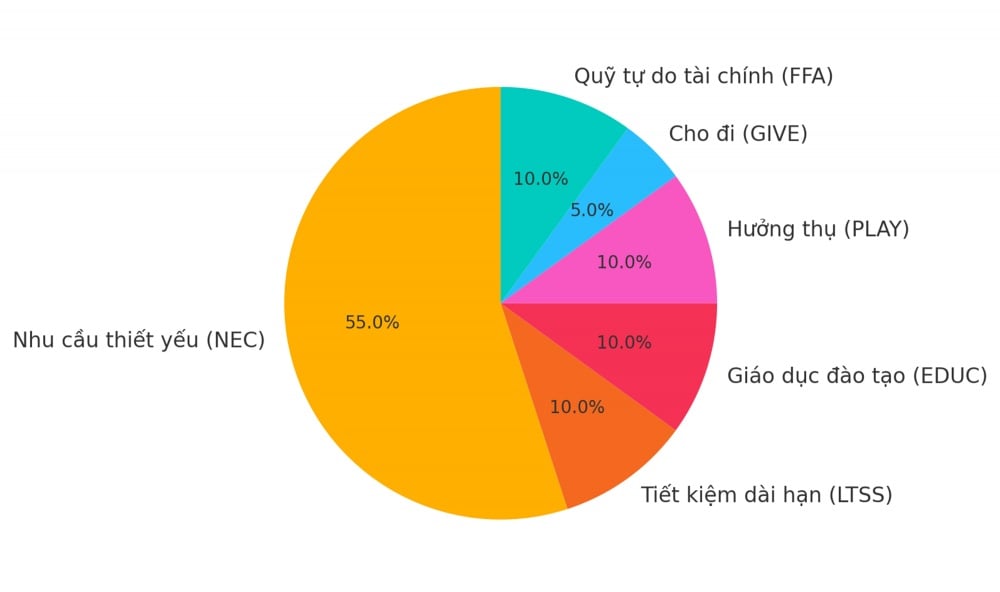

6 JARS method:

|

Originating in Japan, this method divides income into 6 funds as follows:

- 55% - Necessities (NEC): living expenses, electricity, water, food.

- 10% - Long-term savings (LTSS): buying a house, car, retirement.

- 10% -Education (EDUC): learning, self-development.

- 10% - Enjoyment (PLAY): travel , entertainment.

- 10% - Financial Freedom (FFA): invest, create passive income.

- 5% - Charity (GIVE): charity, helping others.

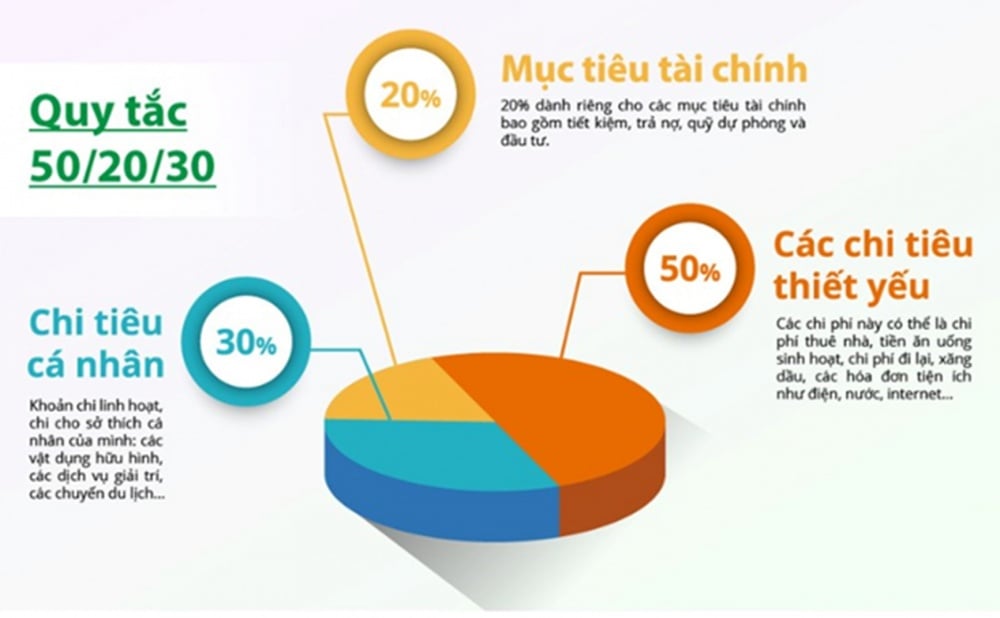

50/30/20 Method:

|

“Each method has its own advantages and disadvantages. Depending on income and spending habits, families should choose the appropriate division method. The most important thing is to create financial discipline in daily spending,” expert Van added.

Nowadays, managing expenses is no longer dependent on pen and paper. AI-integrated mobile applications help:

- Automatically record and classify expenses.

- Alerts when spending exceeds budget.

- Forecast financial trends for next month.

- Sync with bank accounts to track balance changes.

Some apps worth trying: MoneyLover, MISA Money Keeper, Online Income and Expense Book, Savyu, HomeBudget...

One of the most common "money-consuming" expenses in a family is regular bills: electricity, water, internet, cable TV... Seemingly small habits like turning off the lights when leaving the room, turning on the washing machine in economy mode, or canceling rarely used services like pay TV channels will help save hundreds of thousands of dong each month.

Spending cannot be effective without a clear financial goal: buying a house, sending children to study abroad, retiring early, or simply having a reserve fund for 6 months without income. Each family member needs to understand and share that goal in order to act together.

For example: A family aims to save 200 million VND in 2 years to change a car. So each month they need to save 8.5 million VND. From there, unnecessary entertainment or shopping expenses will be cut down reasonably.

One way to help your family maintain good spending habits is to review your budget each week:

- How much did you spend?

- Is there any over budget?

- Are there any expenses that can be reduced or cut back? This will help you “warn up” when your spending habits start to get out of control, especially during holidays, Tet or long vacations.

Spending is something that everyone has to face every day. But to make it serve your life instead of becoming a burden, you need to change your mindset:

- Keep a log and track it closely.

- Divide cash flow by goal.

- Use technology for better control.

- Save before you spend.

“Financial management is not to live a miserable life, but to be proactive and confident in the face of all the changes of modern life,” concluded expert Dr. Dinh Thi Thanh Van.

In the digital age, there is no reason why every family cannot control their spending intelligently. With the help of technology, simple financial allocation methods and a clear sense of goals, every family can absolutely achieve financial stability - regardless of income level.

Source: https://thoibaonganhang.vn/quan-ly-tai-chinh-gia-dinh-thoi-40-chi-tieu-thong-minh-song-an-tam-163058.html

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

Comment (0)