From late June to early July, the community and millions of customers who have registered to use bank accounts and conduct online transactions have been paying close attention to the term "biometric authentication" because, according to Decision No. 2345/QD-NHNN dated December 18, 2023, of the State Bank of Vietnam (Decision 2345) on the implementation of safety and security solutions in online payments and bank card payments, starting from July 1, 2024, money transfers of 10 million VND/transaction or more than 20 million VND/day and some other online banking transactions are required to authenticate using facial recognition.

This is a major effort by the banking sector in its roadmap to accelerate digital transformation, creating safety and convenience for customers when conducting transactions. In fact, the banking sector has been doing everything possible to quickly implement Decision 2345.

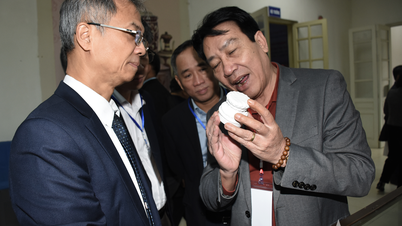

Customers come to Agribank Phu Tho Branch to conduct transactions and perform STH verification.

Secure and safe, increased benefits.

According to the Banking Times, there are currently over 182 million individual customer payment accounts, equivalent to more than 87% of adults having payment accounts at banks. Many banks have processed over 95% of their transactions through digital channels. Non-cash payments are growing strongly, especially the number of mobile and QR code payment transactions, which averaged over 100% per year from 2017 to 2023...

In reality, people are increasingly adapting to, accessing, and using cashless payment applications in transactions and purchases due to the convenience they offer. Instead of using cash, transactions can be completed with just a smartphone connected to the internet. This is especially true for transactions involving large amounts of cash, which are both difficult to secure and prone to errors.

In recent times, the convenience and benefits offered by online banking products and services have been immense. However, the banking industry also faces risks and challenges related to security and confidentiality, including the threat of cyberattacks and the use of advanced technology to defraud and steal money and bank accounts from citizens through increasingly sophisticated and complex methods.

Credit officers of the Social Policy Bank in Cam Khe district advise and assist customers in installing STH.

Therefore, Decision 2345 will address two important issues: ending the practice of opening bank accounts using forged documents and eliminating the practice of opening accounts using genuine documents but not by the account holder themselves. The verification of account numbers as required by Decision 2345 will ensure that the account holder and the person possessing the citizen identification card issued by the Ministry of Public Security are correctly identified.

According to Deputy Governor of the State Bank of Vietnam Pham Tien Dung, facial recognition authentication adds another layer of protection. Banks are not neglecting any security measures, thus making it even safer for customers. This is a major "campaign," a mandatory requirement to increase security, safety, and protect customers' assets. Even if a customer loses their documents or a fraudster brings them to the bank to impersonate the owner and steal money, it will be difficult to succeed because facial recognition authentication is available to verify the identity of the account holder.

Thanks to the efforts of the entire system, in just the first three days after Decision 2345 came into effect, that is, by 5 PM on July 3rd, 16.6 million bank accounts had been checked and cross-referenced with data from the Ministry of Public Security to eliminate fake accounts created with forged documents. The 16.6 million customer accounts that received STH verification in the first three days are equivalent to the number of new accounts opened in a year by the banking industry. One commercial bank verified 2.6 million accounts on the first day, July 1st, 10-20 times more than a normal day. Some banks even started implementing STH verification for customers as early as June. By the afternoon of July 5th, 19 million accounts had received STH verification...

Facilitating and securing STH authentication.

To facilitate customers in registering and using STH (Surname, First Instance) verification information, the State Bank of Vietnam promptly directed its units to strengthen communication, provide guidance on the implementation method to all customers, prepare contingency plans, hotline channels, and assign staff to be on duty 24/7 to guide and support customers in registering and using STH verification information in a timely manner.

Simultaneously, proactively coordinate with the National Population Data Center, the Department of Administrative Management of Social Order (Ministry of Public Security), and relevant organizations to prepare plans for handling difficulties and obstacles in the registration and use of STH authentication services, while simultaneously implementing technical solutions to ensure the security and safety of customer information and data, complying with legal regulations on personal data protection, ensuring the security and safety of information systems, and seriously implementing measures to combat forgery, deepfake technology, and still image falsification...

A teller from Saigon - Hanoi Commercial Joint Stock Bank (SHB) in Phu Tho guides and assists customers in installing STH.

In a similar move, to ensure the rapid, timely, and effective implementation of Decision 2345 of the State Bank of Vietnam, and to meet the needs and rights of customers, the State Bank of Vietnam's provincial branch directed its branch network to closely coordinate with mass media and relevant sectors to promote information and communication about the necessity and benefits of using digital signatures in online banking transactions; to inspect and review information technology infrastructure, and to combine the use of digital platforms and social networks to diversify methods of dissemination and guidance for people to implement the system.

In addition, deploy personnel and assign staff to be on duty at banks to promptly advise, answer questions, guide, and assist those performing STH updates, ensuring safety, smooth operation, and maximum convenience for customers, while remaining vigilant against fraudulent activities related to STH update support...

With proactive, thorough, and meticulous preparation, the nationwide rollout of STH (Social Security, Technology, and Logistics) in Phu Tho province in particular has been effectively implemented, creating a breakthrough and contributing to information security, ensuring the safety of personal assets, increasing benefits for customers, and simultaneously strengthening the prevention and effective fight against high-tech crimes and other types of crimes in the banking sector and operations.

Hoang Anh

Source: https://baophutho.vn/phu-song-sinh-trac-hoc-loi-ich-va-can-thiet-215258.htm

![[Photo] The rapeseed flower season heralds the arrival of spring on the summit of Suoi Giang.](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2026/02/12/1770911320984_baolaocai-br_chuyen-muc00-00-38-10still068-jpg.webp)

Comment (0)