Sewing for export. (Photo: Tran Viet/VNA)

In 2025, immediately cut and simplify administrative procedures related to production and business activities, ensuring the abolition of at least 30% of unnecessary investment and business conditions; reduce at least 30% of the processing time of administrative procedures, and 30% of the cost of complying with administrative procedures.

This is one of the main contents of the Program to reduce and simplify administrative procedures related to production and business activities in 2025 and 2026 (the Program) recently approved by the Government .

The program will promote decentralization and delegation of authority in administrative procedure implementation, associated with resource allocation, and enhance the implementation responsibility of all levels and sectors in the direction of reducing the procedure handling of central agencies. "The level closest to the grassroots and closest to the people will be assigned to handle it, avoiding the situation of many levels, prolonging the handling time and causing harassment and negativity;" closely linked with the application of science and technology, digital transformation, and streamlining the organizational apparatus.

The objective of the Program is to inherit the results achieved by Resolution No. 68/NQ-CP dated May 12, 2020 of the Government promulgating the Program to reduce and simplify regulations related to business activities in the period of 2020-2025, continuing to focus on reviewing, reducing and simplifying administrative procedures and business investment conditions to achieve the following specific goals:

Leather shoe production. (Photo: Tran Viet/VNA)

By 2025: Immediately reduce and simplify administrative procedures related to production and business activities, ensuring the abolition of at least 30% of unnecessary investment and business conditions; reduce at least 30% of the processing time of administrative procedures, and 30% of the cost of complying with administrative procedures.

100% of administrative procedures related to enterprises are performed online, smoothly, seamlessly, effectively, ensuring transparency, minimizing paperwork. 100% of administrative procedures are performed regardless of administrative boundaries within the province.

At the same time, complete the implementation of 100% of the plan on decentralization of authority to handle administrative procedures approved in Decision No. 1015/QD-TTg dated August 30, 2022 of the Prime Minister . 100% of internal administrative procedures between state administrative agencies and within each state administrative agency are reviewed, reduced, simplified procedures, processing time, implementation costs and amended and completed to be consistent with the implementation of streamlining and restructuring the apparatus, while ensuring smoothness and efficiency.

By 2026: Reduce and simplify 100% of unnecessary or conflicting, overlapping investment and business conditions or general, non-specific, and unclear regulations; abolish 100% of investment and business conditions of industries and professions not on the list of conditional investment and business industries and professions of the Investment Law.

Cut 50% of the time to handle administrative procedures and 50% of the cost of complying with administrative procedures compared to 2024; 100% of administrative procedures stipulated in technical regulations and mandatory standards must be published, reviewed, reduced, and simplified; 100% of business reporting regimes are performed electronically.

100% of internal administrative procedures in each state administrative agency are internally managed in the electronic environment.

100% of information, papers and documents in administrative procedures related to production and business activities are provided only once to state administrative agencies and 100% of eligible administrative procedures are performed online throughout.

Loading rice for export. (Photo: Hong Dat/VNA)

The content of the implementation program includes cutting and simplifying administrative procedures related to production and business activities; cutting and simplifying internal administrative procedures; promoting the implementation of administrative procedures regardless of administrative boundaries.

Regarding the reduction and simplification of administrative procedures related to production and business activities, Ministries and ministerial-level agencies shall reduce and simplify administrative procedures within their scope of management; Provincial People's Committees shall reduce and simplify administrative procedures prescribed in documents of People's Councils and People's Committees.

Specifically as follows: Synthesize and compile a list of administrative procedures related to production and business activities; reduce and simplify administrative procedures based on technology application and data reuse; reduce and simplify administrative procedures associated with the arrangement and streamlining of the organizational apparatus; promote decentralization and delegation of authority in the implementation of administrative procedures; reduce and simplify investment and business conditions and transfer some activities or licensing procedures to enterprises and social organizations.

The program clearly states the reduction and simplification of internal administrative procedures, including: internal administrative procedures between state administrative agencies; internal administrative procedures within each state administrative agency.

Among them, the Government requested ministries and ministerial-level agencies to urgently complete the implementation of plans to reduce and simplify internal administrative procedures in accordance with the roadmap approved by competent authorities; fully announce and publicize internal administrative procedures between state administrative agencies on the National Database on Administrative Procedures, to be completed before April 30, 2025./.

According to Vietnam+

Source: https://baothanhhoa.vn/phe-duyet-chuong-trinh-cat-giam-thu-tuc-hanh-chinh-lien-quan-san-xuat-kinh-doanh-243626.htm

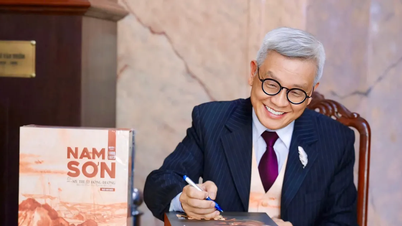

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

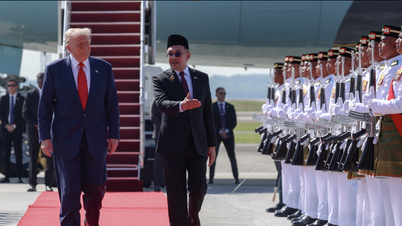

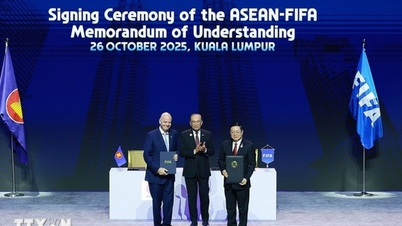

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)