Some experts and National Assembly delegates agree with the inclusion of fertilizers in the value added tax (VAT) category, but some delegates also have concerns.

Delegates attending the discussion - Photo: P.HUNG

On the morning of November 10, Nong Thon Ngay Nay newspaper organized a discussion on Value Added Tax (VAT) for fertilizers - For the benefit of farmers and the development of the domestic fertilizer industry.

Speaking at the seminar, Vice President of the Vietnam Farmers' Association Nguyen Thi Thom said that the National Assembly is discussing the draft revised Law on Value Added Tax, including the content of changing fertilizers from non-taxable to taxable, which is attracting the attention of many farmers, cooperatives, and fertilizer trading and production enterprises.

Therefore, Ms. Thom suggested that National Assembly delegates and experts discuss, exchange democratically and responsibly, and give suggestions so that policies ensure the interests of "three families", with special attention to farmers, to support farmers in agricultural production.

Calculate the impact on farmers

At the discussion, delegate Phan Duc Hieu - Standing member of the National Assembly's Economic Committee - said that there are currently two scenarios to choose from when applying VAT: 0% or 5%, these are two scenarios that many people have opinions about.

Comparing the two options of applying VAT at 5% or 0%, Mr. Hieu emphasized that each scenario has different advantages and disadvantages. No scenario is comprehensive and it is difficult to compare.

According to Mr. Hieu, we can only decide which option to choose if we take the subject as the focus, which is the State, enterprises or consumers (farmers) to decide.

From the consumer perspective, Mr. Hieu said that if businesses reduce production costs, will they be willing to reduce prices for farmers? Because when a 5% tax is applied, product prices will certainly increase.

In the case of a 0% VAT rate, at least the cost of fertilizers will not increase.

With the scenario of applying 5% VAT, Mr. Hieu said that businesses will be refunded input tax, have conditions to promote domestic production, and increase competition.

Mr. Hieu assessed that in both scenarios, businesses have the same benefits and this is an opportunity to reduce costs. Domestic production will be more profitable than imports because imported products add 5%, domestic production will have increased competitive advantage.

But from the consumer's perspective, they have to pay 5% more. Whether or not businesses reduce their prices is just an expectation.

"I propose that we should get separate opinions on the issue of VAT on fertilizers before approving the full draft of the Law on Value Added Tax," Mr. Hieu added.

Ms. Nguyen Thi Lan Huong, chief specialist of the Policy Department (General Department of Taxation), said that applying 5% VAT will help avoid the effect of increasing product prices, creating favorable conditions for domestic manufacturing in the context of competition with imported goods.

At the same time, it will better support agricultural production because all input VAT of production will not have to be accounted for in costs but will be deducted from input VAT.

"Fertilizer manufacturing enterprises will be refunded tax because output VAT (5%) is lower than input (10%), manufacturing enterprises will have room to reduce selling prices if fertilizer prices and input materials on the market do not change" - Ms. Huong analyzed.

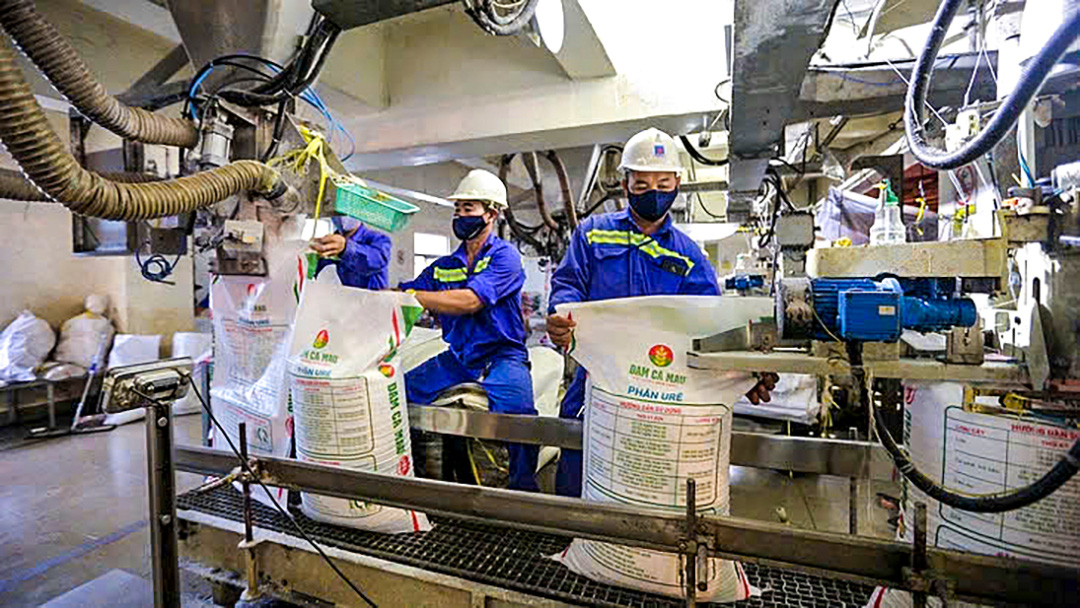

Production line of a large fertilizer enterprise in the South - Photo: N.AN

State regulation is needed if 5% VAT is applied.

Agricultural expert Hoang Trong Thuy said that before 2014, we had imposed a 5% tax on fertilizers. Since January 2015, when VAT was not imposed on fertilizers, farmers were happy and agriculture has grown.

However, later when the agricultural market encountered some problems, businesses encountered difficulties, many businesses struggled, and some places produced poor quality fertilizers...

"We really need to invest in farmers and develop sustainable agriculture. Therefore, my opinion is to impose VAT but must satisfy the conditions and the State must commit to price stabilization," said Mr. Thuy.

Mr. Pham Van Hoa - member of the National Assembly's Law Committee - said that through the explanation of the National Assembly Standing Committee, he realized that since 2015, when fertilizer was changed from being subject to 5% VAT to not being subject to tax, it has caused great impacts and disadvantages for domestic fertilizer production enterprises.

Because input VAT of fertilizer enterprises is not deductible, it must be accounted for in costs, including input tax. This greatly affects investment and purchase of fixed products, causing domestic product prices to increase.

"My point of view is to agree with the explanation of the National Assembly Standing Committee. That is, a 5% VAT must be applied to fertilizers. Fertilizers are currently a commodity subject to price stabilization. The State will regulate to ensure that fertilizers do not increase in price," said Mr. Hoa.

Source: https://tuoitre.vn/phan-bon-chiu-thue-hay-khong-chiu-thue-vat-deu-co-diem-loi-va-bat-loi-20241110151049243.htm

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)