Vietnam Airlines is the parent company that owns 99% of Pacific Airlines. Pacific Airlines has officially stopped operating its fleet after many consecutive years of losses. Vietnam Airlines has also been losing money for many years and currently Vietnam Airlines shares are restricted from trading.

Parent company and subsidiary both lose money "on top of" loss

Since March 18, Pacific Airlines has officially suspended its fleet. Previously, since March 15, many customers who contacted to book air tickets for this summer's flights have no longer seen flights of this airline. On direct ticket sales websites, there is also no information about Pacific Airlines.

The reason is that this airline has completed the payment and debt repayment to the aircraft owner. The pressure of debt from the previous period, even more stressful during the pandemic, makes the revenue not enough to cover expenses.

With such a large debt, threatening its ability to pay, Vietnam Airlines and its shareholders decided to pay off the entire fleet of Pacific Airlines to clear the debt.

Pacific Airlines was born in 1991, the first low-cost airline in Vietnam.

In 2007, Australia's Qantas Group invested in Pacific Airlines under the new name Jestar. However, the business situation continued to suffer losses. In October 2020, Qantas Group withdrew from this airline and transferred 30% of its shares to Vietnam Airlines.

By the first quarter of 2022, this deal was completed, Vietnam Airlines has held nearly 99% of shares in Pacific Airlines since then.

Pacific Airlines said this is a short-term, comprehensive restructuring measure to increase efficiency and optimize costs, and that the information about the airline going bankrupt is unfounded. The airline is still making efforts to restructure, looking for potential investors, and will take off again as soon as possible.

Vietnam Airlines' annual report shows that in 2022, Pacific Airlines recorded a total revenue of nearly VND3,487 billion and a pre-tax loss of VND2,096 billion. During the period 2009 - 2021, Pacific only made a profit in 3 years and lost money in the remaining 9 years. In the last three years from 2020 to now, the airline has lost more than VND2,000 billion each year. It is estimated that by the end of 2022, Pacific Airlines' equity will be negative VND6,700 billion.

At the same time as the business situation at Pacific Airlines was not very positive, the parent company - Vietnam Airlines (HVN, HOSE) also recorded many consecutive years of losses with negative equity.

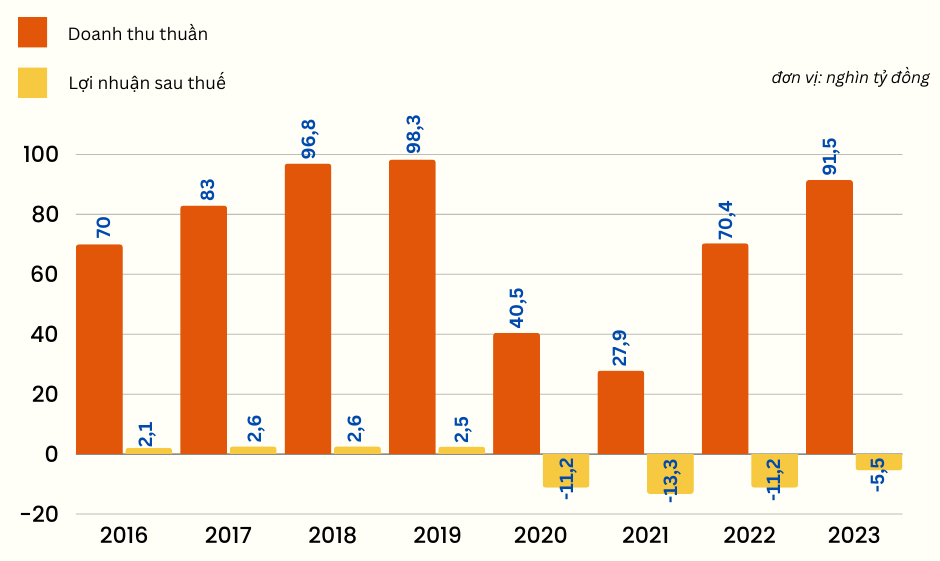

In the fourth quarter of 2023, net revenue at HVN reached VND 23,831 billion, up 23.5%. Accumulated for the whole year of 2023, Vietnam Airlines achieved net revenue of VND 91,459 billion, up 30% over the same period.

Profits improved compared to last year, revenue increased sharply in the last quarter of the year but still not enough for the national airline to escape losses of minus VND2,065 billion. For the whole year of 2023, HVN lost VND5,517 billion, marking the airline's 4th consecutive year of losses.

Looking at the financial report, the reason probably comes from a series of sharp increases in costs, specifically: selling costs increased by 36.7%, business management costs increased by 18.4%. In particular, other costs skyrocketed from VND37,881 billion to VND93,875 billion, 2.5 times higher than the same period last year.

Revenue and profit trends at Vietnam Airlines over the years

Source: Financial Statements

According to the company, in 2023, the international transportation market has not fully recovered, domestic and international passenger transportation activities face many difficulties due to declining demand, overcrowding and high competition. In addition, the aviation market faces many negative factors such as high fuel prices, geopolitical conflicts and exchange rate risks.

In addition, the national airline's financial situation is also alarming. In 2023, Vietnam Airlines will continue to "bear" large debts, at VND 74,562 billion, a slight increase of 4% compared to the beginning of 2023, of which, mainly short-term debt, accounting for 81.3%.

Owner's equity remained at a negative level of -16,945 billion VND. HVN's total assets were 57,617 billion VND.

Continuously losing, HVN stock still survives on HOSE

The business situation has continuously "regressed", with net losses for 4 consecutive years and negative equity. This has caused HVN shares to violate HOSE regulations and face the risk of being delisted from the exchange.

However, HVN will still be able to stay on the stock exchange if the draft amendments and supplements to the Securities Law are passed and the Government wants HVN to stay on the stock exchange.

Accordingly, the draft amending and supplementing Decree 155/2020/ND-CP on a number of articles of the Securities Law, the mandatory delisting item has been supplemented with Clause 7, stipulating "Special cases requiring maintenance of listing shall be considered and decided by the Government".

This is considered a "lifesaver" for HVN to maintain its listing on the HOSE.

HVN stock performance from 2023 to present (Source: SSI iBoard)

Previously, HVN shares were put on warning status from April 25, 2023, and on May 12, 2023, they were transferred to control status due to late submission of audited financial statements for 2022 beyond the prescribed deadline.

On July 12, 2023, Ho Chi Minh City Stock Exchange (HOSE) decided to move HVN from controlled to restricted trading, only allowed to trade in the afternoon session.

At the end of 2023, HOSE removed HVN from the warning list because the company successfully organized the 2023 Annual General Meeting of Shareholders on December 16, 2023, overcoming the cause that led to the stock being put on the warning list.

At the end of today's session (March 19), after the news that Pacific Airlines had temporarily suspended operations, HVN shares still increased slightly by 1.14%, reaching a market price of VND13,350/share. The highest level in HVN's history was in 2018, nearly VND42,000/share.

Source

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)