Mr. Nguyen Duy Hung, Chairman of SSI, shared at the 2025 annual general meeting of shareholders - Photo: HONG PHUC

At the congress, the possibility of SSI participating in the digital asset sector was a topic that attracted the attention of shareholders.

Spending a lot of time clarifying the company's stance on this issue, Mr. Hung said: "People keep saying (SSI - PV) will open a floor, but until now it has not."

"Risk of losing money to the crowd then don't do it"

SSI Chairman said that at present, the company has no policy on whether to make a digital asset exchange or not and there are three things to consider to find the answer.

Firstly, if we become a stock exchange, can it bring benefits and profits to SSI? Secondly, are there any risks in this field and thirdly, can risks be managed with technology?

"Regardless of right or wrong, if we risk losing money to the crowd, we won't do it," Mr. Hung said.

SSI founder affirmed that he and his team aim to build SSI into a leading prestigious financial institution, not the largest financial institution, but the most prestigious.

He explained that top reputation includes "having to know, having to be clear" about all things related to trends, to understand where the team is and how it started.

Although he has no plans to set up a digital asset exchange, he considers this field an inevitable development trend.

Some governments are considering including digital currencies in their national reserves, similar to gold, which means they have built a legal framework.

"We should not consider this a 'meme' to herd chickens and ducks in the market. Blockchain technology and digital technology are the future. When they are the future, they will bring profits and value to the economy," said the chairman of SSI.

SSI has therefore begun to research and survey the digital asset market, but this is only "the first step in understanding and positioning ourselves".

According to Mr. Hung, a leading financial institution cannot be "ignorant, ignorant, and uninterested" in this field, but it cannot be hasty either.

The financial institution has set up a subsidiary that is being described as an "incubator" for digital technology businesses, and is waiting to grow its business once the legal system for digital assets is established.

"We already have successful projects in the incubator, but how to turn all these projects into efficiency depends on the legal framework. Until now, no one has clearly stated what the legal framework is," said Mr. Hung, adding that "anything said about digital assets at this time is a bit early."

However, the person known as the 'boss' of Vietnam's securities market told shareholders: "SSI will not go later or slower than any other organization just because of lack of knowledge, but will only implement and do if it is safe and effective."

Why are there rumors?

Speculations about SSI establishing a stock exchange arose because investors observed that Chairman Nguyen Duy Hung had recently had many activities related to digital assets.

He has repeatedly expressed his views on the digital asset market and believes that with a young workforce and passion for technology, Vietnam will become the region's digital asset center if there is a suitable legal framework.

"If no one lights a fire today, there will be no fire tomorrow. If this opportunity for digital assets is missed, we do not know when we can develop such a new and potential field," Mr. Hung shared at the Vietnam Technology Impact Conference 2024 (VTIS 2024).

Not only did Mr. Hung express his views publicly on forums, he also had many meetings with the world's leading financial leaders. In March 2025, he had dinner with Mr. Jan Van Eck, CEO of VanEck Global, who revealed that he was holding more than 30% of his net worth in bitcoin.

According to SSI's fanpage, an article posted on March 17 also mentioned that CEO Van Eck proposed the idea of establishing a fund and bitcoin investment organization in cooperation with SSI.

Currently, the Minister of Finance is presiding over the completion of the legal framework for crypto-asset exchanges in Vietnam to control risks and protect investors' rights.

On the morning of April 17, Minister of Finance Nguyen Van Thang met with Mr. Ben Zhou, CEO of Bybit, the world's second largest cryptocurrency exchange.

Mr. Ben Zhou expressed his desire to cooperate with Vietnam in building a legal framework and implementing a crypto asset exchange model.

Last February, Bybit was hacked, stealing more than $1.4 billion worth of ethereum.

The CEO shared with the media that the Vietnamese Verichains engineering team helped the cryptocurrency exchange investigate the cause of the recent hack, and assessed this team of engineers as "the most knowledgeable people in the world about cyber attacks".

Source: https://tuoitre.vn/ong-trum-chung-khoan-phu-nhan-tin-don-ssi-lap-san-giao-dich-tien-so-20250418171754736.htm

![[Photo] President Luong Cuong presided over the welcoming ceremony and held talks with Sri Lankan President Anura Kumara Dissanayaka](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/bbb34e48c0194f2e81f59748df3f21c7)

![[Photo] Solemn opening of the 9th Session, 15th National Assembly](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/ad3b9de4debc46efb4a0e04db0295ad8)

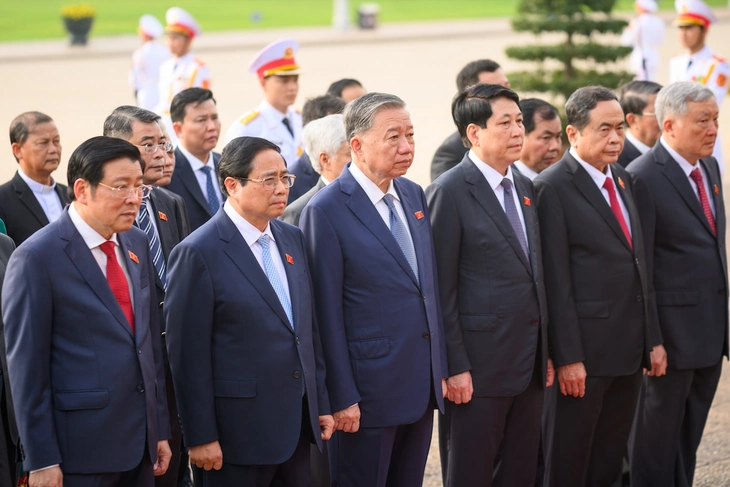

![[Photo] National Assembly delegates visit President Ho Chi Minh's Mausoleum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/5/9c1b8b0a0c264b84a43b60d30df48f75)

Comment (0)