The stock market has just experienced a period of sharp decline. The VN-Index has gradually decreased from over 1,200 points to the threshold of 1,000 points.

Billionaire Nguyen Dang Quang leaves Forbes' list of USD billionaires

Over the weekend, Forbes stopped updating the real-time assets of Nguyen Dang Quang, Chairman of Masan Group (MSN). The number of Quang's assets returned to the ranking in April 2023. This is the assessment table for 2023.

Thus, Mr. Nguyen Dang Quang's assets are no longer worth 1 billion USD or more. At the beginning of last week, Mr. Quang's assets were at 1 billion USD. At the end of September, this figure was 1.1 billion USD.

This is not the first time Mr. Quang has fallen off the list of USD billionaires. At the end of 2019, Mr. Quang also fell off the Forbes list after first entering the list of the richest USD billionaires in 2018.

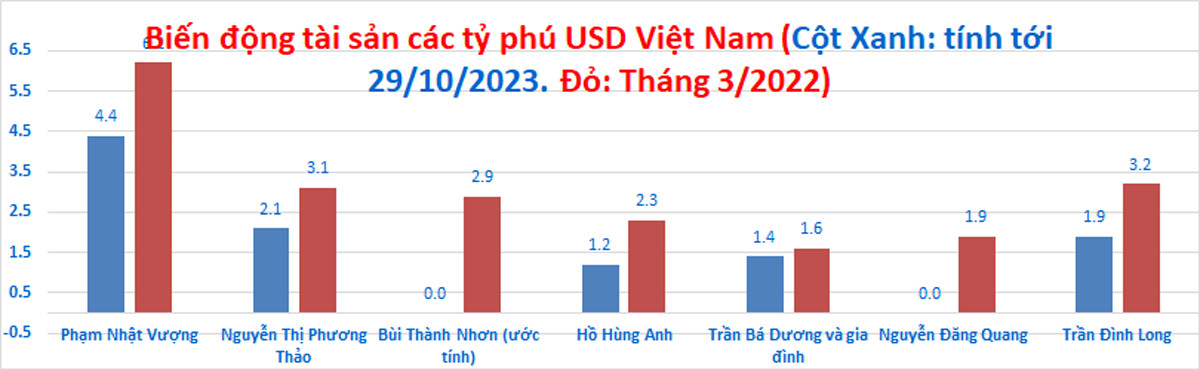

Mr. Quang's assets reached their peak according to Forbes' ranking of 1.9 billion USD in April 2022.

Mr. Quang's assets decreased in the context of MSN shares plummeting to a 2-year low, from over VND 140,000/share at the end of 2021 to the current level of VND 58,000/share.

Mr. Nguyen Dang Quang (born 1963 in Quang Tri) graduated with a PhD in Nuclear Physics from the Belarusian Academy of Sciences . After finishing his studies, he did not return to his country but stayed in Russia and started his business in the 1990s by selling instant noodles to Vietnamese people living there, then invested in soybeans, fish and chili sauce.

In 2022, Mr. Quang returned to Vietnam and developed many products such as Chinsu soy sauce, Chinsu chili sauce, Nam Ngu fish sauce, Omachi noodles, Ponnie sausage, Vinacafe coffee...

Currently, Masan Group is one of the largest enterprises in the consumer and retail sector, after acquiring the Vinmart chain of billionaire Pham Nhat Vuong and changing its name to Winmart.

According to statistics, Mr. Quang currently holds only 15 MSN shares of Masan. However, Mr. Quang indirectly holds a large amount of MSN shares through Masan JSC and Hoa Huong Duong, equivalent to nearly 45% of Masan shares. Mr. Quang also holds more than 9.4 million Techcombank (TCB) shares.

In addition, Mr. Quang's wife, Ms. Nguyen Hoang Yen, is holding more than 42 million MSN shares. Mr. Quang also directly holds shares of Masan Consumer (MCH), Masan Vision...

Vietnamese billionaires' assets decline

Many pillar stocks, including Vingroup (VIC), Vinhomes (VHM) of billionaire Pham Nhat Vuong; Masan (MSN) of Mr. Nguyen Dang Quang; Techcombank (TCB) of billionaire Ho Hung Anh; VietJet (VJC) of female billionaire Nguyen Thi Phuong Thao; HAGL Agrico (HNG) of Mr. Tran Ba Duong... decreased sharply.

The assets of Vietnamese billionaires have decreased sharply. According to Forbes' rankings, there are currently two Vietnamese businessmen who have left the list of USD billionaires: Mr. Bui Thanh Nhon and Mr. Nguyen Dang Quang.

Mr. Tran Dinh Long, Chairman of Hoa Phat Group (HPG), was also once removed from the Forbes billionaire list. Meanwhile, Ms. Nguyen Thi Phuong Thao was not ranked for a short period of time, after which Forbes explained that it was due to technical reasons.

Not only Mr. Quang, the assets of many Vietnamese billionaires have also dropped sharply compared to their peak in March 2022. According to Forbes, Mr. Pham Nhat Vuong's assets have decreased from 6.2 billion USD in March 2022 to 4.4 billion USD (as of October 29).

The assets of VietJet Chairwoman Nguyen Thi Phuong Thao decreased from 3.1 billion USD to 2.1 billion USD. The assets of Mr. Ho Hung Anh (Chairman of Techcombank) decreased from 2.3 billion USD to 1.2 billion USD. Mr. Tran Dinh Long is now at 1.9 billion USD, compared to 3.2 billion USD in March 2023.

Mr. Tran Ba Duong and his family also recorded assets from 1.6 billion USD down to 1.4 billion USD. Mr. Duong's assets fluctuated little because Thaco is not listed on the stock market. However, Mr. Duong has listed shares of HAGL Agrico (HNG).

In 2022, Vietnamese tycoons witnessed a turbulent year when billionaire Pham Nhat Vuong lost 2.1 billion USD, while Mr. Bui Thanh Nhon was removed from the Forbes list. The assets of Vietnamese businessmen decreased along with the stock market.

For the whole year of 2022, VN-Index decreased by 34%, from the peak of 1,525.58 points recorded in the first session of the year to 1,007.09 points.

In 2022, Mr. Bui Thanh Nhon (Chairman of Novaland) fell off the list of USD billionaires due to the stock price plummeting to the floor for dozens of sessions. In early 2023, Mr. Nhon was no longer on the Forbes list even though in March 2022, Mr. Nhon had assets converted from stocks reaching 2.9 billion USD.

Not only USD billionaires, many businessmen in the real estate and banking sectors have seen their assets decline because the real estate market has not yet recovered while banks are facing difficulties, such as Mr. Nguyen Van Dat (Chairman of PDR), Mr. Do Tuan Anh (Chairman of the Board of Directors of Sunshine Group), Ngo Chi Dung (Chairman of VPBank)...

On the other hand, some businessmen in the fields of technology, chemicals, seafood, etc. recorded a breakthrough in their assets. Mr. Truong Gia Binh, Chairman of FPT Board of Directors, was at times in the Top 10 richest people on the stock market thanks to the strong increase in FPT shares and the dividends and purchase of ESOP shares.

FPT shares increased thanks to good business results and prospects of this technology company. Since the beginning of the year, FPT has increased by more than 40% and at one point reached a historical high price.

In 2006, Mr. Truong Gia Binh was the richest person on the stock exchange with assets worth 2,400 billion VND.

FPT is one of the businesses expected to benefit in the software and semiconductor technology sectors after the US and Vietnam upgraded their comprehensive strategic relationship. The US is promoting the re-establishment of high-tech supply chains such as the semiconductor industry to friendly countries.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)