Despite the economic difficulties, some businesses still pay out large cash dividends. The Ministry of Industry and Trade is about to receive nearly VND6,000 billion from the "goose that lays the golden eggs".

The Board of Directors of Vietnam Engine and Agricultural Machinery Corporation - Veam (code VEA) has just approved a resolution to pay 2023 cash dividends at a rate of 50.3518%. The last registration date to receive 2023 dividends is November 20. The expected payment date is December 20.

With more than 1.32 billion shares outstanding on the market, it is estimated that Veam will have to spend nearly VND 6,691 billion to pay shareholders this time.

As of the end of the third quarter, the Ministry of Industry and Trade owns nearly 1.175 billion shares (equivalent to 88.47% of Veam's charter capital). The Ministry of Industry and Trade is expected to collect more than VND5,920 billion.

Regarding business performance, in the last quarter, Veam achieved revenue of more than VND 1,048 billion, an increase of 18.58% over the same period in 2023. Veam's financial revenue in this quarter decreased by 38.9%, earning only nearly VND 204.7 billion.

After deducting taxes, Veam reported a profit of more than VND 1,666 billion, an increase of 8.21% over the same period last year.

In the first 9 months of 2024, Veam had net revenue of more than VND 2,971 billion, up 3.59%, net profit of more than VND 4,924.3 billion, up 4.28% over the same period in 2023.

Compared to the plan, Veam's business results in the first 9 months of the year reached 90% of the after-tax profit target for the whole year 2024.

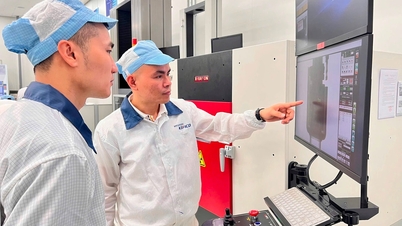

Veam is considered a "golden goose", thanks to its steady profits of several trillion each year, including large profits from joint ventures with foreign auto giants such as Honda, Toyota, and Ford.

The market also recorded a number of businesses spending quite heavily on 2023 dividends, from 50-100%.

In which, Pharmedic Pharmaceutical Materials JSC (code PMC) is one of the rare enterprises that pays dividends of over 100%.

Pharmedic's Board of Directors said that, based on the balance of the accumulated development investment fund as of June 30, the company returned the development investment fund to undistributed after-tax profits with a refund of nearly VND 102 billion, then used this refund to pay cash dividends to shareholders at a rate of 109%.

This dividend rate does not include the 24% 2024 dividend approved by the 2024 Annual General Meeting of Shareholders on April 20, which is divided from the after-tax profit of this year's production and business plan.

Meanwhile, the Board of Directors of Nam Tan Uyen Industrial Park JSC (code NTC) also announced a fairly large dividend payment of 60%. With 24 million outstanding shares, Nam Tan Uy plans to spend VND144 billion on this dividend payment. The ex-dividend date is November 22, and the expected implementation date is December 18.

For many years, Nam Tan Uyen has paid high cash dividends at a rate of 60-120%. In 2024, this enterprise plans to pay cash dividends at a minimum rate of 60%.

Yen Bai Forestry and Agricultural Products Joint Stock Company (code CAP) also decided to spend 90% of accumulated profits to pay 33% cash dividends for the 2023-2024 fiscal year.

This business specializing in trading in votive paper has paid out a fairly large dividend to shareholders for many years, over 50%. However, in the 2023-2024 fiscal year (from October 1, 2023 to September 30, 2024), the company's net profit was only VND31 billion, down 73% year-on-year, the lowest in 4 years.

On the market, at the end of the session on November 8, VEA shares reached 45,500 VND/share; PMC shares reached 102,200 VND/share; NTC shares reached 198,800 VND/share; CAP shares reached 45,500 VND/share.

Source: https://vietnamnet.vn/ong-lon-chia-co-tuc-khung-mot-bo-duoc-nhan-gan-6-000-ty-2340299.html

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

Comment (0)