According to Nhat Viet Securities (VFS), Donald Trump's key policies will have a positive impact on a number of Vietnam's industry groups and create potential investment opportunities in the long term.

Donald Trump wins election, Vietnam stock market expects positive developments in the long term

According to Nhat Viet Securities (VFS), Donald Trump's key policies will have a positive impact on a number of Vietnam's industry groups and create potential investment opportunities in the long term.

After being elected, Donald Trump is expected to implement policies such as: reducing taxes for businesses, imposing a 10-20% tax on imported goods from other countries, 60% for China. On the other hand, Mr. Trump has put pressure on the US Federal Reserve (FED) to keep interest rates low, creating conditions for businesses to borrow easily. It can be said that President Donald Trump's policies aim to boost the domestic economy.

These policies do not change the Vietnamese economy too much, but they still have some impacts. Regarding exports, the policy of increasing import tax to 10-20% will make Vietnamese goods more expensive, reducing the ability to compete with domestic goods in the US. However, if the US imposes a 60% tax on Chinese goods, Vietnam still has room to expand its market share, because data shows that consumption in the US is still maintaining a good recovery.

Regarding FDI capital flows, the application of strong tax policies targeting China will accelerate the process of shifting production out of China. In particular, Vietnam is still a favorite destination for FDI capital flows due to its stable economic policies, abundant labor force, and low costs. On the other hand, policies to promote domestic economic growth may pose a risk of increasing inflation, affecting the monetary easing process of the FED. Thus, the Vietnamese Dong may be under pressure to depreciate, leading to reduced room for monetary policy easing by the State Bank.

|

| FDI inflows into Vietnam tend to increase during Mr. Trump's first term. (Source: VFS synthesis) |

The stock market is a barometer of the economy. Therefore, when Donald Trump's policies do not change the Vietnamese economy too much, the VN-Index is expected to fluctuate positively in the same direction as the US stock market. Historical data shows that the S&P 500 index increased by an average of 11.28% in the presidential election year. Similarly, the VN-Index also increased by an average of 11.9% within 6 months, since the end of the election from 2004 to present.

VFS assessed that Mr. Trump’s election could create major fluctuations for the Vietnamese stock market, as his policies are often unexpected and unpredictable. However, in the long term, the market will move in a positive direction thanks to the stability of the macro economy.

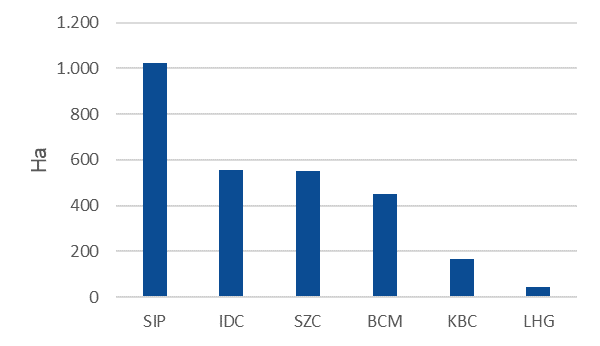

The industrial park real estate group will benefit greatly from the new policies, as the trend of shifting production out of China will boost prices and demand for land in industrial parks, especially in the southern region. In the third quarter, many businesses recorded positive business results such as: IDC, KBC, LHG, SIP... VFS expects the trend of shifting production to increase rental prices by about 10% from now until 2028. From there, it will positively impact the business results of this industry in the long term. In the industry, businesses with large land funds available for lease will be able to take advantage of opportunities from this shift. Potential stocks include: IDC, SZC, and BCM with the potential from continuing to expand projects and having diverse industrial services.

|

| Remaining land area for lease of some Real Estate - Industrial Park enterprises (Source: VFS synthesis) |

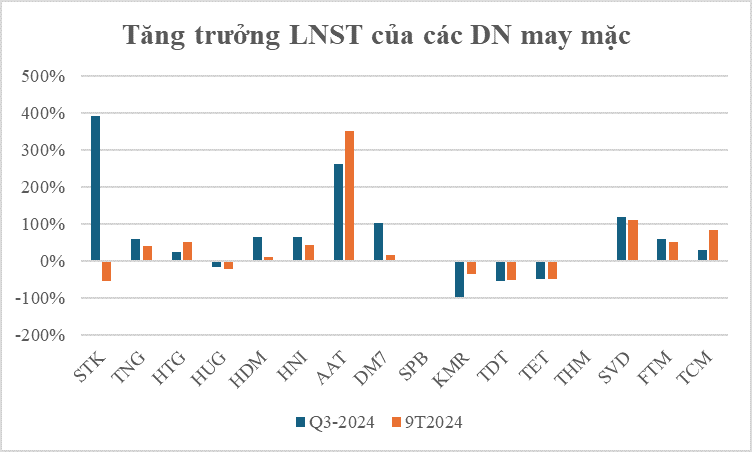

The garment export industry still has room for growth because it is a highly labor-intensive industry that is difficult to replace in the domestic market. Vietnam's textile and garment export markets are mainly the US and EU. In the context of US consumption recovering and China's competitiveness decreasing due to tax policies, the garment industry expects to increase output and selling prices in the US market. Potential stocks include: TCM and TNG with orders filled in 2024, helping these businesses complete their business plans this year.

|

| Many textile and garment enterprises recorded positive growth in after-tax profit in the third quarter and after 9 months of 2024. (Source: VFS synthesis) |

.

For detailed information about VFS Expert product policy, please visit: https://bit.ly/3A6IVzj

Source: https://baodautu.vn/ong-donald-trump-dac-cu-thi-truong-chung-khoan-viet-nam-ky-vong-dien-bien-tich-cuc-trong-dai-han-d230841.html

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)