ANTD.VN - Banks' profits increased modestly in the second quarter of 2024, while the bad debt ratio increased, covering bad debt at the lowest level since the Covid-19 pandemic.

FiinGroup's recently released report shows that the after-tax profit of the entire banking industry in the second quarter of 2024 increased modestly compared to the first quarter (only 6%). Net interest income increased slightly (6% compared to the previous quarter) in the context of slow credit growth and NIM remaining at the bottom.

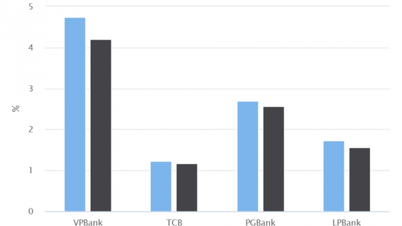

Specifically, the NIM ratio of 27 listed banks was at 3.43% in Q2/2024, remaining at the bottom for the fourth consecutive quarter. This trend was influenced by the narrowing NIM ratio in the group of state-owned joint-stock commercial banks, down from 2.83% in Q1/20224 to 2.73% in Q2/2024. In contrast, the NIM ratio improved from 3.88% to 3.96% in the group of private joint-stock commercial banks (including VPBank, Techcombank , MB).

The net LDR ratio (Total loans/Total deposits) is still on an upward trend, approaching the old peak, showing the high liquidity demand of the system in the context of the gap between credit growth and deposits at a "negative" level.

The recent increase in deposit interest rates will put certain pressure on the industry's NIM ratio, especially in the group of state-owned commercial banks, in the coming quarters in the context of the lending interest rate level continuing to move sideways due to weak credit demand and the Government's policy of keeping interest rates low to support growth.

|

Banking industry records increase in bad debt ratio |

While profitability is at risk of falling, the bad debt ratio is increasing and the ability to cover bad debt across the industry is declining.

The on-balance sheet bad debt ratio of 27 listed banks reported at the end of June 2024 was 2.21%, increasing back to the historical peak (2.24%).

Bad debt increased while provisioning costs remained moderate (thanks to the extension of Circular 02), causing the provisioning buffer to continue to thin, limiting the ability to handle debt in the coming time.

The bad debt coverage ratio (LLCR) will decrease to 81.5% in Q2/2024, the lowest level since the outbreak of Covid-19 and far from the peak (143.2%) in Q3/2022. The new bad debt creation rate will be 0.16% in Q2/2024, increasing for the second consecutive quarter.

Previously, many reports were also concerned about the asset quality of banks. VIS Rating said that the asset quality of many small banks is clearly declining (NCB, BacA Bank, Saigonbank, Vietbank... recorded a higher rate of newly formed problem debt (NPL) than other banks, mainly from the retail and SME segments.

Among state-owned banks, the problem debt ratio of VietinBank and BIDV increased due to the construction and real estate related sectors.

In addition, the industry's bad debt coverage ratio fell to 82% from 89% in the first three months of 2024. State-owned banks (VietinBank, BIDV) recorded the most significant decline due to higher problem debt ratios.

In contrast, the bad debt coverage ratio of some private banks increased thanks to improved asset quality (MB, TPBank) and increased provisioning (OCB).

Capital size of most banks decreased in the first 6 months of 2024. VIS Rating believes that capital size of banks will continue to be low in the second half of 2024 due to limited plans to raise new equity capital.

Some small banks such as ABBank and Viet Capital Bank have had difficulty in growing deposits due to increasingly fierce competition for mobilization and have had to increase the use of short-term interbank loans to support lending growth. Meanwhile, liquid assets accounted for 21% of total industry assets, unchanged from the previous quarter.

Regarding bank stocks, according to FiinGroup analysts, P/B (price/book value) of banks has fluctuated steadily within a narrow range (1.4-1.6 times) for nearly 2 years, significantly lower than the 2021-2022 period (1.7-2.7 times), but this is a reasonable valuation for the banking industry, reflecting concerns about the asset quality of the banking system after the consequences of negative developments in the corporate bond and real estate markets in 2022.

FiinGroup assessed that the outlook for the banking industry is not optimistic while the industry price index remains flat at the peak, limiting the increase in cash flow into this group of stocks.

In the stock market, individuals have been strong net buyers of bank stocks since the beginning of the year (more than 16,200 billion VND) - absorbing all the net selling force of organizations (mainly foreign investors).

Source: https://www.anninhthudo.vn/no-xau-ngan-hang-tien-den-vung-dinh-lich-su-ty-le-bao-phu-xuong-day-ke-tu-dai-dich-covid-19-post587238.antd

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Special flag-raising ceremony to celebrate the 135th birthday of President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/1c5ec80249cc4ef3a5226e366e7e58f1)

![[Photo] Party and State leaders visit President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/d7e02f242af84752902b22a7208674ac)

Comment (0)