Sacombank's 2024 profit increased to the highest level in the bank's history and exceeded the target assigned by the General Meeting of Shareholders, however, bad debt in group 5 with the possibility of losing capital increased by 81%.

Highest 2024 profit in history

The consolidated financial report for the fourth quarter of 2024 of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) recorded that Sacombank's total operating income (TOI) increased by 10.5% to VND 7,410 billion, while operating expenses decreased by 7.6%, helping net profit from business activities increase by 29.1% from VND 3,299 billion to VND 4,259 billion. The resultant profit after tax reached VND 3,598 billion, an increase of nearly 60% over the same period last year.

Accumulated for the whole year of 2024, interest income and similar income reached VND 49,988 billion, down 10.6% compared to 2023. Interest expenses and similar expenses decreased by 24.8% to VND 25,457 billion. As a result, the bank's net interest income reached VND 24,531 billion, up 11.1%.

Pre-tax profit in 2024 will reach VND12,720 billion, up 32.5%; after-tax profit will reach VND10,087 billion, up 30.7% over the previous year. This is a record high profit growth rate in the history of this bank's operations and exceeds the target assigned by the General Meeting of Shareholders.

The bank's total undistributed profit after tax at the end of 2024 was over VND28,400 billion, however, shareholders of this bank have not been able to receive dividends for the past 9 years.

At the 2021 Annual General Meeting of Shareholders, the bank's leaders pledged to completely resolve outstanding issues and complete the restructuring plan in 2023 to pay dividends to shareholders. However, to date, the dividend has not been paid.

Debt with potential loss of capital is more than 8,860 billion VND

According to the report, Sacombank's total assets reached VND 748,095 billion, up 10.9%; total mobilized capital reached VND 674,794 billion, up 16.7%; total outstanding loans to customers reached more than VND 539,315 billion, up 11.7% compared to 2023.

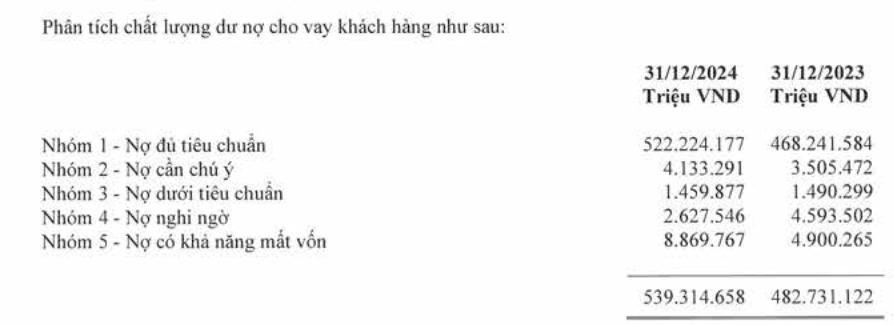

Regarding the quality of outstanding loans, the total outstanding loans of customers in groups 3, 4, 5 of Sacombank in 2024 compared to 2023 increased from VND 10,984 billion to VND 12,957 billion, equivalent to an increase of about 17.9%. The ratio of bad debt to outstanding loans increased slightly from 2.28% at the beginning of the year to 2.4% by the end of 2024.

The bad debt structure has clearly changed. Doubtful debt (group 4 debt) decreased by 42.8% to VND2,627 billion. However, debt with the possibility of losing capital (group 5) increased sharply, from VND4,900 billion at the beginning of the period to VND8,869 billion, an increase of about 81%, accounting for a large proportion of the bank's bad debt structure.

Despite the increase in bad debt, Sacombank's credit risk provisioning costs have decreased significantly, from VND3,688 billion in 2023 to only VND1,974 billion.

Regarding the handling of bad debts related to debts secured by STB shares of Mr. Tram Be and related parties, Sacombank said it has submitted handling plans and is currently waiting for approval from the State Bank.

Cut staff but increase salary steadily

By the end of 2024, the number of employees at Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank - Code: STB) had decreased by 476 people compared to the end of 2023 and was at 18,088 employees.

Compared to the largest scale in 2019, Sacombank has cut nearly 1,150 employees. However, contrary to the trend of staff cuts, the bank's employee costs have continuously increased over the years in the period 2015 - 2024, from 2,858 billion in 2015 to 7,419 billion in 2024.

Therefore, the average income of Sacombank employees has increased continuously over the years. In 2016, the average income of Sacombank employees was only 14.83 million VND/month/person, but by 2024 it had reached 33.8 million VND/month.

Regarding remuneration for senior leaders, the consolidated report also shows that the Board of Directors (BOD), the Board of General Directors and the Board of Supervisors will receive a total after-tax remuneration of the bank and its subsidiaries for the whole year of 2024 of VND 165 billion, an increase of VND 2 billion compared to 2023.

Sacombank spent more than VND53 billion on remuneration for members of the Board of Directors, an increase of nearly VND9 billion compared to last year. With this total expenditure, on average, each member of the Board of Directors received more than VND4.4 billion in 12 months, equivalent to VND367 million/person/month.

Chairman of the Board of Directors Duong Cong Minh alone received 8.75 billion VND, continuing to be one of the bank leaders with the highest income in the system. General Director Nguyen Duc Thach Diem received 12.9 billion VND, an average of 358 million VND/month.

Previously, in 2023, Mr. Duong Cong Minh was the bank chairman with the highest income in the industry, reaching 8.6 billion VND, far exceeding the average of 4.1 billion VND of other bank chairmen.

On March 10, Sacombank finalized the list of shareholders attending the 2025 Annual General Meeting of Shareholders (AGM). According to the announcement, the bank's AGM is expected to be held at 7:30 a.m. on April 25 at the White Palace Convention Center, located at 194 Hoang Van Thu, Ward 9, Phu Nhuan District, Ho Chi Minh City. Currently, Sacombank has not provided further information about the content or the proposals expected to be approved at this year's AGM.

Source: https://baodaknong.vn/no-co-kha-nang-mat-von-cua-sacombank-tang-manh-vuot-8-800-ty-dong-248580.html

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

Comment (0)