In 2024, Ninh Hai was assigned by the province to collect 75.5 billion VND in budget revenue and the District People's Council assigned to increase revenue by more than 13 billion VND; the total public investment capital plan of the district is 263.91 billion VND; of which the assigned public investment capital is 88.9 billion VND, the central budget capital of the Socio -Economic Recovery and Development Program is 175 billion VND including 4 projects. At the conference, delegates focused on discussing, analyzing, and proposing measures to speed up the construction progress of works, projects and disbursement of public investment capital, and solutions to increase revenue to achieve and exceed the set plan. Accordingly, the Ninh Hai tax sector focused on reviewing and assessing the collection situation close to the reality in each locality, coordinating revenue investigation, determining the lump-sum tax rate close to the actual business, and inspecting asset leasing activities to prevent revenue loss in the field of individual households doing business with lump-sum tax. Speed up the processing of VAT refund dossiers, promptly implement policies on tax, fee and charge exemption and extension according to the National Assembly Resolution and the Government Decree, strengthen the dissemination of new tax policies, ensure taxpayers access and comply with regulations, strive to complete the assigned budget collection task in 2024.

Comrade Phan Tan Canh, member of the Provincial Party Committee, Secretary of Ninh Hai District Party Committee spoke at the conference.

Regarding public investment capital, Ninh Hai district focuses on prioritizing 3 national target programs, considering this an important political task; regularly reviewing and urging, promptly detecting and removing difficulties and problems arising from each project, specifying responsibilities to each individual, considering disbursement results as one of the important criteria to evaluate the level of completion of annual tasks.

Bich Thanh

Source

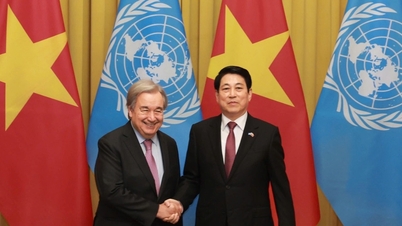

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

Comment (0)