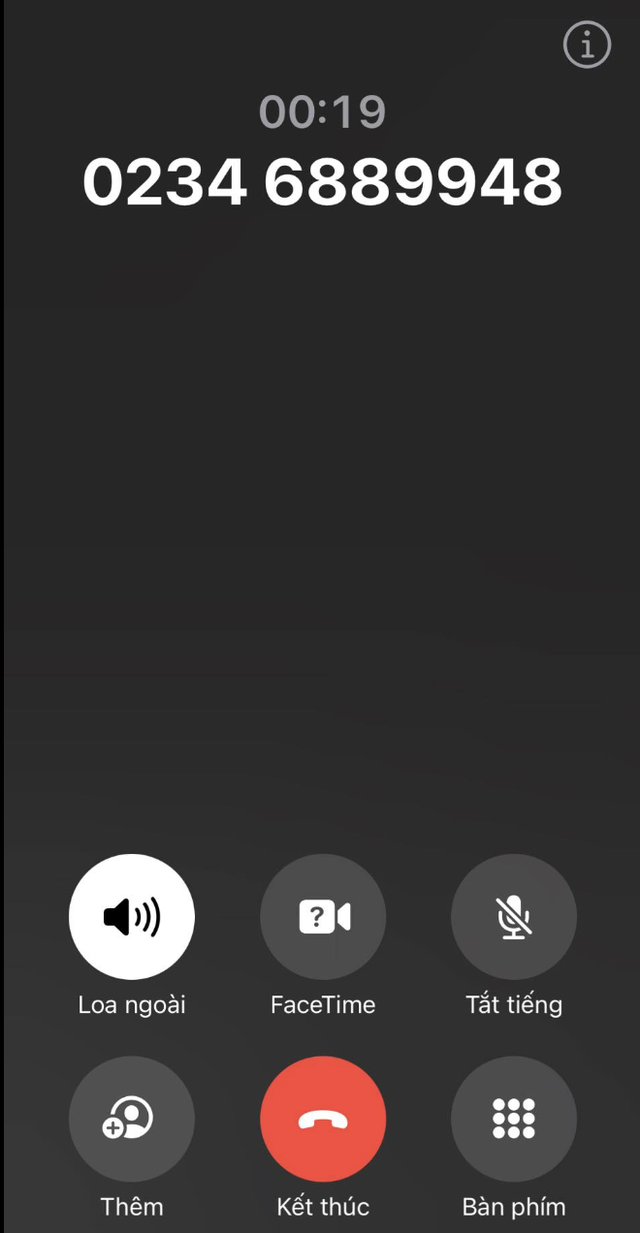

On April 23, reporting to Nguoi Lao Dong Newspaper, Mr. Nguyen Van (living in District 1, Ho Chi Minh City) said that for many days, the phone number 02346889948 continuously called and claimed to be Vietcombank's switchboard, offering account opening services. Although he repeatedly refused, this number still called to bother him.

"This is an automated call number. When you pick up the phone, they automatically introduce themselves and claim to be Vietcombank's switchboard, regardless of whether the customer wants to listen or not. So is it true that bank switchboards often impersonate each other? How can we prevent this?" - Mr. Van was indignant.

Many other people also reported regularly receiving calls from automated callers, claiming to be from the call centers of many other banks, inviting them to open credit cards, open bank accounts, etc.

Vietcombank confirmed that the above calls were all scams. According to this bank, the form of fraud impersonating Vietcombank staff/call center to call to invite to issue credit cards appears quite often.

Fraudsters claiming to be bank employees call and send messages (SMS, Zalo, Messenger...) to persuade customers to proactively open a non-physical debit card or apply for a credit card at the bank. Some reported fraudulent phone numbers: 02366888766, 02488860469, 02888865154...

Automated calls from phone numbers impersonating banks invite customers to open credit cards and accounts to defraud customers.

"The phone number 02346889948 that customer Nguyen Van reported is not the number of Vietcombank's switchboard. In some cases, when receiving the call, customers will hear a message impersonating the automatic switchboard: "Congratulations, you are eligible to issue a credit card at the bank. If you have any needs, press 1 or press 0 to speak to the switchboard operator" - Vietcombank representative informed.

If the person presses the button, the scammer hangs up, then calls back claiming to be a bank employee and tricks the customer into providing personal information and confidential information of the bank service.

At the same time, the scammers also ask customers to provide some card information to link the customer's card to their e-wallet, thereby appropriating money in the card.

The information that criminals often request includes card images; serial numbers printed on the card; name on the card; screen displaying the full card number in the VCB Digibank digital banking service...); OTP code sent to the customer's phone number.

Fraudsters can also ask customers to provide account number information, personal information (CCCD, biometric image...), service security information (password, OTP...) to log in to banking applications and appropriate customers' assets.

During the fraud process, the scammer may ask the customer to transfer money to pay for application fees, card issuance fees, etc.

"Vietcombank absolutely does not provide security information (card information, VCBDigibank application password, OTP code) to anyone. We do not ask customers to provide service security information in any form. Therefore, customers should not access strange links or scan QR codes of unknown origin sent via email, SMS or social networks" - this bank recommends.

Many other commercial banks such as Agribank, BIDV, Sacombank, ACB, VPBank also regularly warn about fraud and impersonation of banks by criminals. However, there are still many people who are deceived and lose money unjustly.

Source: https://nld.com.vn/nhung-so-dien-thoai-mao-danh-ngan-hang-de-lua-dao-196250423161039069.htm

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)