Billions of dollars in cash flow from two Singaporean government funds GIC and Temasek

GIC is Singapore's sovereign wealth fund. The organization has been investing heavily in emerging markets such as India, Indonesia and Vietnam and diversifying production outside of China amid rising US-China tensions since 2018.

GIC is estimated to have assets of more than $700 billion. Recently, GIC has invested heavily in infrastructure and real estate projects to avoid inflation.

Meanwhile, Temasek Holdings is an investment arm of the Singapore Government and 100% owned by the Singapore Ministry of Finance , with a scale of about 300 billion USD.

Both of these funds invest in products with a high degree of safety.

GIC and Temasek are the two organizations on the list of shareholders of VNG Limited - the company that on August 24 filed an application to list on the US Nasdaq stock exchange (like VinFast).

At VNG Limited, GIC holds 11.1% of economic interests, while Seletar Investments Pte Ltd (under Temasek Holdings) holds 6.9%. In addition, China's Tencent holds 47.4%. Ant Group holds 5.7%. VNG Limited holds 49% of VNG (the owner of Vietnam's Zalo social network with about 70 million members).

In early 2019, Temasek valued Zalo's parent company at $2.2 billion. The organization then, through Seletar Investments, purchased VNG's treasury shares at a price of VND1.86 million/share.

In recent years, GIC has poured billions of dollars into Vietnamese bluechips, with a total value of about 2 billion dollars. Of which, GIC holds more than 217.4 million Vinhomes shares (4.99%), worth more than 12,000 billion VND (about 500 million USD, as of the morning of August 29); 2.55% at Vietcombank (about 433 million USD); 5.87% at Masan (about 280 million USD)...

In 2018, GIC invested 853 million USD in Vinhomes and 500 million USD in VCM - then the parent company of Vinmart and Vinmart+.

With Temasek, this fund has many large investment deals in Vietnam. Notably, a group of investors led by KKR, including Temasek, spent 650 million USD to buy shares of Vinhomes in mid-2020. Temasek alone spent up to 200 million USD.

In late October 2019, Temasek invested in Scommerce - the parent company of Fast Delivery Services JSC (GHN) and Instant Services JSC (AhaMove). The value of the deal was not officially announced, but it was rumored to be around $100 million. These two delivery companies have grown very strongly and are said to have skyrocketed in value.

Besides, Temasek also invested in Minh Phu Seafood, FPT, OnPoint, Golden Gate...

More than 70 billion USD from Singapore invested in Vietnam

According to the Ministry of Planning and Investment, in the first 8 months of 2023, Singapore became the country investing the most in Vietnam with a total newly registered capital of more than 3.8 billion USD, accounting for 21.2% of the total investment capital in Vietnam.

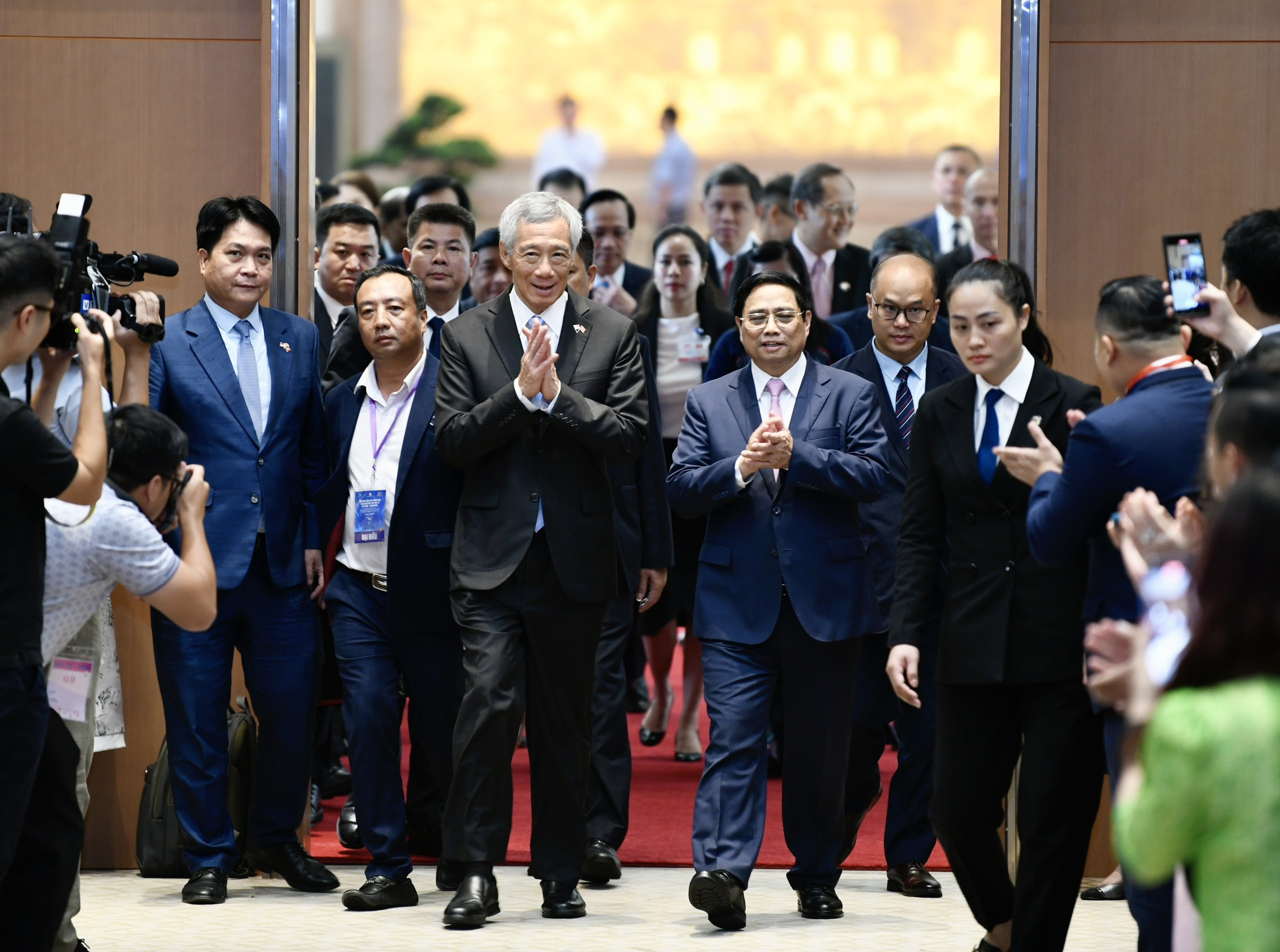

Singapore currently ranks first in ASEAN and second among countries and territories investing in Vietnam, with more than 3,000 valid projects and a total registered capital of more than 70 billion USD. Vietnam - Singapore Industrial Parks (VSIPs) are symbols of economic cooperation between the two countries with thousands of hectares of land, attracting 18 billion USD in investment capital and creating hundreds of thousands of jobs.

Singaporean investors have participated in most economic sectors and fields of Vietnam, focusing on processing and manufacturing industries; real estate business; production and distribution of electricity, gas and air conditioning.

Singapore's recent mega projects in Vietnam are the Bac Lieu liquefied natural gas (LNG) power plant (registered capital of 4 billion USD); the Nam Hoi An resort in Quang Nam (4 billion USD) and the Long An I and II LNG Power Plant project (3.12 billion USD)...

Investors also witnessed the "giants" Shopee and Grab dominating the e-commerce and transportation industry in Vietnam, with revenue of several billion USD per year.

Singapore's Wilmar International is the largest cooking oil manufacturer and has dozens of factories in Vietnam, owning many famous brands such as: Neptune, Simply, MEIZAN, Cai Lan, Kiddy,...

Large private corporations pour money into Vietnamese stocks

F&N Dairy Investments Pte Ltd - a business owned by billionaire Charoen Sirivadhanabhakdi - owns nearly 17.7% of the capital at Vietnam Dairy Products Company Vinamilk (VNM), worth nearly 1.2 billion USD as of the morning of August 29. Prime Minister Lee Hsien Loong's younger brother was chairman of this largest beverage corporation in Singapore from 2007-2013.

Another name is Platinum Victory PTE Ltd - a company under Jardine Cycle & Carriage (JC&C), Singapore's leading enterprise in the field of automobile distribution in Southeast Asia - which owns 10.62% of Vinamilk shares, worth about 715 million USD.

JC&C also owns more than 26.6% of shares at Thaco and has invested heavily in Refrigeration Electrical Engineering Corporation (REE).

Recently, Singaporean corporation Thomson Medical Group (TMG) agreed to acquire FV Hospital for 381.4 million USD (more than 9,000 billion VND).

In early 2023, Daytona Investments Pte. Ltd (Singapore) spent VND1,400 billion to buy 9% of shares of International Dairy Products Joint Stock Company (UpCOM: IDP). Previously, according to Bloomberg , Growtheum agreed to buy 15% of IDP's shares for about USD100 million.

At the end of 2022, TEPCO Renewable Power Singapore acquired 25% of shares to become a major shareholder of Vietnam Power Development Joint Stock Company (VPD).

In early 2019, Wan Hai Lines - one of the world's largest shipping lines - through Wan Hai Lines (Singapore) Pte. Ltd spent nearly VND400 billion to own 20% of Da Nang Port's shares.

Investing in Vietnam real estate

Some Singaporean real estate corporations such as Keppel Land, CapitaLand, Frasers Property... are pouring money into Vietnam's real estate sector.

In particular, Keppel Land invested hundreds of millions of USD in the Saigon Centre tower project, the Empire City Thu Thiem project (Thu Duc City)...

CapitaLand is one of the major real estate investors in Vietnam with two complex projects, over 13,000 apartments in 17 housing projects and a retail area in Ho Chi Minh City and Hanoi such as: Zenity project, Feliz en Vista, Vista Verde, Define...

Recently, Temasek has also been interested in real estate, through Mapletree with many large buildings such as: Mplaza Saigon (acquired from Kumho Asiana), SC Vivo City shopping mall, Mapletree Business Centre, Pacific Place Hanoi... This fund also poured money into logistics center projects.

At the end of March, according to Reuters , Singapore's CapitaLand Group was negotiating to buy back a number of Vinhomes projects, with a total value of up to 1.5 billion USD.

Nikkei Asia said that Singaporean investors have recently tended to shift some investment segments out of China to avoid the adverse effects of the US-China trade war and cope with changes in the global supply chain.

The destinations of Singaporean investors are seen as emerging markets, including Mexico, India, Indonesia and Vietnam.

Source

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

![[Photo] Welcoming ceremony for Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra on official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/cdd9e93739c54bb2858d76c3b203b437)

Comment (0)