Early morning of April 3 (Vietnam time), US President Donald Trump announced a new import tariff policy with trading partners of 160 economies around the world.

Accordingly, from April 5, a basic tax rate of 10% will apply to all imports from trading partners. From April 9, higher import tariffs will be applied to more than 60 countries that have large trade deficits with the US, such as China (34%) and Vietnam (46%).

According to CNBC, the Trump administration calculates reciprocal import tariffs for each country based on the bilateral trade deficit and total imports into the US. This calculation reflects the level of trade imbalance, not based on the nominal tariffs announced by the countries.

Countries with low trade deficits or trade surpluses with the US are subject to a 10% import tax.

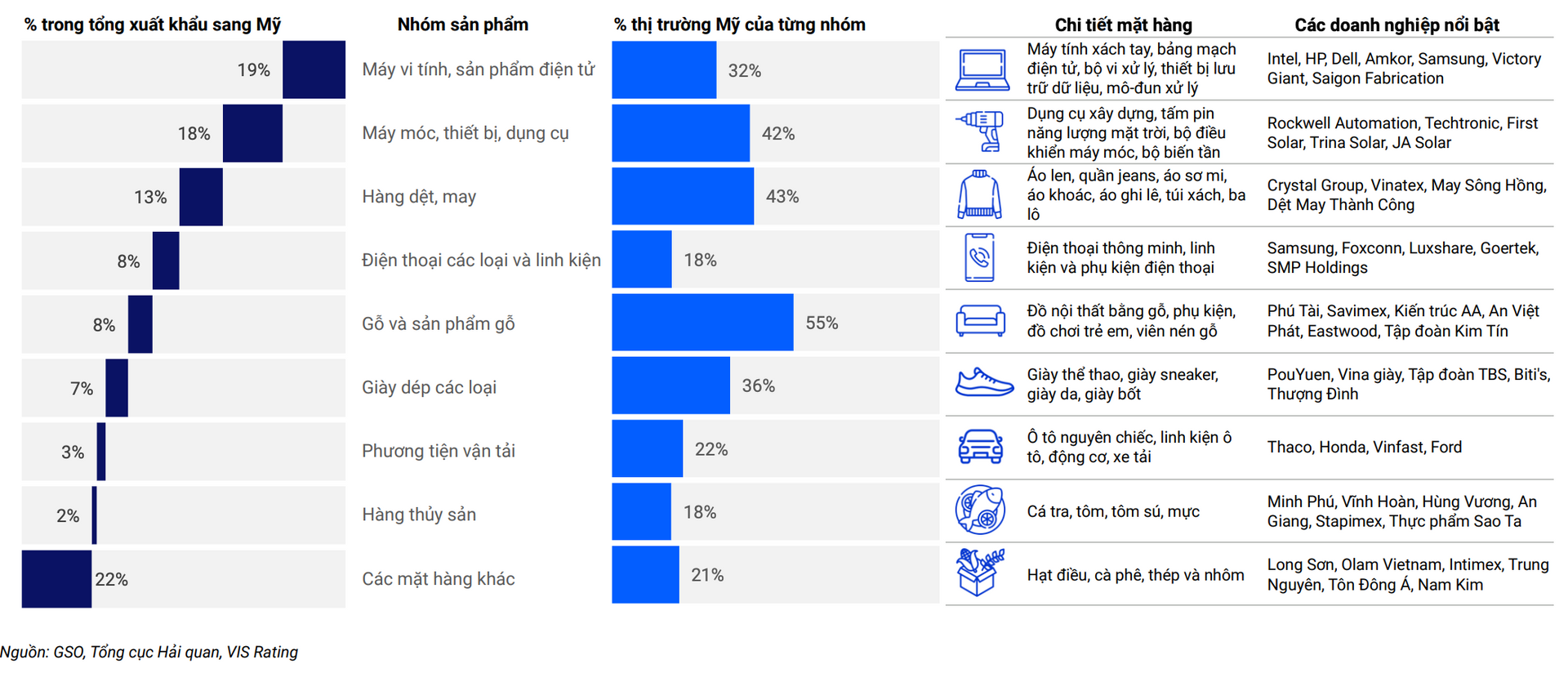

Data from the General Statistics Office and the General Department of Customs of Vietnam show that the industries with the largest export turnover to the US are electronics, machinery and equipment, textiles, footwear and wooden products. Many businesses in these industries have a high percentage of export revenue dependent on the US market. Therefore, these five industries will be affected and most vulnerable.

According to analysts, while multinational companies manufacturing electronics and machinery equipment in Vietnam are better able to respond to tariffs by shifting part of their production or finished goods to other countries, domestic manufacturers of textiles, footwear and wooden furniture may have fewer options to shift and find alternative consumption markets.

Analysts say businesses that rely heavily on export sales will face higher costs, fewer orders and poorer operating cash flow.

The Vietnamese government has been actively negotiating new trade measures with the US and adjusting policies to deal with potential tariff risks. In addition to reducing import tariffs on US goods, the Vietnamese government has approved new agreements allowing US corporations to operate in Vietnam. These measures should, in theory, help boost imports of US goods and reduce Vietnam’s trade surplus with the US over time.

However, according to analysts, how long the 46% import tax rate announced by the US today will be applied will depend on the results of upcoming negotiations between the two governments.

TB (according to VnEconomy)Source: https://baohaiduong.vn/nhung-nhom-hang-xuat-khau-chu-luc-nao-cua-viet-nam-co-the-bi-anh-huong-boi-thue-doi-ung-408660.html

![[Photo] Japanese Prime Minister's wife visits Vietnamese Women's Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/8160b8d7c7ba40eeb086553d8d4a8152)

![[Photo] Living witnesses of the country's liberation day present at the interactive exhibition of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/b3cf6665ebe74183860512925b0b5519)

![[Photo] Fireworks light up Hanoi sky to celebrate national reunification day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/5b4a75100b3e4b24903967615c3f3eac)

![[Photo] General Secretary To Lam's wife and Japanese Prime Minister's wife make traditional green rice cakes together](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/7bcfbf97dd374eb0b888e9e234698a3b)

![[Photo] General Secretary To Lam receives Chairman of the Liberal Democratic Party, Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/63661d34e8234f578db06ab90b8b017e)

![[Photo series] People eagerly visit Bien Hoa Pottery Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/67c85e9e8954429eb8fc84010c6a6f57)

Comment (0)