In August, not long after news of Country Garden’s liquidity problems broke, Huailan, 38, immediately went to a construction site in Shandong province where the house she had purchased was still unfinished. The scene there made her feel sad.

The cranes were idle, and concrete slabs lay scattered in knee-high grass. It was a desolate scene.

For Tom Chen, a civil servant, the fear of becoming permanently homeless came to mind after China's once-largest real estate company stopped construction on an apartment building his family was being compensated for in Zhejiang province.

Meanwhile, Fu, a construction worker in Guangdong province, has resorted to the most extreme option of going on strike after not receiving his salary for two months. “I don’t care about the company’s difficulties. I want to get my hard-earned money back,” he told Bloomberg.

A project by Country Garden in Yangzhou city, Jiangsu province (Photo: Bloomberg).

Homebuyers, workers, real estate developers and the Chinese government have all contributed to the economic leap over the years.

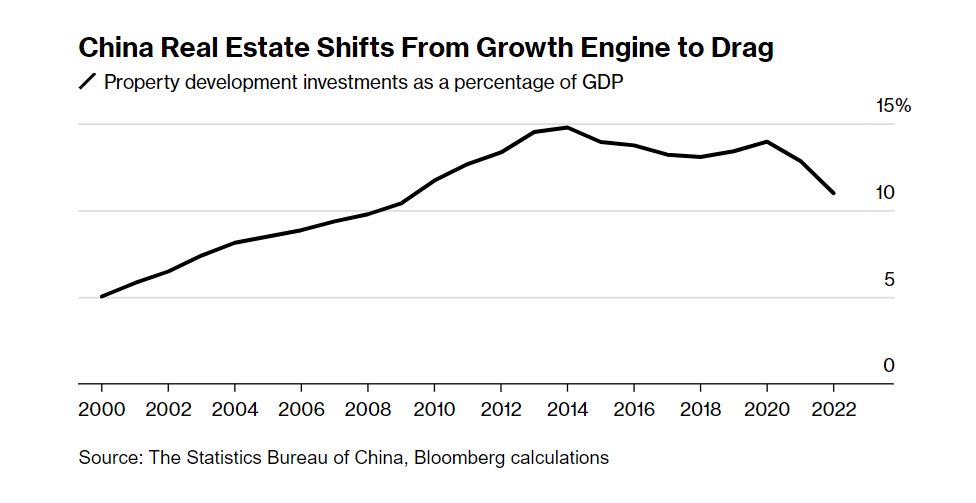

For more than two decades, real estate has been a major growth engine, with the value of the sector reaching $52 trillion as of 2019, contributing 25% of the country’s gross domestic product. Global investors have also been quick to get in on the act, pouring more than $180 billion into buying bonds.

But in the past 3 years, the strategy of reducing dependence on borrowed money for the real estate market has been vigorously implemented by the Chinese government , causing this market to fall into an extremely difficult period when it lost its "main source of life".

Country Garden is one of the most prominent enterprises in the prosperous period but also the most difficult when the market goes down.

At its peak, the company employed 130,000 people and provided housing for tens of thousands of families across the country. Now, it can’t even make a bond payment of just tens of millions of dollars due last week, effectively meaning insolvency.

"With a large corporate default, along with falling sales and prices across the market, the real estate market has yet to see the light," Alicia Garcia Herrero, chief economist for Asia- Pacific at Natixis SA, told Bloomberg.

Country Garden is “a victim of the very model of financing the real estate market that China has adopted for many years,” she added.

Chairman Yeung Kwok Keung (center) at a project in Guangzhou, 2019 (Photo: AP).

Aspirations extinguished

The expectation that property prices will only go up has been ingrained in the minds of millions of Chinese people, and now that expectation is causing trouble for many people’s careers, families, hopes, futures and personal finances. Huailan is no exception.

Not only for Huailan, home ownership has become the biggest inspiration for many young people, for millions of households after the Chinese government removed many restrictions on real estate transactions, which had existed for decades. And Country Garden is one of the pioneering enterprises "entering" this field.

Established in 1992 in Guangdong province, Country Garden quickly became the most prominent name in the market with a strategy of integrating many amenities such as high-quality schools, gyms,... within the project premises.

Founder Yeung Kwok Keung became a role model among Guangdong businessmen as his unique business approach was adopted by many other enterprises, which included setting up an independent service management company for each project.

China's real estate market was fully commercialized in 1998. Three years later, the country was accepted into the World Trade Organization (WTO). By 2005, the country's GDP had more than doubled.

Along with the rapid economic development, construction activities also "exploded". Millions of people flocked to big cities, causing the demand for housing to increase. Fields and vacant land were gradually replaced by new, modern urban areas.

Country Garden's revenue increased more than fivefold in just three years, from 2004 to 2007, making it one of the most profitable businesses in the Chinese real estate market at that time.

The company even weathered the 2008-2009 global financial crisis as China's urbanization trend continued unabated.

Huailan did not see any "dark clouds" looming over the property market at the time. And neither did international investors. Bonds issued by Chinese real estate companies, including Country Garden, became a "hot commodity" in the market.

A bustling scene at a construction exhibition held in Beijing in 1998 (Photo: Getty Images).

However, China’s economy began to slow down in 2015, and construction activity focused on renovating old cities. Tom Chen’s house was slated for demolition, and the local government promised to compensate his family with six other apartments in a project being built by Country Garden, scheduled to be completed in 2023. They happily accepted.

China’s rapid growth over the past several decades has been accompanied by an increasing reliance on real estate. According to a 2020 survey, 80% of the country’s assets are tied up in real estate.

A past penchant for speculation has pushed housing prices beyond the reach of many young people, hampering the government’s goal of narrowing the wealth gap. An aging population and low birth rate mean China faces a future glut.

In fact, banks have tightened lending to real estate developers since late 2020, when China Evergrande Group declared bankruptcy.

This is the result of the three red lines strategy initiated by the central government aimed at reducing real estate debt, thereby pushing more than 100,000 businesses in this sector into a difficult position. Home sales continued to decline after that and the Covid-19 pandemic was the last straw.

Investment in the real estate sector has continuously declined since Evergrande defaulted (Photo: Bloomberg).

Storm

In May 2021, Country Garden expanded its business to Juye, Shandong Province, Huailan’s hometown. She was overwhelmed by the high-profile advertisements about the most expensive complex in the area, promising a 5-star lifestyle.

"The design of the building really impressed me," Huailan said. "I think it's a real home. My two daughters will have their own bedrooms."

The grand opening was a huge success, with red lanterns and a huge crowd. She was even advised not to drive to the event because parking was difficult. The entire project was quickly sold out.

But she had no idea that, behind that glitz, a storm of liquidity difficulties was forming.

A few months ago, since Evergrande defaulted, the view of China's $200 billion real estate bond market has completely changed.

With limited access to loans and sluggish sales, even the so-called "healthiest" businesses are "sick".

Country Garden is no exception, despite being a "national" real estate company in China. The strategy of focusing on small cities, which has been applied for many years, has finally backfired. The psychology of homebuyers in these localities is more easily shaken than in big cities, so home sales here have "miserably" declined.

Country Garden even had to ask the Guangdong provincial government to connect real estate sales to state-owned units at discounted prices to gain more liquidity.

But the company’s business couldn’t go against the market. At its peak, many homebuyers refused to pay mortgages on more than 320 unfinished projects in 100 cities across the country, including those owned by Country Garden.

In October, home prices in China fell at their fastest pace in seven years. The central government was forced to intervene with a 16-point support package, but it was considered too late.

Country Garden Chairman Yeung gave an hour-long speech to reassure workers, saying he "saw light at the end of the tunnel." Was that true?

A view of a Country Garden project in Heyuan City, Guangdong Province in September 2023. (Photo: Bloomberg).

The pain has not stopped yet

Country Garden’s sales fell 81% year-on-year in September, a sad fact: the group’s sales decline was twice as fast as its peers in the first eight months of the year.

The assets of Yang Huiyan, daughter of founder Yeung Kwok Keung, once the richest woman in China, also "evaporated" 86% to only 4.6 billion USD, according to Bloomberg Billionaires Index .

As for Fu, it is difficult for this worker to accept the fact that a large corporation like Country Garden does not have enough money to pay its workers. He is anxiously waiting for the day when he will receive 10,000 yuan in back wages. After that, he will immediately return to his hometown of Guizhou.

"Many people from my hometown no longer want to go out to work. And neither do I," Fu shared.

Stories like those of Fu, Huailan and Chen are not uncommon in China. On Douyin, China’s version of TikTok, construction workers and homebuyers have been posting videos calling on the government to force Country Garden to restart its unfinished projects and pay its workers’ wages.

Many of them marched outside the corporation's headquarters but were "powerless".

"If large real estate businesses go bankrupt or default on their debts, it will directly affect banks and related individuals, and especially, create negative economic spirals," said Christopher Marquis, Professor at Cambridge Judge School of Economics.

The dream of a real home for many will not come true anytime soon (Photo: Bloomberg).

The "pain" from the crisis continues to spread. The government has shown no interest in protecting real estate businesses despite the current difficult situation. According to Bloomberg statistics, as of the end of October, about 100 billion USD, equivalent to more than 50% of the outstanding bonds of Chinese real estate businesses, had fallen into default or were forced to restructure.

This has eroded investor confidence, including in large funds such as Pacific Investment Management Co and Fidelity International Ltd. Evergrande may even have to liquidate assets to repay debts, according to a Hong Kong court ruling.

The property market crisis has also caused local government revenues to plummet, with some schools in his area not even able to pay teachers, Chen said.

As for Huailan, her monthly mortgage payments became a burden when she lost her job earlier this year. The house she had signed a purchase contract for has lost a quarter of its value. If she wanted to sell, she would have a hard time finding a buyer.

"When my daughter asked me when we were moving to our new home, I didn't know how to answer," she said sadly. "If I had a second chance, I wouldn't trust any real estate company completely, even a big company like Country Garden," she said.

Source

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh received the working delegation of Pasaxon Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/da79369d8d2849318c3fe8e792f4ce16)

![[Photo] Prime Minister Pham Minh Chinh chairs the 14th meeting of the Steering Committee on IUU](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/a5244e94b6dd49b3b52bbb92201c6986)

![[Photo] Solemn opening of the 1st Congress of Party Delegates of Central Party Agencies](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/24/82a89e250d4d43cbb6fcb312f21c5dd4)

Comment (0)