|

| Panorama of the 6th Session of the 15th National Assembly . (Source: VGP) |

Greater effort, more decisive action

Although not all, the above information and figures, presented in the Prime Minister 's report at the opening session of the 6th Session, have shown the Government's rather "ambitious" goals.

The Prime Minister said that the 2024 Socio -Economic Development Plan includes 15 main targets, of which GDP growth is about 6-6.5%. In the context of economic growth in 2023 estimated to be only over 5% for the whole year, not reaching the plan and forecasting that the economy will continue to face many difficulties and challenges, possibly even more than forecast, this target can be considered "ambitious".

However, the basis for the expected growth target for 2024 has also been stated by the Government in a full report sent to National Assembly deputies before the session. That is, economic growth is forecast to continue its positive recovery trend. Support policies issued in 2023 will have a clearer impact on the economy. Investment drivers (including private investment, foreign direct investment - FDI, public investment, state-owned enterprises), consumption, tourism and export continue to be strongly promoted.

In addition, long-standing problems and shortcomings are focused on being resolved and transformed more positively, especially problems of enterprises, investment projects, real estate market, corporate bonds, etc.

Then, many important, key national projects with spillover effects were put into operation. Many projects of the Medium-Term Public Investment Plan for the period 2021-2025 were accelerated when investment procedures were completed. Strong improvements in mechanisms and policies related to fire prevention and fighting regulations, immigration, land, construction materials, etc., directed by the Government and the Prime Minister, will continue to be effective, providing better support for production, business, tourism activities, and promoting the development of the private economic sector.

“The stable socio-political and macroeconomic situation, controlled inflation, and improved investment and business environment remain important foundations for promoting development,” the Government report stated.

In addition to the growth target, in each main task and solution for 2024 and the coming time, the head of the Government also presented figures showing the Government's high determination in the face of "bad debts", not only in the banking sector.

For example, regarding the progress of public investment disbursement - an issue that always makes National Assembly deputies impatient, the Prime Minister said he would "ensure the disbursement rate of public investment capital is over 95% of the plan".

The Government also aims to cut at least 10% of administrative procedure compliance costs and business regulations by 2024. Specifically, complete 100% of the administrative procedure decentralization plan under the authority of the Government and the Prime Minister, approved by Decision No. 1015/QD-TTg dated August 30, 2022 of the Prime Minister. Ensure the provision of at least 70% of online public services and the rate of people using online public services reaches at least 40%.

Referring to the very hot issue in 2023, which is the power shortage (which, according to the assessment of the National Assembly's Economic Committee, has significantly affected business operations as well as people's lives), the Prime Minister clearly stated the message: resolutely not to let there be a power shortage for production, business and consumption.

To do this, according to some National Assembly delegates, is extremely difficult.

Another “ambitious” goal that the Prime Minister also reported to the National Assembly is to complete the compulsory transfer of 4 weak banks; perfect legal regulations on bad debt handling, and end cross-ownership. These are bottlenecks that have been mentioned at many sessions of the National Assembly. The plan to handle weak banks has been dragged on for many years. However, by August 2023, the handling of 3 banks that were forced to buy was only at the stage where the Government approved the compulsory transfer policy and was in the stage of determining the value of the enterprise for transfer. The Government has only approved the compulsory transfer policy for one bank.

The Prime Minister emphasized the message in the televised meeting that the tasks from now until the end of 2023 and 2024 are very heavy and important, requiring all levels, sectors and localities to promote the spirit of solidarity, joint efforts, consensus, dynamism, innovation, creativity, flexibility, not to retreat in the face of difficulties and challenges, to have higher determination, greater efforts, more drastic actions, ensuring focus and key points.

Balancing all resources for development

Also on the first day of the sixth session, reports on the 2024 state budget estimate, the 3-year State Finance - Budget Plan 2024-2026, public borrowing and debt repayment, mid-term assessment of the implementation of the medium-term Public Investment Plan for the 2021-2025 period... were all presented to the National Assembly.

Accordingly, the Government proposed the principle of arranging the state budget expenditure estimate for 2024 to ensure that the total development investment expenditure is greater than the state budget deficit for tasks in the medium-term public investment plan according to the Law on Public Investment and other development investment expenditure tasks according to the Law on State Budget.

“The total budget expenditure estimate for the 2024 State budget is about VND 2,100,300 billion, an increase of VND 24,100 billion (up 1.2%) compared to the 2022 estimate. The development investment expenditure estimate is VND 677,300 billion, an increase of VND 108,000 billion compared to the 2023 estimate (excluding the budget allocated for the 2023 Socio-Economic Recovery and Development Program); accounting for 32.2% of total State budget expenditure. This is a high level compared to the past few years,” Minister of Finance Ho Duc Phoc reported to the National Assembly.

Regarding public debt, the Government estimates that the total borrowing demand of the Government in 2024 will be VND 676,057 billion, including: borrowing to cover the central budget deficit of VND 372,900 billion (accounting for 55.16%); borrowing to repay the principal debt of the central budget of about VND 287,034 billion (accounting for 42.46%) and borrowing for re-lending of VND 16,123 billion (accounting for 2.38%).

Regarding the Medium-Term Public Investment Plan for the 2021-2025 period, for the remaining 2 years, the Government has determined to focus resources, prioritize the allocation of State budget capital for development investment expenditure (accounting for about 29% of total State budget expenditure), reduce the proportion of regular expenditure to about 60%, and strengthen the leading role of the Central budget.

“Continue to review and resolutely eliminate ineffective projects, projects that are not really necessary, slow to implement, prioritize capital for key and urgent projects, creating momentum for fast and sustainable development,” Minister of Planning and Investment Nguyen Chi Dung reported to the National Assembly.

Regarding the ability to balance capital for the 2024-2025 period, Minister Nguyen Chi Dung said that with the expected plan for 2024 of VND 225,000 billion, the cumulative arrangement for the 4 years from 2021 to 2024 will reach 61.7% of the total central budget investment plan approved by the National Assembly. Thus, it is expected that 376 projects of the Medium-Term Public Investment Plan for the 2021-2025 period that have been allocated capital annually will be transferred to be implemented and completed in the 2026-2030 period.

During the review, the National Assembly's Finance and Budget Committee commented that, with the current arrangement of central budget capital, the allocation and assignment of medium-term and annual capital plans are slow, the balance of resources for public investment expenditure does not meet the plan, and the requirement to balance capital sources in the remaining two years is quite large.

In addition, the capital allocated for projects under the Socio-Economic Recovery and Development Program under Resolution No. 43 is disbursed very low, creating great pressure on resource allocation and capital disbursement organization. Therefore, the ability to balance enough central budget capital is extremely difficult to implement more effectively in the remaining 2 years of the Medium-Term Public Investment Plan, while the leading role of the central budget is not yet guaranteed, and revenue from equitization and divestment of state capital under the central budget is expected to have a large deficit.

"The Government is requested to carefully assess the actual capital balance capacity and the disbursement situation of allocated capital over the past three years, focusing on allocating and adjusting capital for projects with disbursement capacity to speed up progress and improve the efficiency of public investment capital use," Chairman of the Finance and Budget Committee Le Quang Manh stated the viewpoint of the auditing agency.

Source

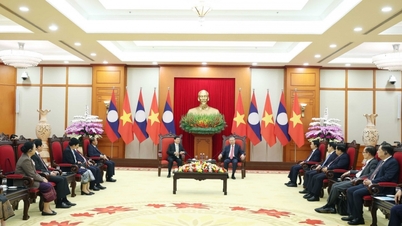

![[Photo] President Luong Cuong attends the 50th Anniversary of Laos National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F27%2F1764225638930_ndo_br_1-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh chairs the 15th meeting of the Central Emulation and Reward Council](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F27%2F1764245150205_dsc-1922-jpg.webp&w=3840&q=75)

Comment (0)