The seminar aimed to share information and discuss difficulties and obstacles encountered in the process of enforcing bank credit judgments, as well as to listen to feedback from credit institutions.

Speaking at the seminar, the Vice President and General Secretary of the Vietnam Banking Association, Dr. Nguyen Quoc Hung, stated that the activities of civil enforcement agencies play an extremely important role in the debt recovery of credit institutions. Although coordination between civil enforcement agencies and credit institutions has improved, the enforcement of bank credit judgments still faces many difficulties and obstacles, leading to limited enforcement capacity and unsatisfactory debt recovery efficiency for credit institutions. There are many reasons for this, but the main cause of the difficulties faced by credit institutions is the lack of uniformity, consistency, clarity, and specificity in the legal regulations on enforcement and related laws.

“Based on practical experience, the General Department of Enforcement – Ministry of Justice has proposed to the Government amendments and additions to Decree 62/2015/ND-CP on detailed regulations and guidance on some articles of the Law on Civil Judgment Enforcement, aiming to gradually overcome difficulties in the process of enforcing judgments in general as well as judgments on credit in particular; and at the same time create a solid foundation for civil judgment enforcement work,” said Dr. Nguyen Quoc Hung.

|

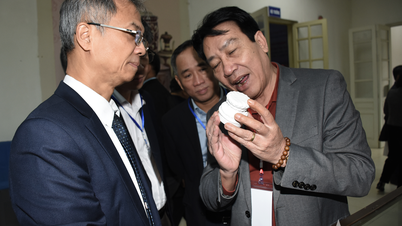

Dr. Nguyen Quoc Hung speaks at the seminar. |

At the seminar, the Chairman of the Legal Club, Nguyen Thanh Long, also stated that, to date, although the General Department of Civil Judgment Enforcement and related agencies have actively and decisively implemented many measures to promote civil judgment enforcement at all levels, contributing to helping banks recover outstanding debts early and unblock credit flows, in reality, many judgment enforcement cases still exist in banks that are delayed for a long time, and the number of outstanding cases remains high, affecting the results of bad debt recovery of banks.

Based on data compiled from 15 member banks, there are currently 399 cases of enforcement proceedings facing difficulties and obstacles, primarily concentrated in major areas such as Hanoi , Ho Chi Minh City, Hai Phong, and Nghe An…

According to Ms. Ta Thi Hong Hoa, Deputy Director of Department 11 ( Supreme People's Procuracy ), besides objective reasons leading to difficulties in enforcing civil judgments in bank credit cases, there are also some subjective errors on the part of the enforcement agencies, such as the failure to determine whether the judgment is difficult to enforce. In reality, the supervisory process has discovered many cases where the judgment was unclear, but the civil enforcement agency did not send a written inquiry to the Court or used unclear methods of inquiry, leading to vague answers from the Court, thus making enforcement impossible…

Therefore, to address the aforementioned difficulties and obstacles and improve the effectiveness of civil enforcement in general and civil enforcement related to credit institutions in particular, Mr. Nguyen Thanh Long proposed the simultaneous implementation of several solutions. Accordingly, the 2008 Law on Enforcement of Judgments was amended and supplemented in 2014; however, due to the shortcomings and obstacles in practice, Mr. Nguyen Thanh Long suggested that the General Department of Enforcement consider and propose amendments to the Law on Civil Enforcement of Judgments and Decree 62/2015/ND-CP (amended and supplemented by Decree 33/2020/ND-CP), especially regarding regulations on the time limit for carrying out coercive enforcement procedures, the maximum time limit for the enforcement agency to hand over assets to the winning bidder, simplified auction procedures, temporary suspension of enforcement, delegation of asset handling, and handling of specific assets such as shares, stocks, and capital contributions, etc.

Source: https://nhandan.vn/hoan-thien-chinh-sach-thi-hanh-an-tin-dung-ngan-hang-post826421.html

Comment (0)