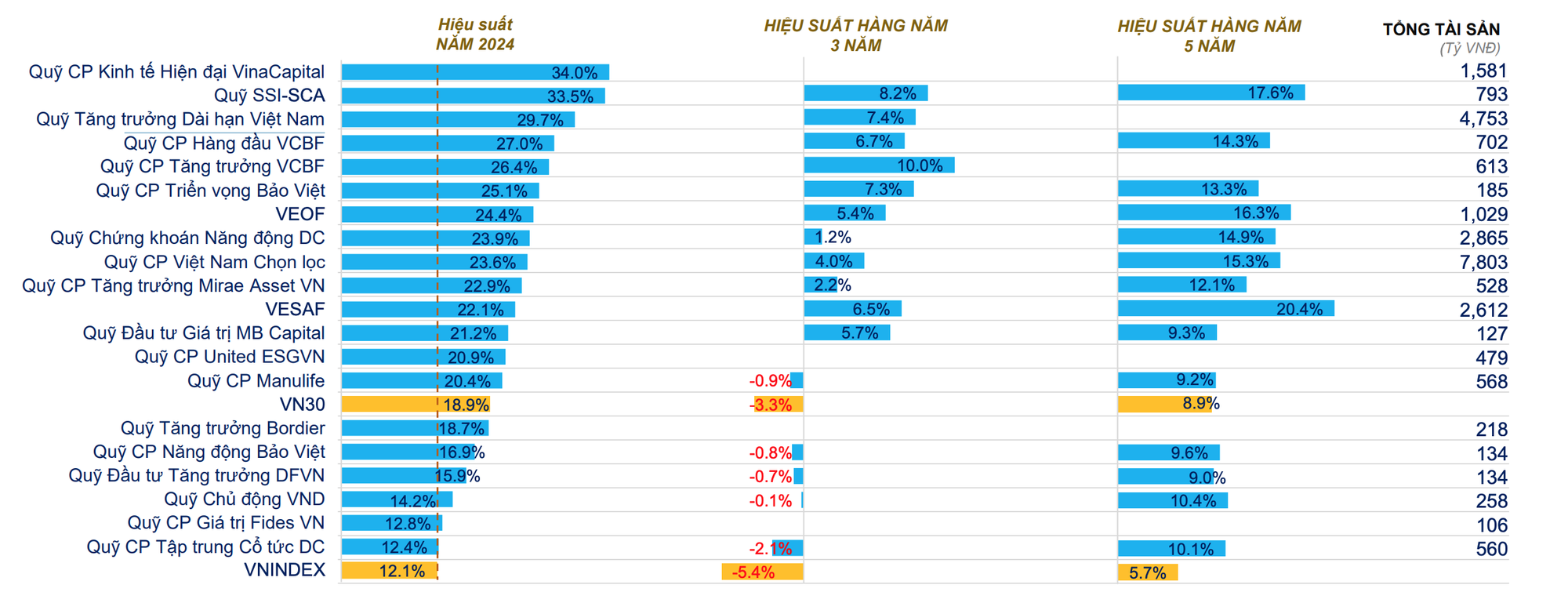

The equity fund group outperformed in 2024 with 20%. However, the average performance was lower (10.3%) over the 5-year time frame and negative -0.8% over the 3-year period, mainly due to the large loss in 2022.

The performance of most equity funds deteriorated significantly in the second half of 2024, when the market was in a sideways state with reduced liquidity - Photo: QUANG DINH

Most equity funds will grow well in 2024, but their performance will be unstable when looking at the long term of 3-5 years, FiinGroup - a unit specializing in providing financial data and analysis, said in a recently published report.

Which stock fund has the highest performance in the market?

According to a report from FiinGroup, 41/66 equity investment funds recorded outstanding growth compared to the VN-Index (+12.1%) in 2024 thanks to positive performance in the first half of the year.

However, the performance of most funds deteriorated significantly in the second half of 2024, when the market was in a sideways state with reduced liquidity and continued net selling pressure from foreign investors.

Of which, VinaCapital Modern Economic Equity Fund (VMEEF) - a new fund established in 2023 - led with a growth rate of 34% thanks to a large allocation of weight to banking and technology stocks ( FPT , FOX).

Top 20 best performing equity funds in 2024 (only funds with net assets greater than VND 100 billion)

Next is the Vietnam Long-Term Growth Fund (VFMVSF) with an increase of 29.7% - the highest performance of the fund since its establishment (2021) and considering the 5-year time frame, this fund has achieved quite high performance with an annual compound growth rate of 15.3%.

Meanwhile, VinaCapital Market Access Equity Fund (VESAF) and SSI Sustainable Competitive Advantage Investment Fund (SSI-SCA) maintain stable annual compound growth in both short and long time frames.

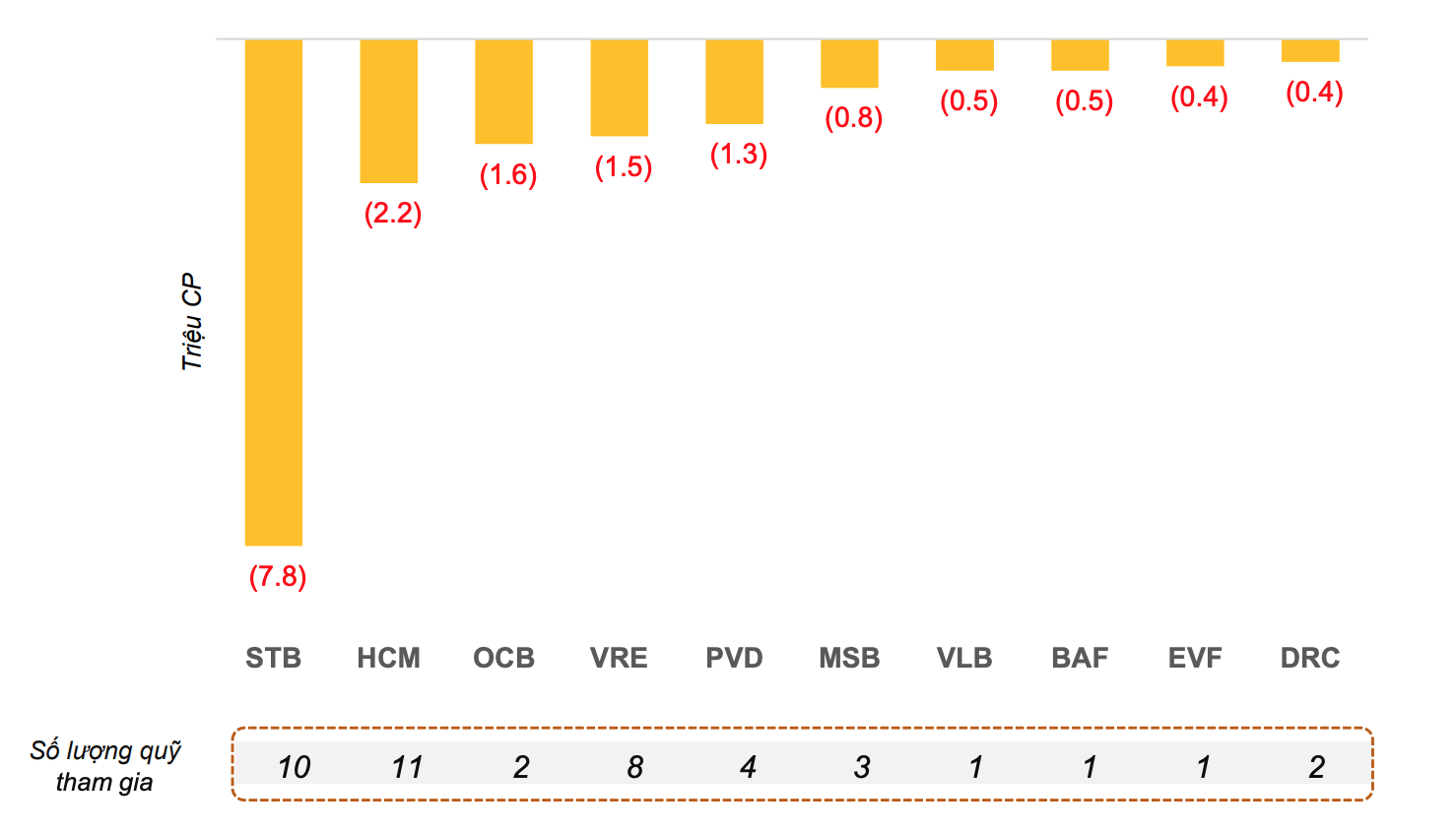

Top 10 stocks that funds net sold in December 2024 (by volume)

Bao Viet Active Stock Fund (+16.9%), VND Active Fund (+14.2%), DC Dividend Focused Stock Fund (+12.4%)... all have performance above VN-Index in 2024, but not significantly.

Negative yield bond fund appears

Fiingroup also said that bond investment funds will continue to have stable performance in 2024 with 19/23 bond funds having higher returns than Vietcombank 's 12-month savings interest rate (4.6%).

In particular, TCBF Fund continues to lead with outstanding performance compared to the general level (+13.7%), but still lower than the performance in 2023 (+32.16%).

Coming in second is MB Bond Fund (MBBOND) with +8.3%. In contrast, HD High Yield Bond Fund (HDBond) is the only bond fund with negative performance (-0.3%) with a portfolio allocated 44.4% to bonds, 13.7% to stocks and the rest mainly to certificates of deposit.

VietCredit bonds and Vingroup shares account for a large proportion of HDBond's portfolio.

In the long term, the performance of bond investment funds is quite positive when profits are better than the 36-month savings interest rate (5.3%) and 60-month savings interest rate (6.8%) of Vietcombank.

Balanced funds recorded high growth performance in 2024, in which the group with large net asset value (NAV) (over VND 100 billion) had better performance than small NAV funds. Leading the way is the VCBF Strategic Balanced Fund with a growth rate of 20.2%.

This fund allocates 61.6% to stocks and 23.1% to bonds, holding a large proportion of FPT shares, bonds of MEATLife (MML) and Coteccons (CTD).

Over the 5-year period, VCBF Strategic Balanced Fund continued to maintain positive performance with an average annual compound interest rate of 11%.

Source: https://tuoitre.vn/nhom-quy-co-phieu-hieu-suat-cao-gap-4-lan-tien-gui-nam-2024-nhung-dai-han-gay-bat-ngo-20250206181727363.htm

Comment (0)