SGGPO

The stock market continued to face significant profit-taking pressure from investors at the start of the week, resulting in continued strong fluctuations. In addition, foreign investors continued their strong net selling streak, contributing to the VN-Index falling back to near 1,100 points.

|

| The VN-Index retreated to near 1,100 points in the first trading session of the week on November 13. |

On November 13th, the stock market saw the VN-Index briefly rise by nearly 8 points, but heavy selling pressure at the end of the session caused the market to reverse and fall.

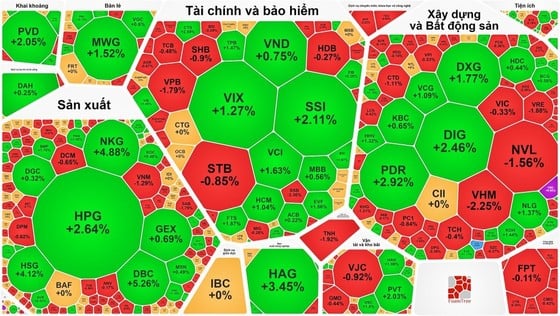

The focus of today's market was on steel stocks, which attracted significant capital inflows and saw strong gains with high trading volume. Specifically, the top three steel stocks were HPG (up 2.64%), NKG (up 4.88%), and HSG (up 4.12%). Additionally, BOM (up 2.06%), TLH (up 1.76%), and SMC (reaching its ceiling price) also rose.

The real estate and construction sector showed strong divergence. Most large-cap stocks declined, such as NLV (down 1.56%), CTD (down 1.11%), and the Vingroup trio (VHM down 2.25%), VRE (down 1.88%), and VIC (down nearly 1%). Conversely, DIG rose 2.46%, PDR 2.92%, DXG 1.77%, VCG 1.09%, NLG 1.37%, KDH 1.44%, and HHV 1.32%.

The securities sector maintained its strong upward momentum, with most stocks trending in the green: CTS increased by 2.59%, VIX by 1.27%, SSI by 2.11%, VCI by 1.63%, HCM by 1.04%, FTS by 1.87%, BSI by 1.67%, SBS by 1.39%; VDS, SHS, MBS, and VND increased by nearly 1%. Only a few stocks declined, such as VFS down 2.96%, ORS down 1.24%, and ARG down nearly 1%.

Meanwhile, the banking sector also showed mixed performance, with more red putting pressure on the index: SSB fell 3.36%, VPB fell 1.79%,SHB fell nearly 1%; STB, TCB, VCB, BID, CTG, HDB fell nearly 1%... Conversely, TPB rose 1.47%, VIB rose 1.05%; ACB, MBB, EIB rose nearly 1%...

At the close of trading, the VN-Index edged down 1.61 points (0.15%) to 1,100.07 points, with 321 declining stocks, 188 rising stocks, and 95 unchanged stocks. On the Hanoi Stock Exchange, the HNX-Index also fell 0.54 points (0.24%) to 226.11 points (0.24%), with 107 declining stocks, 53 rising stocks, and 68 unchanged stocks. Market liquidity decreased by nearly 6,000 billion VND compared to the end of last week's trading session, with the total market trading value reaching only 18,300 billion VND. Of this, the HOSE exchange accounted for only 16,000 billion VND.

Foreign investors extended their net selling streak, with the total value on the HOSE exchange reaching nearly 378 billion VND.

Source

Comment (0)