Deputy Minister of Finance Nguyen Duc Chi talks about tax loss management for livestream sales. Photo: VGP

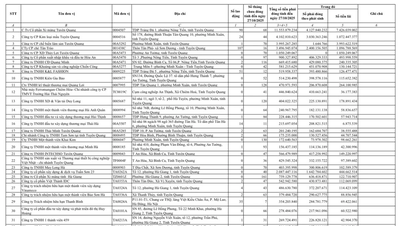

At the press conference, the representative of the Ministry of Finance said that the total number of organizations and individuals doing e-commerce business that have been reviewed is 31,570 cases.

According to the Ministry of Finance, when livestreaming online sales, this activity has generated revenue and can generate income. When revenue and income have generated, it must be subject to the adjustment of tax laws and tax rates as well as the management and supervision of tax authorities. For e-commerce activities in general or livestreaming online sales, the Ministry of Finance has implemented management and supervision according to two tax rates.

For individuals, if revenue and income arise, they are subject to tax on income, regulated by the Law on Personal Income Tax.

If the business household has e-commerce or livestream activities that generate revenue (called commission), then manage and collect taxes according to regulations related to business household management (in the form of contract or tax declaration).

Specifically, the Ministry of Finance said that tax management data in the last two years recorded tax collection results from organizations and individuals with e-commerce business activities: in 2022, tax management revenue was 3.1 million billion VND (130.57 billion USD), with tax paid being 83,000 billion VND. In 2023, management revenue was 3.5 million billion VND (146.28 billion USD), with tax paid being 97,000 billion VND.

In addition, the cumulative results of inspections, checks and handling of violations in the past 3 years (2021, 2022 and 2023) show that the total number of e-commerce business organizations and individuals subject to review is 31,570 (6,257 enterprises, 25,313 individuals).

Here, the total number of cases of tax declaration, tax payment, tax collection, and violation handling was 22,159 business establishments (543 enterprises, 21,616 individuals) with an additional tax amount of 2,900 billion VND.

Source

![[Photo] Draft documents of the 14th Party Congress reach people at the Commune Cultural Post Offices](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761642182616_du-thao-tai-tinh-hung-yen-4070-5235-jpg.webp)

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

Comment (0)