Interest rates of some banks tend to increase

On May 25, Bac A Commercial Joint Stock Bank issued a new deposit interest rate schedule, applicable to deposits under VND1 billion and over VND1 billion. The new interest rate recorded an increase of about 0.1-0.15 percentage points at all terms.

The savings interest rate table for deposits under 1 billion VND is currently listed by Bac A Bank as follows: Interest rate for 1-month term deposits increased by 0.15 percentage points, to 3.1%/year; 3-month term deposits increased by 0.15 percentage points, to 3.3%/year; 6-month term deposits increased by 0.1 percentage points, to 4.5%/year; 9-month term deposits increased by 0.1 percentage points, to 4.6%/year; 12-month term deposits increased by 0.3 percentage points, to 5.4%/year. Interest rate for 18-36-month term deposits remains at 5.5%/year.

On May 27, An Binh Commercial Joint Stock Bank (ABBank) issued a new interest rate schedule. Since the beginning of May, this is the fourth time ABBank has adjusted its deposit interest rates upward.

The online deposit interest rate table at ABBank is currently listed as follows: 1-month deposit interest rate is 2.9%/year; 3-month deposit interest rate is 3.0%/year; 6-month deposit interest rate is 4.7%/year; 9-month deposit interest rate is 4.1%/year; 12-month deposit interest rate increased by 1.1%, to 5.2%/year.

On May 28, Vietnam Technological and Commercial Joint Stock Bank (Techcombank) issued a new deposit interest rate schedule, recording an increase of 0.1 percentage points for some terms. Notably, Techcombank had previously increased interest rates for the first time since the beginning of 2024 not long ago. This is the second time this month that the bank has adjusted its deposit interest rates upward.

The online deposit interest rate table (applied to deposits greater than 3 billion VND) records the following changes:

Interest rate on 1-month deposits increased to 2.95%/year; 3-month deposits increased to 3.25%/year; 6-9 months increased to 4.05%/year; terms greater than 12 months increased to 4.75%/year.

On the same day, the Vietnam Joint Stock Commercial Bank for Industry and Trade (BVBank) also issued a new interest rate schedule for the second time this month with a general trend of increasing interest rates.

BVBank's online deposit interest rate table recorded the following changes: 1-month deposit interest rate increased by 0.2 percentage points, to 3.2%/year; 3-month increased by 0.2 percentage points, to 3.4%/year; 6-month increased by 0.45 percentage points, to 4.7%/year; 9-month increased by 0.05 percentage points, to 4.6%/year; 12-month increased by 0.45 percentage points, to 5.3%/year; 18-month increased by 0.25 percentage points, to 5.5%/year.

Which bank has the highest interest rate?

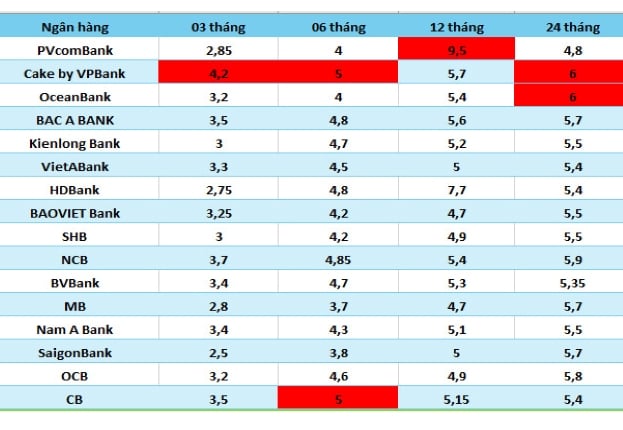

Readers can refer to interest rates of some other banks through the following table:

PVcomBank's interest rate is currently at its highest, at 9.5%/year for a 12-13 month deposit term with a minimum deposit of VND2,000 billion.

Next is HDBank with a fairly high interest rate, 8.1%/year for a 13-month term and 7.7% for a 12-month term, with the condition of maintaining a minimum balance of 500 billion VND.

MSB also applies a fairly high interest rate with interest rates at bank counters of up to 8%/year for a term of 13 months. The applicable conditions are that the savings book is newly opened or the savings book is opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and the deposit amount is from 500 billion VND.

Dong A Bank has a deposit interest rate, term of 13 months or more, end-of-term interest with deposits of 200 billion VND or more, applying an interest rate of 7.5%/year.

Deposit 500 million VND for 12-month term, what is the interest rate?

To calculate interest on savings deposits at the bank, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit

For example, if you deposit 500 million VND for a 12-month term at Bank A with an interest rate of 5.2%/year, you can receive: 500 million VND x 5.2%/12 x 12 = 26 million VND.

With the same term amount, if you deposit savings in Bank B with an interest rate of 5.7%, the interest you receive will be: 500 million VND x 5.7%/12 x 12 = 28.5 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source: https://laodong.vn/tien-te-dau-tu/nhieu-ngan-hang-tang-lai-suat-co-tien-gui-tiet-kiem-12-thang-o-dau-1345997.ldo

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

Comment (0)