The Ministry of Finance has just issued Circular 43/2024/TT-BTC regulating the collection rates of a number of fees and charges to continue to remove difficulties and support production and business activities.

Specifically, a 50% reduction in fees for granting licenses to establish and operate banks (the collection rate is equal to 50% of the fee collection rate prescribed in Point a, Section 1 of the Fee Collection Rate Schedule in Clause 1, Article 4 of Circular No. 150/2016/TT-BTC stipulating the collection rate, collection and payment regime of fees for granting licenses to establish and operate credit institutions; licenses to establish foreign bank branches, representative offices of foreign credit institutions, other foreign organizations with banking activities; licenses to operate intermediary payment services for organizations that are not banks).

This is the fourth time the Ministry of Finance has issued a circular stipulating a reduction in fees and charges by 10-50%, expected to reduce budget revenue by about 700 billion VND.

50% reduction in fees for granting citizen identification cards; fees for granting licenses for establishment and operation of non-bank credit institutions; fees for submitting applications for intellectual property protection; fees for granting certificates of practice as industrial property representatives, publishing and registering industrial property representatives; fees for assessing the content of non-business documents to grant publishing licenses; fees for granting licenses to import non-business publications; fees for registering the import of publications for business purposes...

In addition, a 50% reduction will be made in the fees for appraisal and approval of fire prevention and fighting designs; fees for granting licenses to send workers to work abroad for a limited period; industrial property fees; fees for using railway infrastructure; fees for appraisal and granting international travel service business licenses, domestic travel service business licenses; fees for appraisal and granting tour guide cards, etc.

In this circular, the Ministry of Finance also reduces by 10-30% many fees and charges such as: appraisal fees for granting certificates, licenses, and permits in civil aviation activities; granting permits to enter and exit restricted areas at airports; fees for entering and exiting airports for foreign flights to Vietnamese airports; and customs fees for foreign flights to Vietnamese airports.

For the securities sector, reduce 50% of fees and charges in the securities sector (except for 2 fees and charges: fees for new issuance, exchange, re-issuance of securities practice certificates for individuals practicing securities at securities companies, securities investment fund management companies and securities investment companies; fees for supervision of securities activities...).

The total number of fees and charges subject to reduction is 36.

The Circular takes effect from July 1 to December 31, 2024.

From January 1, 2025 onwards, the collection rates of fees and charges specified in the table stated in the circular shall comply with the provisions of the original circulars, Circular No. 63/2023/TT-BTC and amended, supplemented or replaced circulars (if any).

This is the fourth time, under its authority, that the Ministry of Finance has issued a circular stipulating a reduction in fees and charges by 10-50%. It is expected that this regulation will reduce budget revenue by about 700 billion VND.

Source: https://thanhnien.vn/nhieu-khoan-phi-le-phi-giam-toi-50-ngan-sach-hut-thu-700-ti-dong-185240628161026777.htm

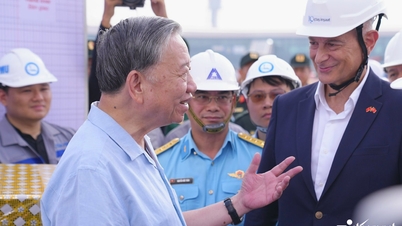

![[Photo] General Secretary To Lam visits Long Thanh International Airport Project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/13/1763008564398_vna-potal-tong-bi-thu-to-lam-tham-du-an-cang-hang-khong-quoc-te-long-thanh-8404600-1261-jpg.webp)

![[Photo] The "scars" of Da Nang's mountains and forests after storms and floods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/13/1762996564834_sl8-jpg.webp)

![Dong Nai OCOP transition: [Article 3] Linking tourism with OCOP product consumption](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/10/1762739199309_1324-2740-7_n-162543_981.jpeg)

Comment (0)