The trend of decreasing interest rates continues to dominate.

After a long period of maintaining a record increase, interest rates have continuously recorded a downward trend since the end of the first quarter of 2023. Specifically, from March to June 2023, the State Bank of Vietnam (SBV) has continuously adjusted interest rates down 4 times with a reduction of 0.5 - 2.0%/year.

In October 2023, the highest term deposit interest rates at 4 State-owned commercial banks were adjusted down by 0.2 - 0.3%, to only 5.5% for terms of 12 - 24 months. For terms of 6-9 months, the deposit interest rate has returned to 4.5%/year.

With the current developments, the State Bank of Vietnam may continue to reduce interest rates by another 0.5% in the last quarter of 2023 to support the economy entering 2024. According to the forecast of VNDirect Securities Corporation, the average mobilization interest rate may return to 6.5 - 6.8%/year by the end of 2023 and drop even lower in 2024. The ceiling interest rate for short-term loans for some priority sectors, especially small and medium enterprises, is expected to remain at a maximum of 4%/year.

Many policies support business financial health

In order to increase businesses' access to capital, many fiscal policies with a total scale of nearly VND 200 trillion are being implemented according to the roadmap, with an actual reduction in budget revenue of more than VND 82 trillion. Promoting public investment this year has a total scale of up to nearly VND 800 trillion, an increase of 30% compared to 2022.

The State Bank of Vietnam also adjusted the credit growth target to a system-wide level of about 14%, contributing to ending the "room shortage" situation as in 2022. Along with that are credit packages of 120 trillion VND for social housing loans, credit packages of 15 trillion VND for forestry and fishery loans with preferential interest rates. Credit growth for the whole year of 2023 is forecast to reach about 12 - 13%.

Solutions to help businesses seize business opportunities quickly

Although there are currently many measures to help businesses, it is necessary to recognize the fact that the ability to increase credit in the coming time will depend largely on the ability to meet credit conditions and demand, as well as the ability to absorb capital of businesses.

For businesses with specific operations that make it difficult to meet these requirements, the need for suitable financial products and timely disbursement to help businesses seize golden opportunities and ensure business operations is extremely large.

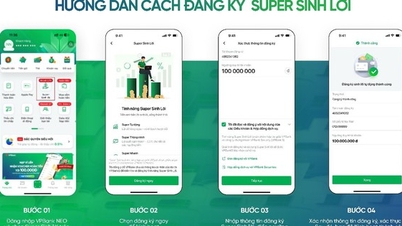

Grasping this urgent need, many financial institutions have launched products designed to best suit businesses at the present time. Notably, Vietnam Maritime Commercial Joint Stock Bank (MSB) with solutions designed in-depth, to best meet the capital needs of businesses.

In particular, the M-Power solution of providing online credit up to 15 billion VND with an approval time of only 3 days will be a necessary support for commercial enterprises that are looking for instant capital solutions, without requiring collateral, to "quickly seize" new business opportunities, meet production requirements to sign orders. Construction enterprises can also benefit from this financial solution when opening guarantees without worrying about "appropriation" of capital or collateral.

Meanwhile, for businesses in the manufacturing sector, with a large capital need to expand their scale, open more factories, and speed up the delivery of products, the M-Supreme solution of providing comprehensive online credit up to 200 billion VND will be the most suitable choice, helping businesses maintain their reputation and enhance their production position in the eyes of partners.

The end of the year is often the "peak" shopping season, so this solution is also worth considering for commercial enterprises that are planning to expand their business and dominate the market in the near future.

Details on conditions, procedures and disbursement time for M-Power and M-Supreme solution packages: https://vaydoanhnghiep.msb.com.vn/

Bich Dao

Source

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)