The World Bank has just released an updated report on Vietnam's economic situation in August 2024. The World Bank believes that Vietnam's economic growth rate is expected to be higher in 2024, thanks to the recovery of exports of manufactured goods, tourism, consumption and investment.

Notably, the WB forecasts that Vietnam's economic growth will reach 6.1% in 2024, higher than 5% in 2023, then will increase to 6.5% in 2025 and 2026.

Although the WB's forecast is lower than HSBC's estimate of 6.5% and the Vietnamese Government 's target, overall, the financial institution's assessment is quite positive.

The report also shows the resilience of the Vietnamese economy in the context of increasing global challenges, including geopolitical tensions in many regions of the world.

The WB report is conservatively calculated based on forecasts of slowing demand from several major economies in the remaining months of 2024, including the US. The US is currently Vietnam's largest export market.

The World Bank also forecasts that the real estate market will reverse more positively in late 2024 and 2025, in the context of the Land Law taking effect from August 2024. Authorities are also trying to revive the corporate bond market, which was quiet in the second half of 2022 and in 2023.

According to the World Bank, countries around the world are showing a tendency to loosen monetary policy. The US is likely to reduce interest rates from September. This is a factor that gradually supports economies, thereby helping to increase demand. Vietnam's exports may benefit.

The Fed’s interest rate cut could help narrow the interest rate differential between VND and USD. Exchange rate pressure could be reduced, which could have a positive impact on the banking and financial sector in Vietnam.

The WB also has a special topic “Reaching new heights in capital markets”, emphasizing that developing capital markets will create important long-term capital sources, helping Vietnam achieve its goal of becoming a high-income country by 2045.

The report also points out the key challenges of Vietnam’s capital market, including the low proportion of institutional investors in the investor structure and under-utilisation of investment from the Vietnam Social Security (VSS) fund. The report recommends a stronger policy framework, in which social insurance will become a key factor promoting the development of the capital market.

Source: https://vietnamnet.vn/world-bank-kinh-te-viet-nam-se-but-pha-2315774.html

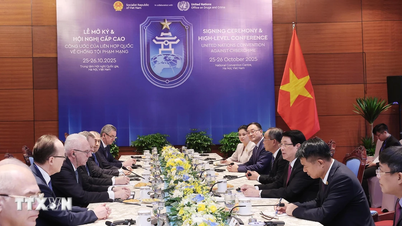

![[Photo] President Luong Cuong receives heads of delegations attending the signing ceremony of the Hanoi Convention](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761377309951_ndo_br_1-7006-jpg.webp)

![[Photo] General Secretary To Lam receives United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761376410088_a1-bnd-4607-5891-jpg.webp)

![[Photo] President Luong Cuong and United Nations Secretary-General Antonio Guterres chaired the signing ceremony of the Hanoi Convention.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/25/1761370409249_ndo_br_1-1794-jpg.webp)

Comment (0)