According to the Tax Authority, the temporary exit suspension measure is applied to ensure that related businesses and individuals fully fulfill their financial obligations to the State. The list of individuals subject to this measure includes:

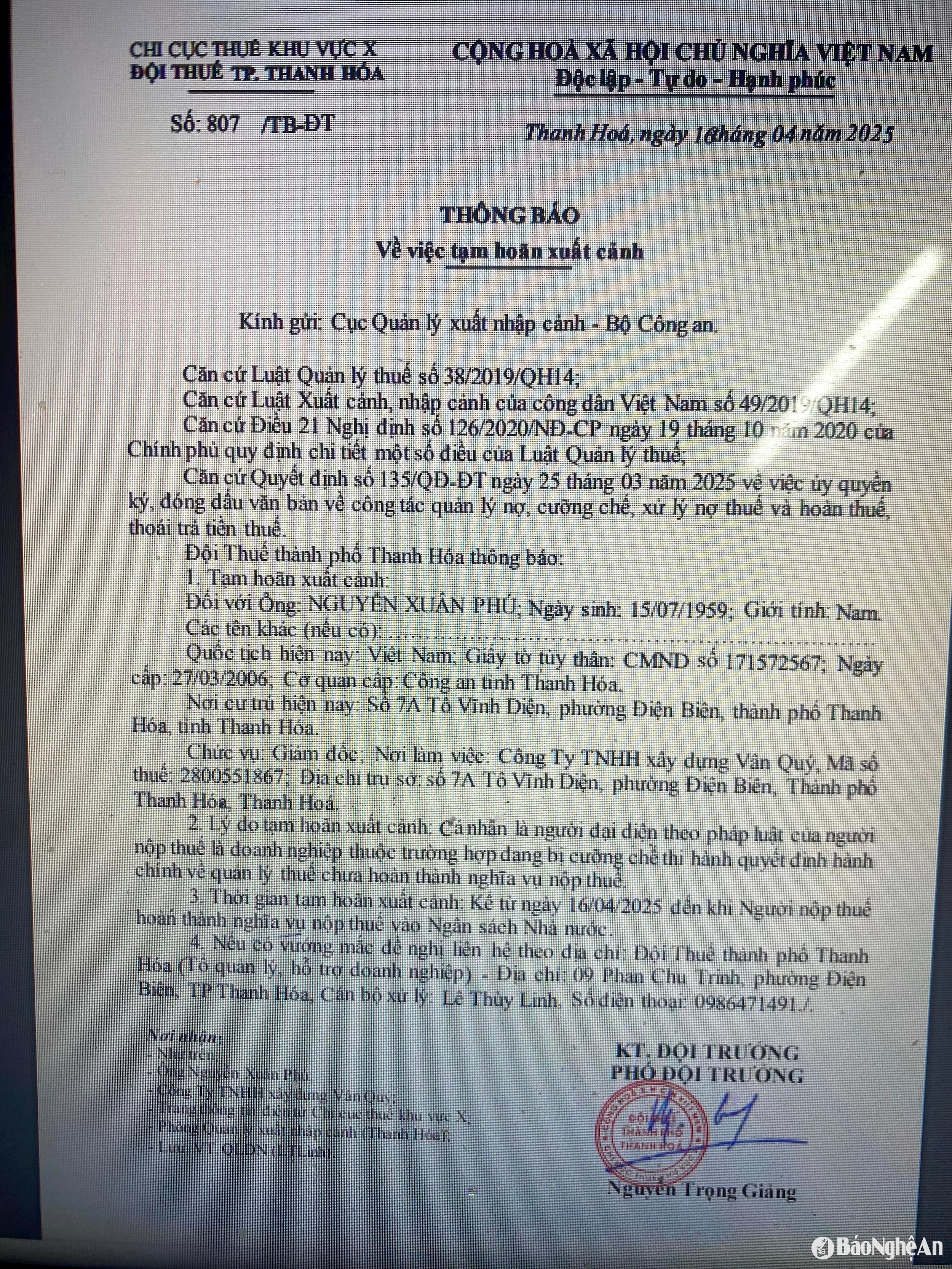

- Mr. Nguyen Xuan Ph., born on July 15, 1959, address at 7A To Vinh Dien, Dien Bien ward, Thanh Hoa city, Thanh Hoa province. Mr. Ph. is the legal representative of Van Q. Construction Company Limited, headquartered at the same address.

- Mr. Le Tan C., address at 61 Ly Thuong Kiet Street, Vinh City, Nghe An Province. He is the legal representative of DONAMART Supermarket Joint Stock Company.

- Mr. Dang Cong V., address at Tay Ho 1 block, Quang Tien ward, Thai Hoa town, Nghe An province, is the legal representative of Cua Lo Real Estate Joint Stock Company.

- Mr. Hoang Van D., residing in Hamlet 1, Xuan Son Commune, Do Luong District, Nghe An Province. Mr. D. is the legal representative of Thien Nhan Real Estate Joint Stock Company.

In total, the Tax Department of Region X has suspended the exit of 8 business owners who have tax debts during the period from April 9 to April 16, 2025.

The temporary suspension of exit is carried out according to the procedures of the Tax Department. After reviewing and verifying the tax obligations of individuals, the tax authority will make a list and send a request to the immigration authority. At the same time, a notice will also be sent to the taxpayer so that they are aware and promptly complete their financial obligations.

Immediately after receiving the document from the Tax authority, the immigration authority will proceed to suspend exit according to regulations and publicize the information on its Electronic Information Portal.

In case the taxpayer has fulfilled his/her financial obligations, within 24 working hours, the Tax authority shall be responsible for issuing a document canceling the temporary suspension of exit and sending it to the immigration authority for updating, ensuring the legitimate rights of citizens.

Source: https://baonghean.vn/nhieu-chu-doanh-nghiep-bi-tam-hoan-xuat-canh-do-no-thue-10295293.html

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)