1. Characteristics of Vietnam's energy security

Energy security, simply put, is the ability to access energy easily, at an acceptable price. To access energy easily, countries often prioritize and focus on developing domestic energy sources. If there is a shortage and they are forced to import energy, countries often choose the type that is easy to buy and sell, diversifying the supply, limiting dependence on certain regions and countries.

Vietnam is a tropical monsoon country with many rivers, lots of sunshine and wind, so along with the identified fossil resources, there are also abundant hydropower, wind power, solar power, etc. Vietnam's fossil energy resources include coal, oil and gas, however, due to the ongoing energy transition and Vietnam's commitment, along with the remaining reserves of mainly gas, coal and oil, their role will gradually decrease. Hydropower, gas power and renewable energy (mainly solar power and wind power) will become the three important pillars of national energy security.

Up to now, Vietnam only has one central LNG Thi Vai port warehouse with a capacity of 1 million tons/year of PV GAS, which has been put into operation since July 2023 and is implementing the capacity increase to 3 million tons/year by 2026 to serve the entire Southeast region.

Since 2015, Vietnam has become an energy importer. With the strong development of shale gas exploitation technology, the US has become the leading LNG exporter, along with the Middle East, Russia, Australia, etc., creating conditions for Vietnam to have many sources of gas imports. Not to mention the ability to import both by pipeline and LNG from Malaysia and Myanmar, gas exporting countries in Southeast Asia. These geopolitical factors further demonstrate that choosing gas as a strategic energy source is the right choice in Vietnam's conditions.

The recently approved Power Plan VIII also shows that managers have chosen gas-fired power as a strategic energy source. According to this plan, by 2030, gas-fired power capacity will reach 37,330 MW, equivalent to 24.8%, coal-fired thermal power will account for 20%, hydropower will account for 19.5%, and onshore and offshore wind power will account for 18.5% of the total power source capacity. Thus, gas-fired power installation capacity accounts for the largest proportion in the power source structure.

2. The role of gas-fired thermal power in Vietnam

a. One of the three pillars of energy security

As analyzed above, electricity is one of the three pillars of energy security, from the perspective of domestic production as well as import.

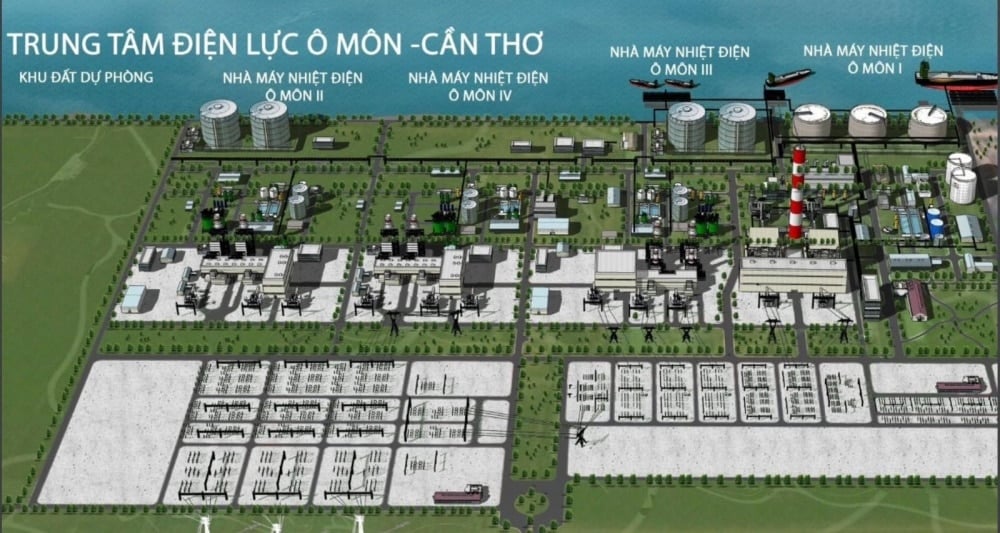

Currently, two important project chains are being implemented in the country, providing gas for 9 gas power plants: O Mon I, II, III, IV; Central I, II; Dung Quat I, II, III with a total capacity of 7,240 MW. In addition, Bao Vang mine also has enough reserves to supply Quang Tri gas power plant. Not to mention the remaining recovery potential is estimated at about 2.6 billion m3 of oil equivalent, but is biased towards gas.

O Mon Power Center – Can Tho

The world LNG market is growing strongly, so the source of imported gas is quite abundant and easy. Importing from the US will also help balance the trade balance between the two countries, thereby promoting the export of Vietnamese products with strengths to this large market.

b. Important elements in stabilizing Vietnam's power system

Of the three energy pillars, renewable energy is erratic by day and season, while hydropower is often limited in the dry season. The power shortage in May-June 2023 clearly demonstrates the risks of hydropower. In that context, gas-fired electricity is an important component that both ensures overall energy security and helps stabilize the power system when the other two components encounter unfavorable conditions.

The outstanding advantage of LNG power source is the ability to run at peak, start up quickly, be ready to supplement and quickly supply electricity to the system when other energy sources are reduced.

c. Effective solutions in energy transition

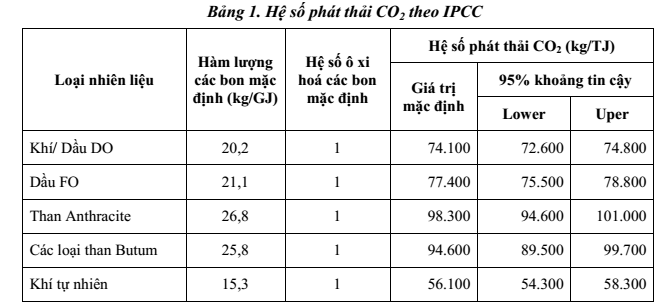

The table above shows that the emissions of gas-fired power are about 60% of those of coal-fired power. For that reason, many countries consider gas-fired power as an intermediate solution in the early stages of the energy transition. Vietnam also needs to pursue this strategy because we have committed to no new investment in coal-fired power after 2030.

d. Developing domestic gas value chain brings high value to the economy

Domestic power projects (the later stage) contribute to promoting the development of the first stage (exploration and exploitation). Therefore, they contribute to the effective use of the country's mineral resources, bring high value, contribute significantly to GDP, national income, budget payment... as well as being the driving force for economic development of many regions.

For example, when the Block B project chain comes into operation, in addition to contributing about 22 billion kWh/year to the national power system, it will also bring in large revenues to the budget, create jobs for thousands of workers and promote economic development in the Mekong Delta region. According to calculations, the upstream stage (gas exploitation) of the project chain alone can bring about 1 billion USD/year to the state budget.

3. Gas-fired thermal power in some Southeast Asian countries and implications for Vietnam

The same is true for Southeast Asian countries. With many similar conditions to Vietnam, such as domestic natural gas reserves, high economic growth and electricity demand, and energy transition orientation, many countries maintain a high proportion of gas-fired electricity in the overall national power generation system. For example, in Thailand, about 60% of electricity produced is gas-fired. Malaysia has this ratio of 45% and in Indonesia it is more than 22%.

Nhon Trach 3&4 Power Plant Project, the first LNG-fired power plant in Vietnam

Meanwhile, in 2022, the proportion of electricity produced from natural gas to Vietnam's total electricity production will be only about 11%. Although the Power Plan VIII mentioned above, this proportion is on a downward trend in 2023. Data from EVN shows that in the first 10 months of 2023, of the total electricity production of the entire system of 24.28 billion kWh, of which electricity production from gas turbines was only 22.9 billion kWh, accounting for 9.8%.

The progress of gas-fired thermal power is also slow. Of the total 23 gas-fired power projects according to the Plan, only 1 is operational, 1 is under construction, and 21 are being prepared or selecting investors. Notably, the two domestic gas project chains, Block B and Blue Whale, have both been delayed many times. This shows that the gap between planning and reality is still quite large.

4. Conclusion

Electricity plays a particularly important role in energy security and the stability of Vietnam's power system. The chain of power projects using domestic gas sources is also important to the economy and is a driving force for development in many regions.

However, the implementation of power projects is still slow and facing many difficulties. The basic bottleneck in the implementation of the above projects is that the Vietnamese energy market development institution still has many points that need to be improved.

Firstly, the price of domestic gas is currently strictly managed by the state, along with a consumption regime for investors, while the new component of the gas market is imported LNG, the price and consumption volume are negotiated according to market rules. The problem is how to deal with these two types of gas to ensure fairness in the market, that is, equal benefits and risks for all investors?

Second, the lack of connectivity in the energy market. Currently, electricity prices are managed by the state, while LNG prices, as an input fuel for electricity, are freely traded on the world market. This leads to an objective need for electricity prices to be closer to market rules and have a mechanism for allocating reasonable benefits and risks among enterprises participating in the electricity chain when LNG, from port investment, import, construction and operation of factories, to purchasing electricity, generating electricity to the system, distributing and retailing to end users.

Solving the above problems is to implement the policy of "building a synchronous, competitive, transparent energy market, diversifying ownership forms and business methods", as stated in Resolution No. 55-NQ/TW of the Politburo, as well as ensuring the harmony of interests and risk sharing between the State and enterprises.

Nguyen Hong Minh

Source: https://www.pvn.vn/chuyen-muc/tap-doan/tin/885c5421-a7a9-45e2-aefd-b4e2126acd98

Comment (0)