The debt due is over 3,000 billion VND.

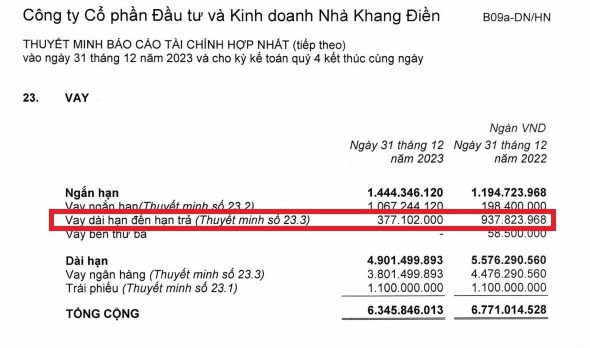

According to the consolidated financial report for the fourth quarter of 2023 of Khang Dien House Investment and Business Joint Stock Company (Stock code: KDH), total liabilities as of December 31, 2023 increased by 12% to nearly VND 10,890 billion. Of this, borrowings amounted to VND 6,345 billion, a decrease of 6% compared to the same period last year.

Khang Dien Group has 1,100 billion VND in unsecured bond debt with an interest rate of 12% per year; the remainder is secured bank loans with interest rates ranging from 10.9% to 12.6% atOCB (outstanding debt over 4,100 billion VND) and 10.5% per year at VietinBank.

Notably, the company has long-term loans due for repayment totaling VND 377 billion. According to the explanatory notes, KDH has a loan of nearly VND 500 billion at Orient Commercial Bank (OCB) - District 4 Branch, with principal repayment due from January 25, 2024 to April 6, 2025, and a loan of nearly VND 44 billion at OCB, with principal repayment due on March 9, 2024.

Meanwhile, KDH's operating cash flow at the end of 2023 continued to be negative for the third consecutive year, reaching a loss of VND 1,556 billion (compared to a loss of VND 1,047 billion in 2022), largely due to inventory and accounts receivable. Simultaneously, its financing cash flow also recorded a negative figure of over VND 293 billion (compared to a positive VND 3,231 billion in 2022) as the company repaid nearly VND 4,520 billion in principal debt, while borrowings amounted to less than VND 4,100 billion.

In terms of business performance, in the fourth quarter of 2023, Khang Dien recorded net revenue of VND 469 billion, a decrease of 62% compared to the same period, and after-tax profit of VND 63 billion, a decrease of 42.7% compared to the same period.

For the full year 2023, Khang Dien recorded net revenue of VND 2,093 billion, a decrease of 28.1% compared to the same period, and after-tax profit of VND 730 billion, a decrease of 32.5% compared to the previous year.

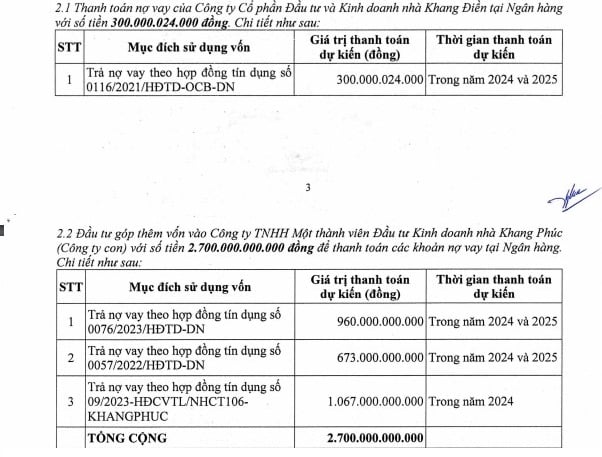

Besides the 377 billion VND debt due at KDH, recent information reveals that Khang Dien's wholly owned subsidiary, Khang Phuc House Investment and Business Company Limited, has three bank loans totaling 2,700 billion VND that are also nearing their repayment deadlines.

How did Khang Dien's family manage the situation?

To repay the aforementioned debts, Khang Dien recently announced that the company is conducting a written shareholder consultation regarding a share offering to raise capital for debt repayment. The deadline for completing the shareholder consultation is 2 PM on March 6th.

Accordingly, Khang Dien plans to offer more than 100 million shares in 2024 to 20 professional securities investors (including 14 institutions such as funds, securities companies, banks, and real estate companies, and 6 individuals).

The offering price is expected to be VND 27,250 per share, a 12% discount compared to the average closing price of the 30 trading sessions preceding February 23, 2024. The newly offered shares will be subject to a one-year transfer restriction from the date the offering ends.

It is estimated that the amount raised from the offering is over 3,000 billion VND. Khang Dien plans to use 300 billion VND to repay loans under credit agreement No. 0116/2021/HĐTD-OCB-DN; and 2,700 billion VND to invest additional capital in Khang Phuc House Investment and Business Company Limited to help this entity repay three bank loans totaling 2,700 billion VND.

The disbursement period for payment is expected to be in 2024 and 2025. If the issuance is successful, KDH's charter capital is expected to increase from VND 7,993.1 billion to VND 9,094 billion.

If some loans are repaid before the end of the offering period, Khang Dien will adjust the plan and flexibly arrange a suitable alternative or supplement the working capital.

In the event that the shares are not fully subscribed, resulting in the amount raised from the offering not meeting expectations, Khang Dien will prioritize the use of the raised capital, rebalance its capital sources, and flexibly utilize other capital sources to develop an appropriate solution.

Also related to Khang Phuc House's borrowing activities, Khang Dien House recently committed to guaranteeing the full and timely repayment of Khang Phuc House's 4,270 billion VND loan at Vietinbank - Hanoi Branch.

Previously, in October 2022, Khang Dien also approved a guarantee for Khang Phuc Investment and Business Company Limited to borrow no more than VND 1,220 billion from Orient Commercial Bank (OCB) - District 4 branch to pay land lease fees of up to VND 420 billion as per the land lease payment notice from the State agency and to pay up to VND 800 billion for investment and construction costs of technical infrastructure for the Le Minh Xuan Industrial Park expansion project, phase 1.

Source

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)