VinFast shares are expected to nearly double

The global electric vehicle market was less buoyant last week as industry giants Tesla “switched gears” aggressively, causing billionaire Elon Musk to lose billions of dollars. Meanwhile, shares of electric vehicle startups Fisker (FSR), Rivian Automotive (RIVN), and Lucid (LCID) were all lower, according to Market Watch.

At one point, VinFast’s stock price increased by 36%. Last night, this code adjusted slightly but still received trust from investors.

VinFast shares have received two analyst ratings since the SPAC merger in August, Market Watch said. Both recommendations are “buy.” The average analyst price target is $9. One analyst has a price target of $11.

The news that billionaire Pham Nhat Vuong unexpectedly met Indian billionaire Adani received great attention from the public (Photo: Gautam Adani).

Thus, if VinFast develops as predicted by international experts, this stock price will nearly double compared to the present time.

And finally, Market Watch commented: “VinFast is still a valuable electric vehicle start-up.”

VinFast received attention from domestic and international investors when Indian billionaire Gautam Shantilal Adani shared about his meeting with Vingroup Chairman Pham Nhat Vuong on his personal Twitter page.

During the meeting, the two businessmen, both on the Forbes list of “The Richest People in the World ,” discussed potential business opportunities between India and Vietnam.

The second richest man in India and the 23rd richest man in the world said he was truly inspired by the impressive entrepreneurial journey of Mr. Pham Nhat Vuong. Billionaire Adani was impressed by the visionary leadership of the Chairman of Vingroup.

Investors win big in race to buy VIN stocks

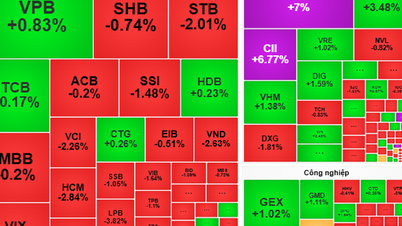

VinFast’s rise on the Nasdaq has inspired “VIN” stocks in the domestic market. In recent sessions, investors have rushed to buy VIC, VHM and VRE stocks, causing these codes to skyrocket.

Specifically, at the close of trading on November 9, Vingroup's VIC stock increased by VND2,400/share, equivalent to 5.58% to VND45,400/share. Thanks to that, Vingroup's market capitalization increased by VND9,153 billion to VND173,153 billion.

Compared to the end of last week, VIC price increased by 3,800 VND/share. The value of VIC shares of shareholders increased by 14,493 billion VND. Thus, after less than 1 week, VIC shareholders "pocketed" nearly 14,500 billion VND.

Similar to VIC, Vinhomes' VHM stock also accelerated, increasing by VND1,900/share, equivalent to 4.63% to VND42,900/share. VHM helped Vinhomes' market capitalization increase by VND8,273 billion.

Compared to last weekend, VHM increased by VND2,400/share, bringing Vinhomes VND10,450 billion in market capitalization. That is also the benefit that all Vinhomes shareholders receive.

At the close of the stock market session on November 9, VRE shares of Vincom Retail Joint Stock Company increased by VND600/share, equivalent to 2.53% to VND24,300/share. VRE helped shareholders' VRE shares value increase by VND1,397 billion.

It can be seen that thanks to the competition to buy "VIN family" stocks, investors have earned billions of dollars in profits this week.

And not only bringing benefits to shareholders, in recent sessions, VIC, VHM and VRE have also played an inspiring role and led the excitement of the stock market in recent sessions.

VN-Index escapes liquidity "exhaustion"

In addition to helping VN-Index increase strongly, the role of the trio VIC, VHM and VRE is even more important in improving liquidity for VN-Index.

For a long time, one of the biggest concerns of the market has been the lack of liquidity. But recently, especially on November 9, the trading value on the Ho Chi Minh City Stock Exchange has skyrocketed to over VND21,000 billion from an average of over VND14,000 billion over the past period. This positive signal appeared when money rushed to buy "VIN" stocks.

VIC's liquidity in the session on November 9 was 7.3 million shares, a sharp increase compared to 4.7 million shares in the session on November 8, VHM's trading value was 15.5 million shares, an increase compared to 7.7 million shares.

In the session of November 10, "VIN family" stocks slightly adjusted along with VN-Index. And this is a buying opportunity for those who "missed the boat" yesterday.

Source

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)