E-commerce businesses pay nearly 55,000 billion VND in taxes, General Department of Taxation sends "Open Letter"

The General Department of Taxation has just sent an "Open Letter" to organizations and individuals doing e-commerce business in Vietnam.

Statistics from the General Department of Taxation show that in the first 6 months of 2024, tax management revenue from organizations and individuals with e-commerce business activities was 1.98 million billion VND, the amount of tax paid was about 55,000 billion VND, an increase of 23% compared to the average tax amount in the first 6 months of 2023, there were 26 new foreign suppliers registered, declared and paid taxes in Vietnam.

As of June 19, 2024, there were 102 foreign suppliers registering, declaring and paying taxes via the Electronic Information Portal from many countries such as: United States; Netherlands; Korea; Singapore; Ireland; Switzerland, Australia; UK; Switzerland;... The total tax that foreign suppliers declared and paid directly via the Electronic Information Portal was 4,039 billion VND, an increase of 18.5% over the same period in 2023.

Regarding the review, inspection, and handling of violations, the General Department of Taxation said that in the first 6 months of 2024, the total number of enterprises and individuals subject to review, urging, and support for tax declaration and payment was 42,898. Individuals and enterprises declared and paid taxes of VND 9,979 billion, an increase of about VND 3,480 billion over the same period (equivalent to an increase of 53.5%). The number of cases of violations handled was 4,560 with the amount of tax collected and fined being VND 297 billion.

|

| TikTok Shop e-commerce product has grown strongly in Vietnam in recent times. |

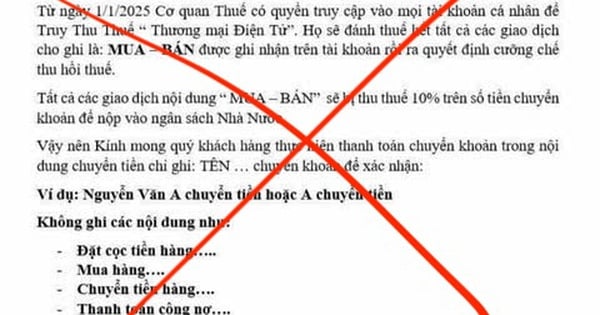

Recently, the General Department of Taxation has sent an "Open Letter" to organizations and individuals doing e-commerce business in Vietnam to discuss the implementation of tax obligations for e-commerce activities and business on digital platforms and provide a set of documents guiding tax registration, declaration, tax payment and email list of tax authorities for taxpayers to proactively contact when having problems.

This unit said that according to the provisions of Article 17 of the Law on Tax Administration No. 38/2019/QH14, all enterprises, organizations and individuals, if they have business activities, are responsible for self-declaration, self-payment and self-responsibility before the tax law, including e-commerce business activities. All enterprises, organizations and individuals, if they have business activities, are responsible for self-declaration, self-payment and self-responsibility before the tax law, including e-commerce business activities.

At the same time, implementing the Prime Minister's direction in Directive 18/CT-TTg dated May 30, 2023 on promoting connection and data sharing to serve e-commerce development, combat tax loss, and ensure monetary security, in recent years, the General Department of Taxation has focused on building a large database (big data) on tax management for organizations and individuals with production and business activities, including domestic and cross-border e-commerce business.

Currently, the Tax sector has been and is continuing to promote administrative reform, propaganda, support and comprehensive and synchronous digital transformation of tax management, thereby determined to successfully implement the goal of "Taxpayer-centered service" to create maximum favorable conditions for taxpayers to fulfill their tax obligations in accordance with the provisions of law.

In addition, the Tax sector deploys electronic tax support applications, operates the E-commerce Portal for foreign suppliers to fulfill their tax declaration and payment obligations in Vietnam; Etax Mobile application supports individuals in paying taxes and looking up information on tax obligations quickly and conveniently; Applying electronic invoices to the entire economy including business households and individual businesses;...

In order to continue to effectively support organizations and individuals operating in the field of e-commerce to fulfill their tax obligations in accordance with regulations, the General Department of Taxation respectfully sends to organizations and individuals the document set "Guidelines on tax registration, declaration, and payment" (QR code in the letter) at the General Department of Taxation's electronic information portal.

The General Department of Taxation said that in the process of accessing documents and performing tax obligations, if there are any problems or comments, organizations and individuals are requested to contact the tax authority directly for timely guidance and resolution of problems according to the "List of tax authority email addresses" (QR code in the letter) at the General Department of Taxation's electronic information portal.

Source: https://baodautu.vn/nguoi-kinh-doanh-thuong-mai-dien-tu-nop-gan-55000-ty-dong-thue-tong-cuc-thue-gui-thu-ngo-d221469.html

Comment (0)