People pay taxes easily anytime

According to information from the Binh Dinh Provincial Tax Department, in the first 6 months of 2024, 14,014 individuals and business households paid taxes via the eTax Mobile application with an amount of 41.4 billion VND.

To support individual taxpayers, since 2022, the People's Committee of Binh Dinh province has issued a directive on the implementation of the electronic tax application (eTax Mobile). Since December 2022, the Provincial Tax Department has consulted and guided the installation of the eTax Mobile application for 44,967 individuals and business households.

As in Quy Nhon city (Binh Dinh), all businesses and business households that pay taxes by declaration method carry out electronic tax payment transactions.

There are many forms of electronic tax payment, including: Electronic tax payment through the General Department of Taxation's Electronic Information Portal (eTax, eTax Mobile); Performing electronic tax payment transactions through banking services (Smart Banking) or going directly to commercial bank transaction points for tax payment support.

In particular, paying taxes electronically via the eTax Mobile application (an application installed on smartphones) is the most convenient method. In addition to paying taxes, the eTax Mobile application also supports business households in looking up tax obligations (including non- agricultural land use tax, registration fees, etc.), and tax payment documents.

Taxpayers can conduct electronic transactions with tax authorities easily, anytime, anywhere, at any location with an Internet connection; without having to go directly to the treasury or bank, they can still complete their tax obligations quickly and accurately.

The application of information technology in tax collection management has helped Binh Dinh Tax Department continue to reap many successes.

State budget revenue in the first 6 months of the year, the whole province of Binh Dinh collected 6,022 billion VND, reaching 52.9% of the estimate assigned by the Ministry of Finance , 42.2% of the estimate assigned by the Provincial People's Council; increased by 29.9% over the same period. Excluding land use fees, the revenue was 3,626 billion VND, increased by 6.7% over the same period. Of the 17 revenue items, 10 revenue items increased over the same period. In terms of locality, there are some localities with high revenue growth compared to the same period such as: Tax Department of Tay Son - Vinh Thanh area increased by 99.8%; Quy Nhon city increased by 95.7%; Hoai Nhon - Hoai An - An Lao increased by 89.1%...

Good and creative way

In the past 6 months, Binh Dinh Tax Department has focused on performing well the tax management functions. Tax refunds have been resolved quickly; inspections have been carried out synchronously, detecting and handling many violations in tax compliance, contributing to increasing revenue for the state budget and ensuring fairness among taxpayers.

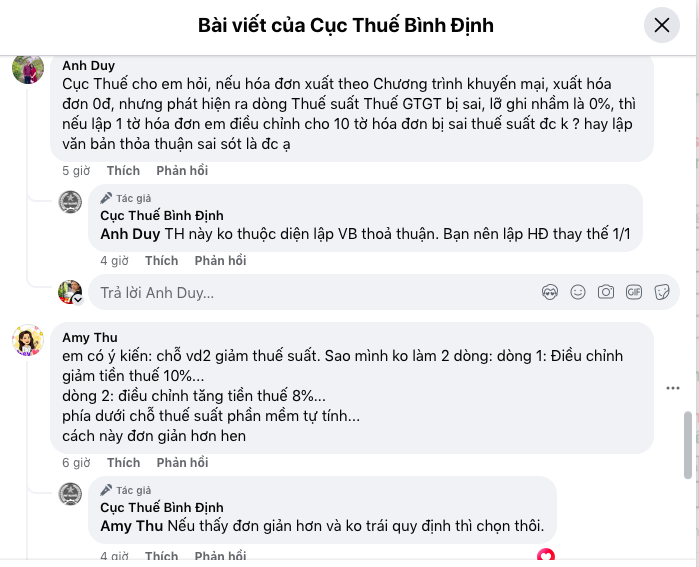

In particular, the propaganda and support work has been strongly transformed into digital. Binh Dinh Tax Department is promoting propaganda and support work on the Tax Department's social platforms such as: Biditax.vn communication portal, fanpage, Zalo, Youtube. By June 2024, the Tax Department's Fanpage had surpassed the Hanoi Tax Department and ranked 2nd in terms of followers (10.5 thousand people).

Taxpayers' questions will be answered online according to the 24/7 principle and according to the 5-star tax support service standards. The results of daily online Q&A are compiled into a Diary, posted on the Fanpage and Communication Portal for taxpayers to easily refer to and apply.

According to Binh Dinh Tax Department, interacting with taxpayers on digital platforms helps the business community and people access tax policies more quickly and effectively, thereby creating consensus, improving compliance and implementing tax laws and policies.

Mr. Nguyen Anh Tuan - Director of Binh Dinh Tax Department said that in the last 6 months of the year, the province will continue to implement policies to support taxpayers, promote production and business development, create a premise for increasing budget revenue; complete inspection and examination targets according to plan; units focus on standardizing personal tax codes.

In addition, complete the plan for electronic invoices generated from cash registers; strengthen the fight against revenue loss in the fields of e-commerce, accommodation, food and beverage, and mineral resource exploitation. At the same time, strengthen discipline, order, improve the spirit, attitude, and responsibility in serving taxpayers...

Dieu Thuy

Source: https://vietnamnet.vn/nganh-thue-binh-dinh-ghi-diem-voi-cong-tac-ho-tro-truc-tuyen-24-7-2306496.html

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)