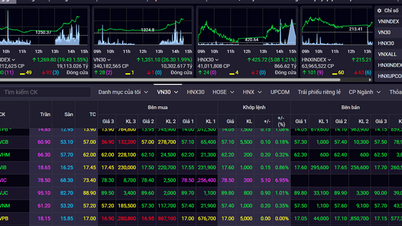

At the meeting on April 10, banks agreed on the policy of implementing a credit package of VND500,000 billion, and at the same time proposed clear regulations on responsibilities in lending so that banks can confidently implement it.

Vietcombank General Director Le Quang Vinh stated that the banking industry has identified credit as an effective support tool for businesses. However, to provide effective support, businesses should consider building a capital contribution and benefit sharing mechanism, instead of applying traditional lending methods.

Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that, implementing the Government's policy, on April 4, the State Bank of Vietnam met with commercial banks to discuss and develop a VND500,000 billion credit program with preferential interest rates to support businesses investing in infrastructure and digital technology.

The implementation of the VND500 trillion credit package and timely support policies is urgent, demonstrating the correct policy of the Party, State and Government. With that spirit, the banking industry is unanimous in implementing this program in the spirit of "only discussing, not backtracking".

Banks must implement effectively and substantially. However, in the implementation process, banks need to harmonize the goals of supporting businesses, promoting capital efficiency while ensuring operational safety.

Regarding the lending mechanism, the Deputy Governor said that resources from commercial banks will be mainly used. Banks will balance mobilized capital to lend appropriately.

Loans within the framework of this credit package must still ensure credit conditions, without lowering standards, but there will be support mechanisms regarding interest rates, terms, co-financing mechanisms, etc.

The State Bank encourages the expansion of participation by more banks in the spirit of big banks doing big, small banks doing small. In particular, state-owned commercial banks need to promote their leading role and demonstrate greater responsibility to the economy.

Regarding lending interest rates, commercial banks proactively determine and publicize the applicable interest rates and interest calculation methods for borrowers in each period, in the spirit of supporting customers to reduce costs and promote investment in infrastructure and digital technology.

Regarding disbursement time, the Deputy Governor said the program will last until 2030 or until all capital is disbursed, whichever comes first.

Source: https://hanoimoi.vn/ngan-hang-trien-khai-goi-tin-dung-500-000-ty-dong-giup-doanh-nghiep-dau-tu-cong-nghe-so-698547.html

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)