Some banks currently maintain a tiered interest rate policy; the larger the amount of money a customer deposits, the higher the interest rate they will receive.

Online deposit interest rates, interest received at the end of the term at ACB apply to 4 deposit levels including: under 200 million VND, from 200 million VND to under 1 billion VND, from 1 billion VND to under 5 billion VND and from 5 billion VND or more.

For deposits under 200 million VND, 1-month term has interest rate of 3.1%/year, 2-month term 3.2%/year, 3-month term 3.5%/year, 6-month term 4.2%/year, 9-month term 4.3%/year and 12-month term 4.9%/year.

Deposits from 200 million VND to under 1 billion VND have interest rates 0.1% higher per year than deposits under 200 million VND. Interest rates for the remaining two levels increase by 0.05% per year, respectively.

Thus, the highest savings interest rate at ACB is 5.1%/year when customers deposit for a 12-month term from 5 billion VND.

ACB currently applies the highest interest rate at the counter of 4.7%/year for 18-month term. The bonus interest rate for savings deposits at the counter from 200 million VND to under 1 billion VND is 0.1%/year, from 1 billion VND to under 5 billion VND is 0.15%/year and from 5 billion VND or more is 0.2%/year.

In addition, this bank also applies a "special interest rate" policy of 6%/year when customers deposit savings for a 13-month term with a deposit balance of 200 billion VND or more.

Bac A Bank maintains a ladder interest rate policy when issuing regulations on mobilization interest rates for two deposit levels: under 1 billion VND and over 1 billion VND.

For deposits under 1 billion VND, the interest rate for 1-2 month terms is 3.6%/year, 3 months 3.9%/year, 4 months 4%/year, 5 months 4.1%/year, 6-8 months 5.05%/year, 9-11 months 5.15%/year, 12 months 5.6%/year, 13 months 5.7%/year. The 18-36 month term has the highest interest rate, up to 6%/year.

Bac A Bank adds 0.2%/year to all terms when customers deposit over 1 billion VND. Therefore, the highest deposit interest rate listed by this bank is 6.2%/year, applied for terms of 18-36 months.

At Eximbank , in addition to the highest online deposit interest rates of up to 6.6%/year (24-36 months), 6.5%/year (18 months) and 6.2%/year (15 months), this bank also applies a ladder interest rate for customers depositing savings at the counter according to 4 limits: Silver account (equal to a regular account), Gold, Platinum, Infinite.

The interest rate for deposits at the counter for Silver accounts with terms of 1-2 months and 4-5 months is 3.5%/year, 3 months 3.4%/year, 6 months 5.2%/year, 9 months 4.3%/year, 12 months 5.4%/year, 15 months 5.6%/year, 18 months 5.7%/year, 24 months 5.8%/year, 36 months 5.1%/year.

Compared to Silver deposit accounts, the interest rate for Gold accounts is 0.3% higher for 6-month terms and 0.4% higher per year for the remaining terms.

Interest rates for Platinum accounts are 0.3% higher per year for 6-month terms and 0.5% higher per year for other terms.

The highest interest rate for savings deposits with Infinite deposit accounts is 0.5%/year higher than Silver accounts for a 6-month term (equivalent to 5.7%/year). The interest rate for 12-month term deposits is 0.7%/year higher (equivalent to 6.1%/year).

The deposit interest rate for the remaining terms for Infinite accounts is 0.8%/year higher than that of Silver accounts. Therefore, the highest deposit interest rate is up to 6.6%/year (24-month term), the 12, 15, 18-month terms are 6.1% - 6.4% - 6.5%/year respectively.

Orient Commercial Bank ( OCB ) also applies a ladder interest rate for customers making online savings deposits, with 3 deposit levels under 100 million VND, from 100 million VND to 500 million VND and over 500 million VND.

The interest rate difference between deposit levels is from 0.05-0.3%/year, except for the 21-36 month term where there is no difference.

Specifically, the online interest rate for deposits under 100 million VND for a term of 1 month is 4%/year, 2 months is 4.1%/year, 3-4 months is 4.2%/year, 5 months is 4.6%/year, 6-11 months is 5.2%/year, 12-15 months is 5.3%/year, 18 months is 5.5%/year, 21 months is 5.6%/year, 24 months is 5.7%/year, and 36 months is 5.9%/year.

The highest savings interest rate applied by OCB for deposits from 500 million VND or more, 1 month term is 4.5%/year, 25 months 4.65%/year, 6-11 months 5.5%/year, 12-21 months 5.6%/year, 24 months 5.7%/year and 36 months 5.9%/year.

Techcombank applies interest rates for three levels of deposits: under VND1 billion, from VND1 billion to under VND3 billion and from VND3 billion. The interest rate difference between the limits is 0.2%/year.

For online deposit accounts under 1 billion VND, the interest rate for 1-2 months is 3.35%/year, 3-5 months is 3.65%/year, 6-11 months is 4.65%/year. The interest rate for 12-36 months remains at 4.85%/year.

With online deposits from 1 billion VND to under 3 billion VND, interest rate for 1-2 month term is 3.45%/year, 3-5 months is 3.75%/year, 6-11 months is 4.7%/year, 12-36 months is 4.9%/year.

For online deposit accounts of 3 billion VND or more, the interest rate for 1-2 month terms is 3.55%/year, 3-5 months 3.85%/year, 6-11 months 4.75%/year. The highest listed savings interest rate is 4.95%/year, applicable for terms of 12-36 months.

Techcombank also has a policy of adding 0.5%/year interest rate for the first deposit account with terms of 3, 6 and 12 months. Therefore, the highest mobilization interest rate at Techcombank in reality can be higher than 5%/year.

In addition, the interest rate for priority customers with increased deposit balance will be added 0.3%/year interest rate when depositing for a term of 3-5 months.

At VPBank , online deposit interest rates are also being applied to 4 deposit levels including: under 3 billion VND, from 3 billion VND to under 10 billion VND, from 10 billion VND to under 50 billion VND, from 50 billion VND.

Online deposit interest rates applied to deposit accounts under 3 billion VND with a term of 1 month are 3.8%/year, 2-5 months 4%/year, 6-11 months 5%/year, 12-18 months 5.5%/year, 24-36 months 5.6%/year.

VPBank applies the same interest rate schedule for deposit accounts from 3 billion VND to under 10 billion VND as above. The difference only occurs in the 24-36 month term with the listed interest rate of 5.7%/year.

For deposits from 10 billion VND to under 50 billion VND, interest rate for 1-month term is 3.9%/year, 2-5 months is 4.1%/year, 6-11 months is 5.1%/year, 12-18 months is 5.6%/year, 24-36 months is 5.8%/year.

VPBank's interest rate for deposits of VND50 billion or more is 0.1% higher per year than for terms of 1-11 months. However, there is no change in interest rates for deposits of 12-36 months.

VPBank also adds 0.1%/year for priority customers with a minimum balance of 100 million VND when depositing for at least 1 month. Therefore, the highest mobilization interest rate at VPBank can be up to 5.9%/year compared to the listed interest rate.

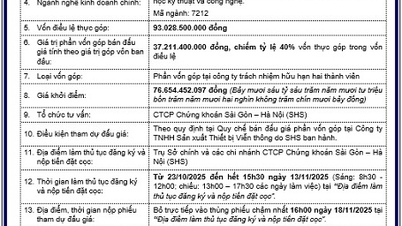

| INTEREST RATE TABLE FOR ONLINE DEPOSITS AT BANKS ON FEBRUARY 8, 2025 (%/YEAR) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 2.4 | 3 | 3.7 | 3.7 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETINBANK | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| ABBANK | 3.2 | 4 | 5.5 | 5.6 | 5.8 | 5.6 |

| ACB | 3.1 | 3.5 | 4.2 | 4.3 | 4.9 | |

| BAC A BANK | 3.6 | 3.9 | 5.05 | 5.15 | 5.6 | 6 |

| BAOVIETBANK | 3.3 | 4.35 | 5.45 | 5.5 | 5.8 | 6 |

| BVBANK | 3.95 | 4.15 | 5.45 | 5.75 | 6.05 | 6.35 |

| DONGA BANK | 4.1 | 4.3 | 5.55 | 5.7 | 5.8 | 6.1 |

| EXIMBANK | 4.1 | 4.4 | 5.4 | 5.4 | 5.6 | 6.5 |

| GPBANK | 3.5 | 4.02 | 5.35 | 5.7 | 6.05 | 6.15 |

| HDBANK | 3.85 | 3.95 | 5.3 | 5.7 | 5.6 | 6.1 |

| IVB | 4 | 4.35 | 5.35 | 5.35 | 5.95 | 6.05 |

| KIENLONGBANK | 4.3 | 4.3 | 5.8 | 5.8 | 6.1 | 6.1 |

| LPBANK | 3.6 | 3.9 | 5.1 | 5.1 | 5.5 | 5.8 |

| MB | 3.7 | 4 | 4.6 | 4.6 | 5.1 | 5.1 |

| MBV | 4.3 | 4.6 | 5.5 | 5.6 | 5.8 | 6.1 |

| MSB | 4.1 | 4.1 | 5 | 5 | 6.3 | 5.8 |

| NAM A BANK | 4.3 | 4.5 | 5 | 5.2 | 5.6 | 5.7 |

| NCB | 4.1 | 4.3 | 5.45 | 5.55 | 5.7 | 5.7 |

| OCB | 4 | 4.2 | 5.2 | 5.2 | 5.3 | 5.5 |

| PGBANK | 3.4 | 3.8 | 5 | 5 | 5.5 | 5.8 |

| PVCOMBANK | 3.3 | 3.6 | 4.5 | 4.7 | 5.1 | 5.8 |

| SACOMBANK | 3.3 | 3.6 | 4.9 | 4.9 | 5.4 | 5.6 |

| SAIGONBANK | 3.3 | 3.6 | 4.8 | 4.9 | 5.8 | 6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.95 | 3.45 | 3.95 | 4.15 | 4.7 | 5.45 |

| SHB | 3.5 | 3.8 | 5 | 5.1 | 5.5 | 5.8 |

| TECHCOMBANK | 3.35 | 3.65 | 4.65 | 4.65 | 4.85 | 4.85 |

| TPBANK | 3.7 | 4 | 4.8 | 5.3 | 5.5 | |

| VCBNEO | 4.15 | 4.35 | 5.85 | 5.8 | 6 | 6 |

| VIB | 3.8 | 3.9 | 4.9 | 4.9 | 5.3 | |

| VIET A BANK | 3.7 | 4 | 5.2 | 5.4 | 5.7 | 5.9 |

| VIETBANK | 4.2 | 4.4 | 5.4 | 5 | 5.8 | 5.9 |

| VPBANK | 3.8 | 4 | 5 | 5 | 5.5 | 5.5 |

Source: https://vietnamnet.vn/ngan-hang-tra-lai-suat-bac-thang-gui-tien-o-dau-loi-nhat-2369497.html

![[Photo] Da Nang: Shock forces protect people's lives and property from natural disasters](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/22/1761145662726_ndo_tr_z7144555003331-7912dd3d47479764c3df11043a705f22-3095-jpg.webp)

![[Photo] General Secretary To Lam and his wife begin their official visit to Bulgaria](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761174468226_tbtpn5-jpg.webp)

![[Photo] Comrade Nguyen Duy Ngoc visited and worked at SITRA Innovation Fund and ICEYE Space Technology Company](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761174470916_dcngoc1-jpg.webp)

![[Photo] Award Ceremony of the Political Contest on Protecting the Party's Ideological Foundation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/22/1761151665557_giaia-jpg.webp)

Comment (0)