ANTD.VN - Proud to be the pioneer bank to deploy Mobile Banking service in Vietnam, after more than 10 years of launching, VietinBank iPay application has become a "universal" digital banking solution for every home.

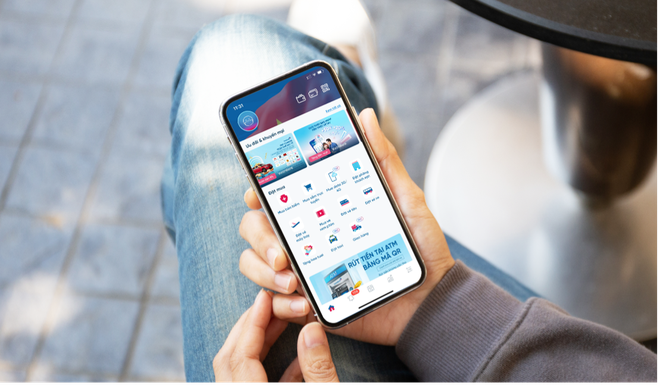

VietinBank iPay Mobile - Smart, modern digital banking application with optimal security

In the face of the increasingly strong wave of digital transformation in the banking sector, in October 2013, VietinBank officially launched Mobile Banking services in Vietnam. Then in 2019, VietinBank iPay Mobile was upgraded and developed on a new technology platform based on open application programming interfaces (Open APIs) called VietinBank iConnect. With this modern platform, VietinBank can easily connect with partners to increase features and utilities, build a comprehensive digital banking ecosystem, and meet the diverse financial needs of customers.

By applying a modern technology system that is highly appreciated in the Asia- Pacific region, combining Big Data and AI, VietinBank iPay Mobile is like a virtual financial assistant that helps users manage their accounts, propose/suggest the best features and products and services, suitable for the needs of each customer.

The bank also focuses on “contactless” features and continuously updates new features to provide customers with perfect digital banking experiences, meeting a variety of customer needs, from financial needs to daily life needs of customers simply anywhere. Customers only need to own a smartphone or tablet with Internet connection (3G, 4G, wifi) to be able to access and use the application easily.

|

Choosing to use VietinBank iPay Mobile, customers also get "All transactions free" on the application such as free money transfers within and outside the system, free iPay services... without any binding conditions on maintaining account balance or transactions. In addition, customers can also personalize their personal accounts to express their personality and uniqueness with the features of setting account nicknames (Alias) or customizing payment account QR codes...

In addition to diversifying features to meet all customer needs, VietinBank also prioritizes the safety and security of customers when using digital products and services. All customer transactions on the Digital Banking channel are secured by Soft OTP authentication or facial authentication, providing customers with peace of mind when making financial transactions. On the other hand, customers transacting on the iPay Mobile application can choose to participate in cyber security insurance to help protect users from technological fraud that causes loss of customer accounts.

VietinBank iPay Mobile - Complete smartphone experience

To date, VietinBank has partnered with more than 2,000 providers and brought more than 150 features and services to the application, helping users easily experience and enjoy life in the most complete, simple and cost-effective way. The features developed and provided by VietinBank to customers on the iPay Mobile application include:

Basic financial features, available 24/7 anywhere without going to the bank: open an online account, transfer money within/outside the system; international money transfer; savings, overdraft, open debit/credit card, repay card debt, repay loan debt...

Group of features serving customers' daily life needs: paying bills (electricity, water, telecommunications, internet...); shopping for VNShop goods; calling a taxi; recharging phone, road tolls...

Group of health care, travel, entertainment features: make health check-up appointments, family doctor appointments, vaccine appointments; buy plane tickets, train tickets, hotel reservations, buy sightseeing tickets, sports , entertainment...

Investment feature group: linking securities accounts, transferring securities money, buying fund certificates...

Group of public service features, tax payment...

By diversifying the product and service portfolio and features on the application, VietinBank iPay Mobile has become a multi-featured digital banking ecosystem, meeting diverse customer needs and bringing a perfect experience to customers on a single smartphone device.

Ms. Nguyen Thu Trang, Hanoi City shared: “Since I learned about VietinBank iPay Mobile, I no longer have to worry about debt reminders or overdue bill payments, because there is an automatic bill payment feature with just a few simple and quick steps, helping me save time.”

“I really like the VietinBank iPay Mobile ecosystem that it brings to customers, with countless great features that help me book taxis, movie tickets, shop, transfer money, and stocks... in general, I find that there is basically no lack of benefits. Not to mention that there are many incentives, so just using the VietinBank iPay Mobile application can solve all my personal needs” - Mr. Tran Bao Nam, Hai Phong City said.

|

VietinBank iPay Mobile – the numbers speak

The goal of increasing features, enhancing security... of VietinBank for iPay Mobile application is to increase customer experience and benefits when using. This is the guideline to help VietinBank iPay Mobile become a banking application trusted by customers with an average customer growth rate of 20% -30% and an average digital channel transaction growth of 200% compared to previous years.

In particular, VietinBank iPay Mobile has received many major awards: Top 10 Sao Khue ; "Best Mobile Banking Technology Implementation" awarded by The Asian Banker Magazine ...

|

In the coming time, VietinBank will continue to enrich its utility store, providing more APIs to connect more strongly and widely with all industries and fields in life. Together with partners, VietinBank will complete a comprehensive digital banking ecosystem, in which customers continue to be the focus and enjoy all the features and utilities of that ecosystem.

Source link

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

![[Photo] The Prime Ministers of Vietnam and Thailand witnessed the signing ceremony of cooperation and exchange of documents.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/935407e225f640f9ac97b85d3359c1a5)

![[Photo] General Secretary To Lam receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/7f6a2a37f9324e61b3088c464cbc7b16)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

Comment (0)