ANTD.VN - Interbank interest rates rose sharply after the State Bank of Vietnam continuously withdrew money through treasury bills, indicating that the banking system's liquidity has somewhat reduced its surplus.

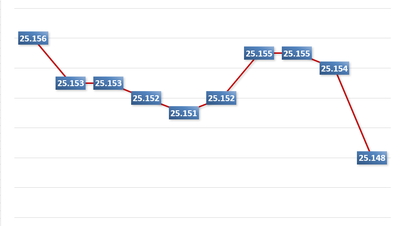

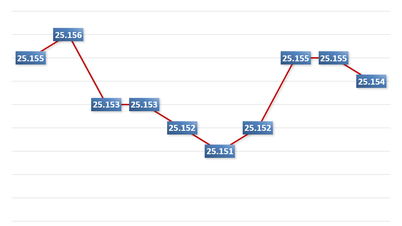

According to the latest data released by the State Bank of Vietnam (SBV), the average interbank VND interest rate on October 20th for the overnight term (the main term accounting for 90% of transaction value) has sharply increased, almost doubling to 1.47%/year from 0.79%/year recorded in the previous session (October 19th). This is also the highest interest rate for this term since mid-June 2023.

Thus, compared to the end of last month, the interest rate for this term has increased tenfold (at the end of September, the overnight interest rate was only 0.15%/year).

In addition, interest rates for other key maturities also increased sharply. The 1-week rate rose to 1.64%; the 2-week rate to 1.66%; and the 1-month rate to 1.86%.

|

The banking system no longer has excessive liquidity. |

Interbank interest rates have tended to rise sharply in recent sessions, following the State Bank of Vietnam's continuous withdrawal of funds through treasury bills. Since reopening this channel on September 21st, the central bank has withdrawn funds continuously for 22 sessions, with a total amount of nearly 241,600 billion VND withdrawn.

Along with the sharp increase in interbank interest rates, indicating a somewhat reduced liquidity, the amount of money withdrawn from circulation has also gradually decreased. In the October 23rd session, the total volume of treasury bills issued was only 850 billion VND, compared to 1,650 billion VND in the previous session.

During peak sessions, the central bank withdrew up to 20 trillion VND per session. The winning bid interest rates in the most recent sessions also increased sharply to 1.45%/year, compared to just over 0.5%/year in the initial sessions.

The State Bank of Vietnam's issuance of treasury bills aims to adjust system liquidity amidst excess liquidity in banks. It is also a measure to reduce exchange rate pressure by pushing up interbank interest rates for VND, thereby narrowing the interest rate differential between the USD and VND.

The State Bank of Vietnam's (SBV) leadership has repeatedly confirmed the excess liquidity in the system, citing very limited credit growth and a lack of borrowing demand from businesses. SBV leaders affirmed their commitment to flexible management to alleviate pressure on exchange rates and interest rates for businesses.

Deputy Governor of the State Bank of Vietnam, Dao Minh Tu, stated that the central bank will manage exchange rate stability. “Businesses can rest assured about the exchange rate. Currently, the exchange rate is fluctuating within the permitted range, and we affirm that we will manage it to prevent hoarding of foreign currency in anticipation of a rise in the exchange rate. Currently, abundant foreign exchange reserves, continued growth in FDI inflows, and positive developments in other foreign currency sources… are the basis for stabilizing the exchange rate,” the Deputy Governor said.

Regarding interest rates, the State Bank of Vietnam's leadership stated that the institution will continue to manage them in a stable manner, lowering them further when conditions permit, and even the policy interest rate may be reduced further if conditions are suitable.

However, representatives of the State Bank of Vietnam also acknowledged that managing interest rates is the most difficult challenge in current macroeconomic management. This is because when interest rates fall sharply, exchange rate stability is at risk of being disrupted, affecting foreign borrowing, national credit ratings, and so on.

This forces the State Bank of Vietnam to carefully consider and harmonize many factors in managing monetary policy.

Source link

![[Infographic] Cross-exchange rates for determining taxable value from December 11-17](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765413245543_infographic-ty-gia-tinh-cheo-de-xac-dinh-tri-gia-tinh-thue-tu-11-1712-20251211021920.jpeg)

![[Infographic] Cross-calculated exchange rates to determine taxable value from December 4-10](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/04/1764832340841_infographic-ty-gia-tinh-cheo-de-xac-dinh-tri-gia-tinh-thue-tu-4-1012-20251204120447.jpeg)

Comment (0)