This bank has sharply reduced savings interest rates for all deposit terms from 1-36 months, including both over-the-counter and online savings. Notably, some terms have been reduced by more than 1%.

Specifically, for the online savings program. The interest rate for 1-2 month term with interest paid at the end of the term is currently at 3.7%/year, down 0.3% and 0.4%/year respectively compared to the previous listing. The interest rate for 3-month term was brought back to 3.9%/year by OCB after a 0.3%/year reduction. The interest rate for 4-5 month term decreased by 0.1% and 0.3%/year to 4.1% and 4.3%/year respectively. The online mobilization interest rate for 6-11 month term was reduced by OCB by 0.4%/year, all at 4.7%/year. This reduction also applies to 12-15 month term, the interest rate for these terms has been adjusted to 4.8%/year.

Meanwhile, the 18-month online savings interest rate was reduced by 0.5%/year to 4.9%/year; the 21- and 24-month terms were reduced by 0.55% and 0.65%/year respectively to 4.95%/year, which is also the highest online mobilization interest rate at OCB.

The deepest interest rate reduction for online deposits is for the 36-month term, down 0.95%/year to 4.85%/year.

|

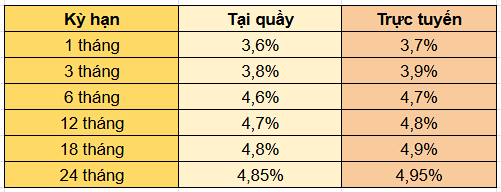

| Interest rate at OCB after adjustment |

For savings at the counter, OCB adjusted the interest rate for 1-2 month term to 3.6%/year (down 0.3% and 0.4%/year respectively); The interest rate for 3-month term savings was adjusted down 0.3%/year to 3.8%/year, the interest rate for 4-month term savings slightly decreased 0.1%/year to 4%/year; The interest rate for 5-month term deposits was 0.3%/year, down to only 4.2%/year; The interest rate for 6-11 month term deposits was simultaneously brought back to 4.6%/year after all decreasing by 0.4%/year.

OCB has reduced the bank interest rate for 12-15 month terms to 4.7%/year for customers depositing savings at the counter. This is also a reduction in the 18-month term deposit interest rate after it was reduced to 4.8%/year; OCB has also reduced the 21- and 24-month term deposit interest rate to 4.85%/year, down sharply by 0.65% and 0.75%/year, respectively.

In particular, the 36-month term deposit interest rate has been strongly reduced by OCB by 1.05%/year, currently listed at only 4.75%/year. Thus, for the two savings programs at the counter and online at OCB, there is no longer an interest rate of 5% at any term. Currently in April, a number of joint stock commercial banks have reduced their deposit interest rates, including VPBank , MB, Eximbank, Nam A Bank, OCB.

Source: https://thoibaonganhang.vn/ngan-hang-dieu-chinh-manh-lai-suat-huy-dong-xuong-duoi-5nam-tai-cac-ky-han-162808.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)